Company of the week: Bellway

Housebuilder Bellway is in rude health, says Phil Oakley. But are the shares still a buy?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Housebuilder Bellway (LSE: BWY)is in rude health. Half-year profits were up by 70% on the back of selling 25% more houses at prices that were 13% higher. Government subsidy scheme, Help to Buy, accounted for nearly a third of reservations. Bellway is also helped by having a lot of building plots in the south of England, which accounted for 62% of its sales.

Analysts expect the good times to keep on rolling. As profit margins and return on capital have yet to reach their pre-crisis peaks, you can see why they hold this view.

That said, builders have benefited massively by selling houses on cheap land bought at the bottom of the market. Whether they can make thesame juicy returns on land bought more recently remains to be seen.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

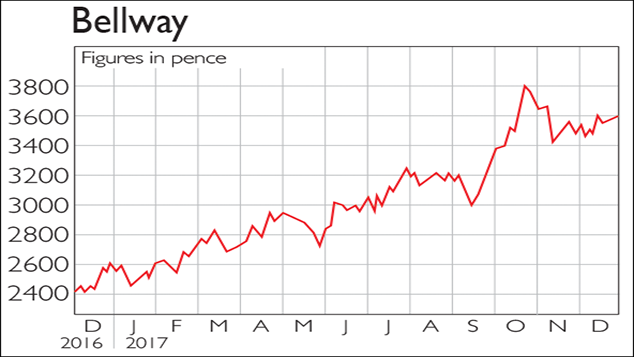

Bellway shares are up by 30% since we tipped them as a punt back in June. As long as Help to Buy stays in place, it will keep selling lots of houses and making good money.

However, house prices, particularly in southeast England, are rising much faster than wages, and affordability is becoming stretched.

For a cyclical business, Bellway's shares on 12 times earnings and 1.6 times book value are no bargain and the easy money has probably been made. There may still be further gains ahead, so hold them if you've got them, but I wouldn't buy in now.

Verdict: hold for now

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Despite cooling UK house prices, builders are charging ahead

Despite cooling UK house prices, builders are charging aheadTips The rate of UK house price growth is slowing. But demand for new houses remains high, and housebuilders are firing on all cylinders. Rupert Hargreaves picks the best stocks in the sector.

-

If only you’d invested in: Bellway

If only you’d invested in: BellwayFeatures Bellway is a major house builder in the UK. Over the year to July the firm’s pre-tax profits rose 12.6% to £561m while revenues were up around 14% to £2.6bn.

-

Should you buy housebuilders?

Should you buy housebuilders?Features House builders have seen their shares hammered since the Brexit vote. Is there further to fall – or is this a buying opportunity? Sarah Moore investigates.

-

Company in the news: Bellway

Features Bellway is a housebuilder that is doing well, says Phil Oakley. So should you buy the shares?