Company in the news: Bellway

Bellway is a housebuilder that is doing well, says Phil Oakley. So should you buy the shares?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Britain's house builders have been riding the wave of another boom. Low interest rates and huge amounts of government support, such as the Help-to-Buy scheme have been kind to them over the last couple of years. But now the housing market is starting to cool.

Last week, Bellway (LSE: BWY)said that conditions were returning to more normal patterns. The company is doing well, with reservations slightly ahead of this time last year, and it's set for another good year of increased profits.

So how much better can things get for companies like Bellway? The company reckons its profit margins will be around 20% in 2015, which would be more than it was able to achieve during the last boom a decade ago.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Its share price is at similarly lofty levels. At 1,837p,it trades on nearly 1.7 times net asset value, which is very expensive compared to the past 20 years.

Profits could stay high for a while yet given that Bellway has been buying land at good prices. But one day, the housing market will head south again Bellway's shares don't reflect that risk.

Verdict: take profits

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Despite cooling UK house prices, builders are charging ahead

Despite cooling UK house prices, builders are charging aheadTips The rate of UK house price growth is slowing. But demand for new houses remains high, and housebuilders are firing on all cylinders. Rupert Hargreaves picks the best stocks in the sector.

-

If only you’d invested in: Bellway

If only you’d invested in: BellwayFeatures Bellway is a major house builder in the UK. Over the year to July the firm’s pre-tax profits rose 12.6% to £561m while revenues were up around 14% to £2.6bn.

-

Should you buy housebuilders?

Should you buy housebuilders?Features House builders have seen their shares hammered since the Brexit vote. Is there further to fall – or is this a buying opportunity? Sarah Moore investigates.

-

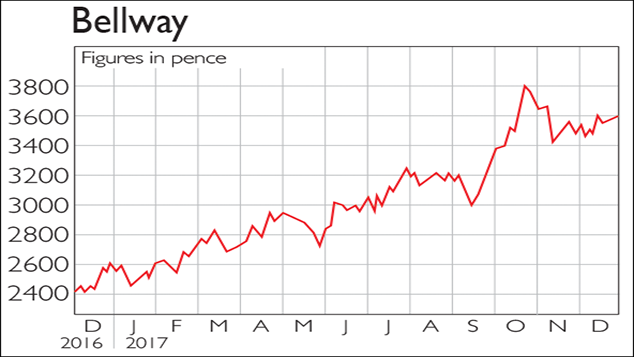

Company of the week: Bellway

Features Housebuilder Bellway is in rude health, says Phil Oakley. But are the shares still a buy?