Why you shouldn't pay full-price for a shoddy new-build house

Housebuilder Persimmon is to allow buyers to hold back some of the purchase price of their new-build home until problems are resolved. It's a start, but it's hardly revolutionary.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Persimmon's gesture is a start, but hardly revolutionary

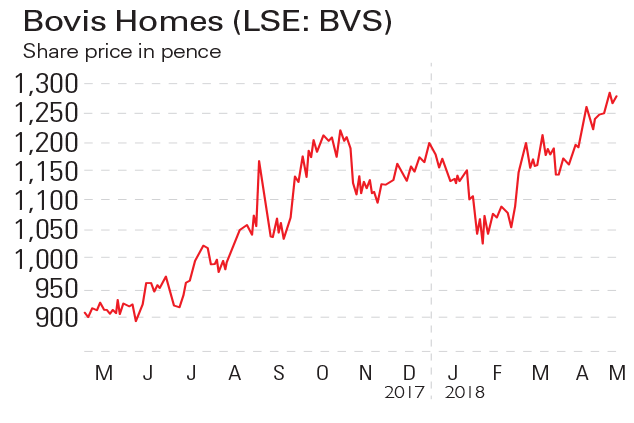

Housebuilder Persimmon is to allow buyers to hold back 1.5% of the purchase price of their home until problems with their property are resolved. This comes after several years in which Persimmon, along with other major UK housebuilders such as Bovis Homes, have been widely criticised for selling new homes that are riddled with problems or delivered far behind schedule, as well as for the salaries they pay senior staff.

Persimmon is the first UK housebuilder to offer buyers (or, more accurately, their solicitors) the opportunity to hold back some of the purchase price. It says it hopes this move will encourage others in the industry to follow suit. However, given the scale of the problem of quality in new-build housing, they could have done more.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

On average, people will be able to hold back £3,600, which is hardly a huge sum. It's been suggested that 5% would have been a more appropriate amount (this is the case in the Netherlands). As Patrick Hosking notes in The Times, "there's a danger the scheme will descend into countless legal disputes, with buyers' solicitors quickly swallowing up that cash buffer in fees".

Moreover, buyers can only take advantage of this option if they report problems on the day they get their keys. This means people must spend that first day in their home checking thoroughly for snags, even though many problems such as faulty plumbing will not come to light immediately. What would be more sensible was if the buyer had, say, a month in which to report problems. Persimmon customers can submit a one-month inspection form to report early problems, but this is separate from the ability to hold back money.

What to do if your new-build is shoddy

It's important to be aware of what protection you're entitled to as the owner of a new-build home. It's not always as much as you might hope. Nine out of ten new homes built in the UK are protected by one of the main new home warranty bodies. They include the National House Building Council (NHBC), Premier Guarantee and LABC Warranty. Under NHBC Buildmark, builders cover any defects that occur in the first two years of ownership that are not general wear and tear.

After that, NHBC will provide a further eight years of insurance against failure to meet their requirements. Depending on the policy, you may also be covered for failure to comply with UK building regulations. These regulations set minimum standards for the design, construction and energy consumption of buildings, but compliance with these regulations is not necessarily "sufficient...to ensure good quality", warned the 2007 Calcutt Review of Housebuilding Delivery.

Finally, any housebuilder registered with a home warranty body should also adhere to the Consumer Code for Home Builders, which requires them to arrange a system for dealing with customer complaints.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Sarah was MoneyWeek's investment editor. She graduated from the University of Southampton with a BA in English and History, before going on to complete a graduate diploma in law at the College of Law in Guildford. She joined MoneyWeek in 2014 and writes on funds, personal finance, pensions and property.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

If you'd invested in: Bovis Homes and Crest Nicholson

If you'd invested in: Bovis Homes and Crest NicholsonFeatures Regional housebuilder Bovis has seen its shares rise by 40% in the last year, while Crest Nicholson's have slid by 20%.

-

Sharks circle Bovis

Sharks circle BovisFeatures Bovis’s rivals are trying to make a meal of its assets on the cheap. It should hold out for a better deal, says Ben Judge.

-

Shares in focus: Should you buy Bovis?

Shares in focus: Should you buy Bovis?Features The housebuilder’s profits are booming, but is there anything left still to play for? Phil Oakley investigates.

-

It’s time to sell out of the housebuilding sector – here’s why

It’s time to sell out of the housebuilding sector – here’s whyFeatures Shares in housebuilders have done very well in the last few years. But it's time to sell. Ed Bowsher explains why, and picks a more attractive sector to buy.