It’s time to sell out of the housebuilding sector – here’s why

Shares in housebuilders have done very well in the last few years. But it's time to sell. Ed Bowsher explains why, and picks a more attractive sector to buy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If you bought shares in a housebuilder three years ago, you're probably feeling pretty happy now. Shares in several leading firms have doubled or trebled since then.

And with house prices still rising, you may be planning to hang on to your shares for some time to come.

I think that would be a mistake. You need to remember that this isn't a buy and hold' sector. Housebuilding is a very cyclical business. Today's boom will inevitably turn to bust at some point. And because stock market investors normally look ahead, share prices often start to fall before the good times have ended in the real world'.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So that raises two questions: is now the time to sell out of housebuilders? And are there some more attractive sectors out there?

Why people like housebuilders

The big plus point is there's plenty of unmet demand for housing, especially in southeast England. Yet the number of new housing starts is still well below the peak level it hit in the last cycle, according to broker Brewin Dolphin. As a result, builders can sell new homes at premium prices.

What's more, Rics (the Royal Institution of Chartered Surveyors) thinks that house prices will carry on rising until 2020.

Even better, a modest relaxation of planning rules in 2012 means that housebuilders have more scope to boost the number of housing starts if they want.

And you could argue that many housebuilders don't look that expensive they're largely trading on price/earnings (p/e) ratiosof ten or 11.

Trouble is, because housebuilding is so cyclical, firms in this sector normally trade on lower p/e multiples than the stock market as a whole. (A company is less attractive to investors if there's a strong chance that profits will fall in the future, as is so often the case with housebuilders in other words, they're less willing to pay a high price for £1 of earnings, because they can't be confident that those earnings will still be there next year.)

Look below at the valuations for some of the best known stocks.

If you look at the price/bookcolumn, you can see that Galliford Try's share price, for example, is more than twice as high as its net assets including its land. Granted, that's partly because Galliford also has a separate construction business. But all of these builders are on price/book ratios that look high to me.

I'm also worried that Rics may be over-optimistic on house prices. When interest rates start to rise, we may see some forced sales of homes as some people can no longer afford their mortgage payments.

Lenders have also been forced by the regulator to tighten their rules on how much they can lend to homeowners. These new affordability criteria were only implemented last month, so they may begin to make an impact soon.

But the most important point is that developers are starting to cut back on their landbanks, according to Brewin Dolphin. The broker says that developers are positioning themselves to make plenty of money in the short term, but not to be too vulnerable if the bubble bursts.

In other words, the housebuilders' bosses fear that the good times will end in the next two or three years, and they don't want to get caught out. Indeed Brewin thinks that 2016 is most likely time for a big slowdown in housebuilding. It'll be a year after the election and interest rates will almost certainly be moving up by then.

Bigger payouts aren't compensation enough to hang on

Thanks to these higher payouts, Brewin Dolphin reckons that income investors can stick with the housebuilders for a while yet. But growth investors who are more interested in gaining from rising share prices should consider getting out.

But I think that even the income investors should consider moving their money elsewhere. Although dividend payments may continue to grow for a while yet, a bad bust would trigger dividend cuts later this decade. You can probably get more sustainable dividends in other sectors tobacco, pharmaceuticals and consumer goods spring to mind.

And as Brewin says, if you're looking more for a mix of growth and income, the case for switching out of housebuilders is all the stronger. Once again, pharmaceuticals could be a better bet, and I also think some small-caps look like an attractive, if riskier alternative. (I highlighted some decent small-cap stocks to buy earlier this year. If you're not already a subscriber, sign up for a free trial and you'll get four free magazines plus access to our full web archive where you can read the article.)

Of course, another option is to use some of your sale proceeds to boost your cash balance. There's no shame in holding some cash when a bull market is five years old and several housebuilder stocks have trebled.

Our recommended articles for today

How to buy and sell penny shares

Should the Bank of England step in to cool the housing market?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ed has been a private investor since the mid-90s and has worked as a financial journalist since 2000. He's been employed by several investment websites including Citywire, breakingviews and The Motley Fool, where he was UK editor.

Ed mainly invests in technology shares, pharmaceuticals and smaller companies. He's also a big fan of investment trusts.

Away from work, Ed is a keen theatre goer and loves all things Canadian.

Follow Ed on Twitter

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Persimmon yields 13.8%, but can you trust it to deliver?

Persimmon yields 13.8%, but can you trust it to deliver?Tips With a dividend yield of 13.8%, Persimmon looks like a highly attractive prospect for income investors. But that sort of yield can also indicate a company in distress. Rupert Hargreaves looks at the numbers to find out if it's sustainable.

-

Despite cooling UK house prices, builders are charging ahead

Despite cooling UK house prices, builders are charging aheadTips The rate of UK house price growth is slowing. But demand for new houses remains high, and housebuilders are firing on all cylinders. Rupert Hargreaves picks the best stocks in the sector.

-

Taylor Wimpey’s a winner – here's how to play it

Taylor Wimpey’s a winner – here's how to play itFeatures Housebuilder Taylor Wimpey pays a generous dividend and the shares are cheap.

-

Why you shouldn't pay full-price for a shoddy new-build house

Why you shouldn't pay full-price for a shoddy new-build houseFeatures Housebuilder Persimmon is to allow buyers to hold back some of the purchase price of their new-build home until problems are resolved. It's a start, but it's hardly revolutionary.

-

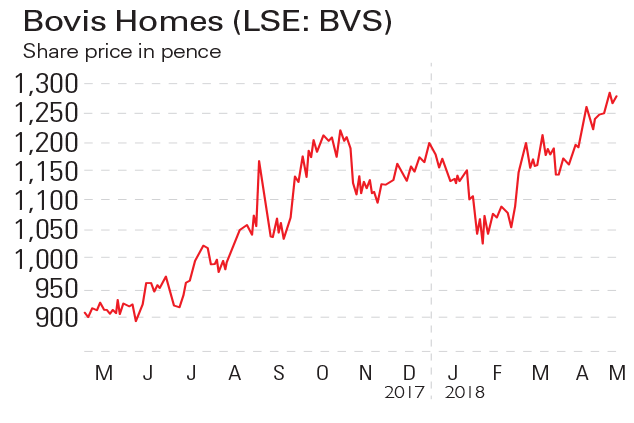

If you'd invested in: Bovis Homes and Crest Nicholson

If you'd invested in: Bovis Homes and Crest NicholsonFeatures Regional housebuilder Bovis has seen its shares rise by 40% in the last year, while Crest Nicholson's have slid by 20%.

-

If you’d invested in: Persimmon and Centrica

If you’d invested in: Persimmon and CentricaFeatures Persimmon is the UK’s second-largest housebuilder. In November, it said the total sales rate per site for the third quarter was in line with the same period last year.

-

Sharks circle Bovis

Sharks circle BovisFeatures Bovis’s rivals are trying to make a meal of its assets on the cheap. It should hold out for a better deal, says Ben Judge.

-

Should you buy housebuilders?

Should you buy housebuilders?Features House builders have seen their shares hammered since the Brexit vote. Is there further to fall – or is this a buying opportunity? Sarah Moore investigates.