Should you buy housebuilders?

House builders have seen their shares hammered since the Brexit vote. Is there further to fall – or is this a buying opportunity? Sarah Moore investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

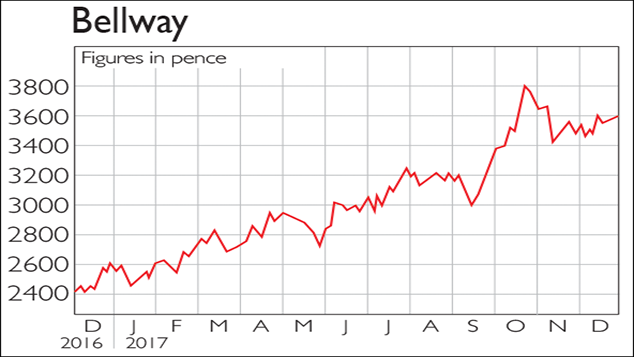

Shares in housebuilders and property groups have been hammered since the UK voted to leave the European Union, amid fears a struggling economy will hit demand for property. Three of the UK's biggest housebuilders Persimmon, Barratt and Bellway have seen their share prices fall by between 24% and 26% since the day of the vote. Is there further to fall or is this a buying opportunity?

It's very much the latter, reckons Tristan Chapple of Aurora Investment Trust. Aurora has just upped its holding in Barratt from 11.2% of its fund to 12% and in Bellway from 7.1% to 10.5% both are "far too cheap". Investors fear that falling house prices will hit housebuilders' profits. But "what the market doesn't properly understand is that falling house prices also mean falling land prices".

If house prices fall, the builder will initially take a hit to profit margins. But land a builder's major input cost will also become cheaper. So within a few years, margins will recover, even if house prices don't. That will show up down the line as a leap in profits.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

There's also no guarantee that Brexit will hurt the sector as badly as people fear. Most people buy houses because of major life events they are not usually a discretionary purchase, notes Chapple. Although some potential buyers may pull out if they're concerned about the economy, most will carry on regardless unless their job specifically is threatened.

Meanwhile, business remains good for the builders. Persimmon reported strong earnings for the first half of 2016. It built 7,238 new houses, up by 6% on last year, and group revenues were up 12% on last year's £1.33bn. The firm puts this success down to low borrowing costs (likely to continue, judging by noises from the Bank of England) and a healthy labour market. We are probably in for some short-term volatility, admits Chapple. But for a long-term investor, "it's a tremendous opportunity".

But prospects aren't good for all companies in the sector. There are signs that the wider industry was starting to struggle even before the Leave vote. The Markit/CIPS Construction Purchasing Managers' index, which surveys activity in the sector, fell to 46 in June, its lowest level since June 2009. A number below 50 suggests a contraction. We've also talked a lot in MoneyWeek about the unsustainability of the London housing market. Demand is already waning for luxury property, especially after the introduction of extra stamp duty for purchases of second homes.

London-focused St Modwen, which specialises in regenerating brownfield sites, acknowledged difficult trading conditions in its half-year results. It plans to adopt a more cautious development approach in the near future. Its pre-tax profit for the first half was £30m, down from £206m last year (though that figure included one-off valuation gains from a new development in Nine Elms, London). St Modwen has now cut £21m off the value of its Nine Elms development, as residential prices in the area have fallen by 3.75%.

So housebuilders are by no means a one-way street. And as we've noted before, concerns about "under-supply" may be overdone especially if the government embarks on infrastructure spending and buy-to-let landlords sell up as new tax rules bite. As Merryn Somerset Webb wrote earlier this week, you only want to buy in now if you reckon that whatever happens to prices, volumes will stay high in the UK profit per house is by the by if you're selling 50% fewer properties.

Equally, if a correction in profit margins lies ahead, there could be a better opportunity to buy builders in the future. The three firms mentioned above trade at around seven to nine times earnings. That sounds cheap, but not if earnings are at a cyclical peak. If you are interested in the sector, however, Aurora (LSE: ARR) is a good way in. It trades at a premium of around 6% to its net asset value.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Sarah was MoneyWeek's investment editor. She graduated from the University of Southampton with a BA in English and History, before going on to complete a graduate diploma in law at the College of Law in Guildford. She joined MoneyWeek in 2014 and writes on funds, personal finance, pensions and property.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Persimmon yields 13.8%, but can you trust it to deliver?

Persimmon yields 13.8%, but can you trust it to deliver?Tips With a dividend yield of 13.8%, Persimmon looks like a highly attractive prospect for income investors. But that sort of yield can also indicate a company in distress. Rupert Hargreaves looks at the numbers to find out if it's sustainable.

-

Despite cooling UK house prices, builders are charging ahead

Despite cooling UK house prices, builders are charging aheadTips The rate of UK house price growth is slowing. But demand for new houses remains high, and housebuilders are firing on all cylinders. Rupert Hargreaves picks the best stocks in the sector.

-

If only you’d invested in: Bellway

If only you’d invested in: BellwayFeatures Bellway is a major house builder in the UK. Over the year to July the firm’s pre-tax profits rose 12.6% to £561m while revenues were up around 14% to £2.6bn.

-

If you’d invested in: Persimmon and Centrica

If you’d invested in: Persimmon and CentricaFeatures Persimmon is the UK’s second-largest housebuilder. In November, it said the total sales rate per site for the third quarter was in line with the same period last year.

-

FTSE 100 ahead as eurozone succumbs to deflation

FTSE 100 ahead as eurozone succumbs to deflationMarket Reports Falling prices in the eurozone have heaped yet more pressure on central bank boss Mario Draghi to turn on the money taps.

-

Company in the news: Bellway

Features Bellway is a housebuilder that is doing well, says Phil Oakley. So should you buy the shares?

-

It’s time to sell out of the housebuilding sector – here’s why

It’s time to sell out of the housebuilding sector – here’s whyFeatures Shares in housebuilders have done very well in the last few years. But it's time to sell. Ed Bowsher explains why, and picks a more attractive sector to buy.

-

Company of the week: Bellway

Features Housebuilder Bellway is in rude health, says Phil Oakley. But are the shares still a buy?