Average UK house price reaches £300,000 for first time, Halifax says

While the average house price has topped £300k, regional disparities still remain, Halifax finds.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The average price of a house in the UK has risen above £300,000 for the first time, as buyers have returned to the market after a December dip.

The milestone will be welcomed by homeowners who, on average, will have seen the price of their property reach new highs. But for prospective buyers, the growth will depress affordability even more.

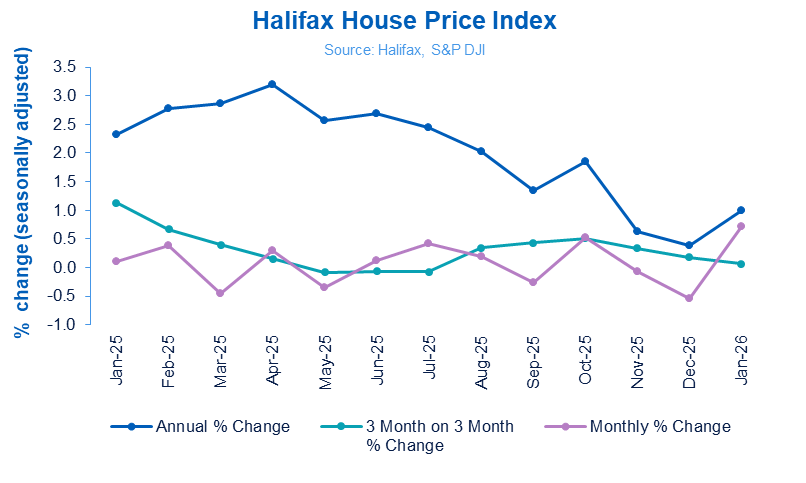

House prices increased by 0.7% month-on-month between December and January, bringing the average price of a home to £300,077, new data from Halifax shows.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The January rise also reversed December’s 0.5% fall, giving house price growth a strong start in the new year.

Meanwhile, the annual rate of house price growth edged higher to 1%, between January 2025 and January 2026, up from 0.4% in December.

Quarterly growth in the three months to January was effectively flat, rising by just 0.1%.

Amanda Bryden, head of mortgages at Halifax, said the “housing market entered 2026 on a steady footing,” with activity levels showing the market has stayed resilient despite the ups and downs of recent years.

The average price of a house has risen by 5.7%, or around £16,000, over the past three years, significantly lower than the growth seen during and just after the coronavirus pandemic.

House price growth between 2023 and 2026 was restricted as higher interest rates and stretched affordability pushed down demand and kept house price growth muted.

In contrast, the three years between 2020 and 2023 saw prices increase by almost 19%, or around £44,000, as buyers embraced the low cost of borrowing.

Despite house price growth being relatively low in the last three years, Bryden believes the market’s health is set to get better.

She said: “Broader economic conditions continue to provide some support. Wage growth has been outpacing property price inflation since late 2022, steadily improving underlying affordability. That’s a positive trend for buyers, and the long-term health of the market.

Affordability worsens as house prices rise

While rising house prices will be welcome news for those who already own a house, it is less good news for those who are trying to become homeowners.

With increasing prices, those attempting to get onto the housing ladder are having a more difficult time putting together enough savings for a deposit, and seeing more of their income being spent on mortgage payments.

However, Bryden says there are signs that affordability could increase this year, even while house prices shoot over the £300,000 milestone.

She said: “Affordability is still a challenge, but stronger wage growth and falling mortgage rates have helped relieve some of the pressure in recent years.

“We expect that improvement to continue in 2026, meaning that with the right support and advice, home ownership should become a realistic prospect for more would-be buyers.”

She added that while the headline numbers may be daunting for first-time buyers, most will be looking for smaller properties at a price point significantly lower than the average.

“Many locations offer far more accessible price points, especially in northern regions where homes can often be found for under £200,000.”

Regional house price performance differences deepen

Large price differences between different regions in the UK are not a new phenomenon, but they have become more pronounced in recent years as the divide between house prices in the north and south has deepened.

Northern regions and the devolved nations have consistently experienced strong house price growth as demand has remained high, while some regions in the south have seen price growth stall or even reverse.

The UK region that experienced the highest annual price growth was Northern Ireland, where prices increased by 5.9% in 2025, meaning the typical house there now costs £217,206.

Scotland also experienced high annual price growth of 5.4%, bringing the average price of a house in the nation to £221,711.

As for England, its northern regions and the Midlands were the only places where house prices grew in the past year.

The North West leads the way, as the average price of a house there increased by 2.1% to £244,329, while the North East saw prices increase by 1.2% to £181,198.

Not a single southern region saw the average price of a home increase in 2025.

The two worst-performing regions were the South West and South East, where average prices fell by 1.6%.

Greater London also suffered shrinking price growth, as the average house there is now 1.3% lower than it was a year ago, bringing it to £538,600.

Region | Average house price | Annual change |

|---|---|---|

Northern Ireland | £217,206 | 5.9% |

Scotland | £221,711 | 5.4% |

North West | £244,329 | 2.1% |

North East | £181,198 | 1.2% |

Yorkshire and Humber | £217,516 | 0.9% |

East Midlands | £246,433 | 0.6% |

Wales | £228,415 | 0.5% |

West Midlands | £261,817 | 0.4% |

Eastern England | £332,366 | -1.2% |

Greater London | £538,600 | -1.3% |

South East | £385,086 | -1.6% |

South West | £303,625 | -1.6% |

Source: Halifax, 6 February

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Daniel is a financial journalist at MoneyWeek, writing about personal finance, economics, property, politics, and investing.

He covers savings, political news and enjoys translating economic data into simple English, and explaining what it means for your wallet.

Daniel joined MoneyWeek in January 2025. He previously worked at The Economist in their Audience team and read history at Emmanuel College, Cambridge, specialising in the history of political thought.

In his free time, he likes reading, walking around Hampstead Heath, and cooking overambitious meals.

-

What the government’s baby boomer retirement data says about the future of pensions

What the government’s baby boomer retirement data says about the future of pensionsA study of the retirement routes of people born in 1958 paints a worrying picture for people’s pension savings

-

An experienced investor’s end of tax year checklist

An experienced investor’s end of tax year checklistThe clock is ticking down before the end of the 2025/26 tax year, when any tax-free savings and investment allowances are lost. For experienced investors, though, the deadline for some tax-saving schemes is even earlier.

-

Halifax: House prices rise at fastest pace since start of year

Halifax: House prices rise at fastest pace since start of yearThe average UK house price jumped 0.4% in July, reaching £298,237, close to a record high, new house price index data shows. Will property prices increase further this year?

-

UK house prices remained flat in May, Halifax finds

UK house prices remained flat in May, Halifax findsNews Average house prices fell 0.1% month-on-month, meaning they have remained relatively static for three consecutive months on the Halifax HPI.

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Halifax: House prices rise for the third month in a row

Halifax: House prices rise for the third month in a rowNews Despite higher interest rates, Halifax says house prices are still rising in some parts of the country

-

Which house price index is the best?

Which house price index is the best?There are at least five indices measuring house prices. But which house price index is the best?

-

House prices fall for four months straight

House prices fall for four months straightNews UK house prices dipped by 1.5% in December, the fourth consecutive month, Halifax’s latest House Price Index reveals

-

The days when you could get 7% from your bank are long gone – so what do you do?

The days when you could get 7% from your bank are long gone – so what do you do?Opinion With interest rates at rock bottom for so long, we’ve been forced to move from saving to speculating to earn any sort of return. Dominic Frisby asks where we should put our money now, and explains where he’s put his.