If you’d invested in: Persimmon and Centrica

Persimmon is the UK’s second-largest housebuilder. In November, it said the total sales rate per site for the third quarter was in line with the same period last year.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

Persimmon (LSE: PSN) is the UK's second-largest housebuilder. In November, it said the total sales rate per site for the third quarter was in line with the same period last year, although it reported £909m of forward sales reserved beyond 2017, an increase of 10% on the same period last year.

The government's help-to-buy equity loan scheme, which allows people to buy newly built homes with deposits of only 5%, has been used in more than half of the firm's sales.

Be glad you didn't

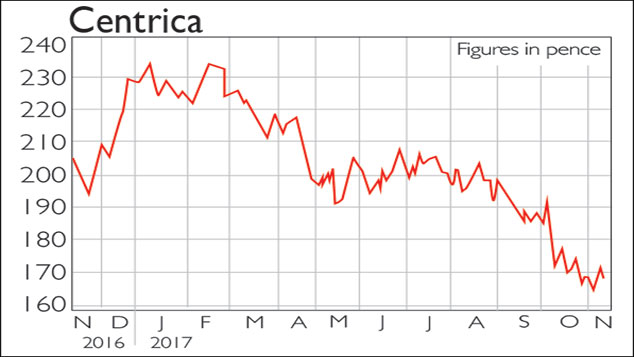

Centrica (LSE: CNA) provides energy for homes and businesses. Its shares have fallen by 57% over the past four years. In October, it announced a restructuring the management plans to reallocate £1.5bn of resources from asset businesses to customer-facing businesses by 2020. In November, it also acquired REstore, a firm that manages electricity demand for heavy energy users, for £62m.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Persimmon yields 13.8%, but can you trust it to deliver?

Persimmon yields 13.8%, but can you trust it to deliver?Tips With a dividend yield of 13.8%, Persimmon looks like a highly attractive prospect for income investors. But that sort of yield can also indicate a company in distress. Rupert Hargreaves looks at the numbers to find out if it's sustainable.

-

Despite surging profits investors should avoid Centrica shares

Despite surging profits investors should avoid Centrica sharesTips Profits in the energy sector are booming but Centrica shares are struggling. Rupert Hargreaves explains why he’d avoid the stock.

-

Centrica: the only way is up

News Centrica's share price has fallen by nearly 90% over the past few years. New finance director Chris O’Shea will hope to reverse that.

-

Will Centrica slash dividends?

Will Centrica slash dividends?Features Finances are tight and payouts are under threat. The gas supplier’s new boss faces some tricky decisions, says Alice Gråhns.

-

Is it time to buy Centrica for its huge dividend?

Is it time to buy Centrica for its huge dividend?Features Shares in Centrica, owner of British Gas, come with a dividend yield of 8% after the share price fell dramatically last week. So should you buy in?

-

Should you buy housebuilders?

Should you buy housebuilders?Features House builders have seen their shares hammered since the Brexit vote. Is there further to fall – or is this a buying opportunity? Sarah Moore investigates.

-

FTSE 100 ahead as eurozone succumbs to deflation

FTSE 100 ahead as eurozone succumbs to deflationMarket Reports Falling prices in the eurozone have heaped yet more pressure on central bank boss Mario Draghi to turn on the money taps.

-

Shares in focus: Centrica’s comeback trail

Shares in focus: Centrica’s comeback trailFeatures Utility company Centrica has had a rough ride. But with the shares offering a decent dividend yield, should you still buy in? Phil Oakley investigates.