Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

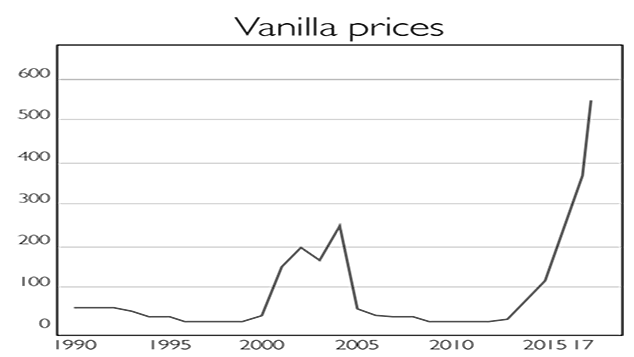

Your "artisanal vanilla ice cream" could be "under threat", says the FT's Emiko Terazono. Vanilla prices have rocketed to a record peak of more than $600 a kilo. A cyclone in March dented supplies from Madagascar, which accounts for half of world output. The storm accelerated an upswing caused by food manufacturers promising to use real vanilla rather than synthetic flavourings, while speculative hoarding by traders in Madagascar also raised prices. Vanilla pod producers are now frantically planting more, but it could be several years before prices subside to historical norms.

Viewpoint

"What a bloodbath the UK stockmarket was last week. Profit warnings from Provident, WPP and Dixons Carphone mean 2017 is shaping up to be a real rollercoaster for investors, after Serco, Carillion and Pearson served up some proper horrors earlier in the year.With the economy slowing investors may fear a slew of others. Yet the reality is that most are the result of problems specific to individual companies. Dixons has been hit by changes in consumer behaviour, while WPP is a victim of the rise of the big online giants Provident was the architect of its own downfall [due to a] botched attempt to embrace technology. This isn't part of any wider trend."

Ben Marlow, The Sunday Telegraph

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

What would the greatest mathematician of the Middle Ages say about gold today?

What would the greatest mathematician of the Middle Ages say about gold today?Sponsored Italian mathematician Fibonacci is most famous for a curious sequence of numbers. Continuing his series on technical analysis, Dominic Frisby explains what these numbers are, and what they can tell us about gold’s next move.

-

How moving averages can reveal trades worth betting on – and ones to avoid

How moving averages can reveal trades worth betting on – and ones to avoidSponsored Dominic Frisby looks in more depth at how moving averages can help you catch turning points in markets and help you decide which trades are worth pursuing.

-

This chart pattern could be extraordinarily bullish for gold

This chart pattern could be extraordinarily bullish for goldCharts The mother of all patterns is developing in the gold charts, says Dominic Frisby. And if everything plays out well, gold could hit a price that investors could retire on.

-

Believe it or not, this market is a “buy”

Believe it or not, this market is a “buy”Charts With the world in the state it’s in and the market so volatile, buying stocks right now might go against all your instincts. But that’s just what you should be doing, says Dominic Frisby. Here, he explains why.

-

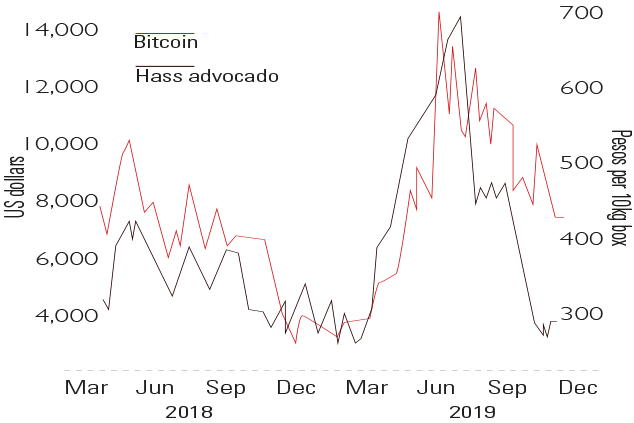

Chart of the week: avocados and bitcoin are in sync

Chart of the week: avocados and bitcoin are in syncCharts An amusing new spurious correlation has been spotted between the price of bitcoin and Mexican Hass avocados. In reality, of course, they have nothing to do with each other beyond “superficial price action”.

-

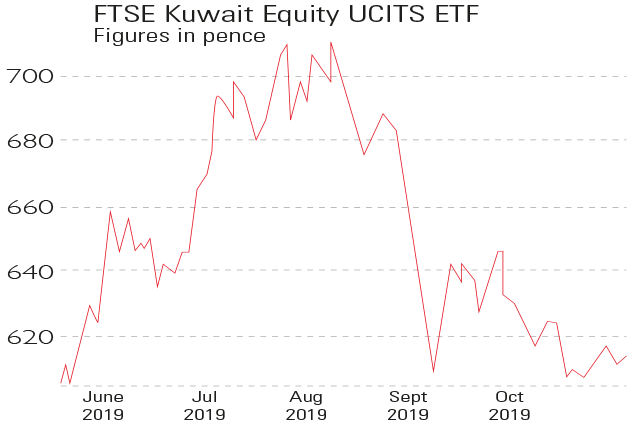

Chart of the week: Kuwait's stockmarket is ready for take-off

Chart of the week: Kuwait's stockmarket is ready for take-offCharts Kuwait's stockmarket is due to be promoted from “frontier” status to an emerging market by index provider MSCI next June. That should entice almost $10bn of global investors’ cash into the country.

-

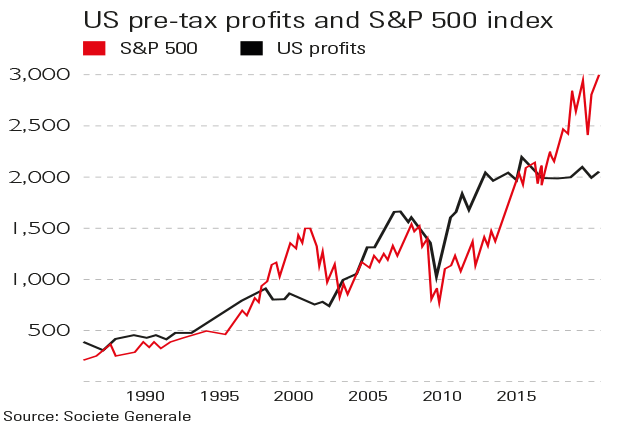

Chart of the week: US stocks outrun profits

Chart of the week: US stocks outrun profitsCharts The US stockmarket has become totally detached from underlying profits of its constituent companies over the past three years.

-

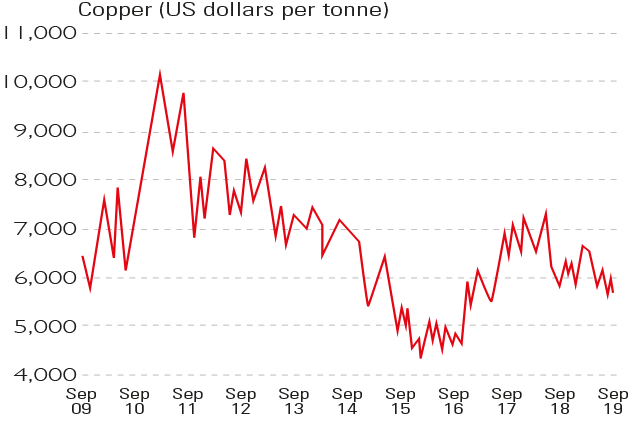

Chart of the week: Dr Copper diagnoses an ailing economy

Chart of the week: Dr Copper diagnoses an ailing economyCharts The price of copper has slipped by a fifth this year and is now at a near-two-year low of around $5,600 a tonne.