Average UK house price reaches £300,000 for first time, Halifax says

While the average house price has topped £300k, regional disparities still remain, Halifax finds.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The average price of a house in the UK has risen above £300,000 for the first time, as buyers have returned to the market after a December dip.

The milestone will be welcomed by homeowners who, on average, will have seen the price of their property reach new highs. But for prospective buyers, the growth will depress affordability even more.

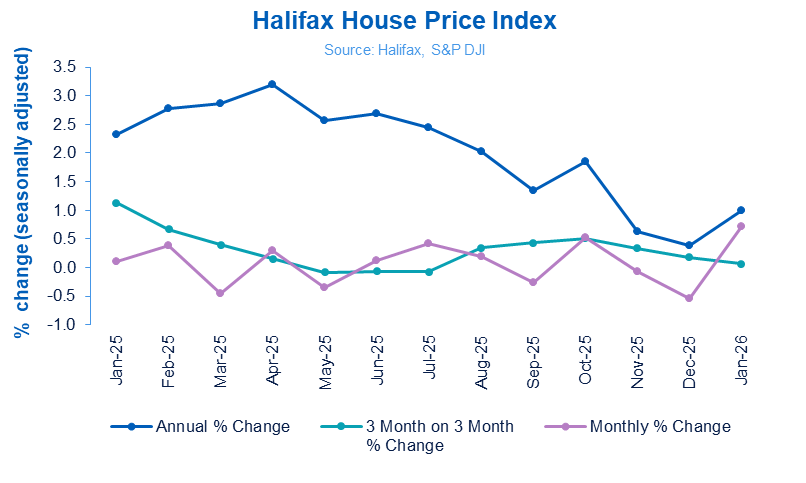

House prices increased by 0.7% month-on-month between December and January, bringing the average price of a home to £300,077, new data from Halifax shows.

Article continues belowTry 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The January rise also reversed December’s 0.5% fall, giving house price growth a strong start in the new year.

Meanwhile, the annual rate of house price growth edged higher to 1%, between January 2025 and January 2026, up from 0.4% in December.

Quarterly growth in the three months to January was effectively flat, rising by just 0.1%.

Amanda Bryden, head of mortgages at Halifax, said the “housing market entered 2026 on a steady footing,” with activity levels showing the market has stayed resilient despite the ups and downs of recent years.

The average price of a house has risen by 5.7%, or around £16,000, over the past three years, significantly lower than the growth seen during and just after the coronavirus pandemic.

House price growth between 2023 and 2026 was restricted as higher interest rates and stretched affordability pushed down demand and kept house price growth muted.

In contrast, the three years between 2020 and 2023 saw prices increase by almost 19%, or around £44,000, as buyers embraced the low cost of borrowing.

Despite house price growth being relatively low in the last three years, Bryden believes the market’s health is set to get better.

She said: “Broader economic conditions continue to provide some support. Wage growth has been outpacing property price inflation since late 2022, steadily improving underlying affordability. That’s a positive trend for buyers, and the long-term health of the market.

Affordability worsens as house prices rise

While rising house prices will be welcome news for those who already own a house, it is less good news for those who are trying to become homeowners.

With increasing prices, those attempting to get onto the housing ladder are having a more difficult time putting together enough savings for a deposit, and seeing more of their income being spent on mortgage payments.

However, Bryden says there are signs that affordability could increase this year, even while house prices shoot over the £300,000 milestone.

She said: “Affordability is still a challenge, but stronger wage growth and falling mortgage rates have helped relieve some of the pressure in recent years.

“We expect that improvement to continue in 2026, meaning that with the right support and advice, home ownership should become a realistic prospect for more would-be buyers.”

She added that while the headline numbers may be daunting for first-time buyers, most will be looking for smaller properties at a price point significantly lower than the average.

“Many locations offer far more accessible price points, especially in northern regions where homes can often be found for under £200,000.”

Regional house price performance differences deepen

Large price differences between different regions in the UK are not a new phenomenon, but they have become more pronounced in recent years as the divide between house prices in the north and south has deepened.

Northern regions and the devolved nations have consistently experienced strong house price growth as demand has remained high, while some regions in the south have seen price growth stall or even reverse.

The UK region that experienced the highest annual price growth was Northern Ireland, where prices increased by 5.9% in 2025, meaning the typical house there now costs £217,206.

Scotland also experienced high annual price growth of 5.4%, bringing the average price of a house in the nation to £221,711.

As for England, its northern regions and the Midlands were the only places where house prices grew in the past year.

The North West leads the way, as the average price of a house there increased by 2.1% to £244,329, while the North East saw prices increase by 1.2% to £181,198.

Not a single southern region saw the average price of a home increase in 2025.

The two worst-performing regions were the South West and South East, where average prices fell by 1.6%.

Greater London also suffered shrinking price growth, as the average house there is now 1.3% lower than it was a year ago, bringing it to £538,600.

Region | Average house price | Annual change |

|---|---|---|

Northern Ireland | £217,206 | 5.9% |

Scotland | £221,711 | 5.4% |

North West | £244,329 | 2.1% |

North East | £181,198 | 1.2% |

Yorkshire and Humber | £217,516 | 0.9% |

East Midlands | £246,433 | 0.6% |

Wales | £228,415 | 0.5% |

West Midlands | £261,817 | 0.4% |

Eastern England | £332,366 | -1.2% |

Greater London | £538,600 | -1.3% |

South East | £385,086 | -1.6% |

South West | £303,625 | -1.6% |

Source: Halifax, 6 February

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Daniel is a financial journalist at MoneyWeek, writing about personal finance, economics, property, politics, and investing.

He covers savings, political news and enjoys translating economic data into simple English, and explaining what it means for your wallet.

Daniel joined MoneyWeek in January 2025. He previously worked at The Economist in their Audience team and read history at Emmanuel College, Cambridge, specialising in the history of political thought.

In his free time, he likes reading, walking around Hampstead Heath, and cooking overambitious meals.