Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Futures and options are the oldest types of derivatives, and the principles involved underpin many financial instruments. But they're not the most popular tools with individual British traders.

Instead, the UK's favoured way of using leverage (borrowed money) and shorting (profiting from falling prices) is through spread betting.

Around 85,000 people placed a financial spread bet last year, according to research firm Investment Trends, making the UK the world's largest spread-betting market.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Place your bets

Because spread betting is so popular, it's quite likely you've tried it already or at least tested a demo paper-trading' account. But in case you're not entirely sure how it works, let's look at a typical bet.

We want to bet on the S&P 500, which is at 1,950. We believe it's set to rise. Our spread-betting provider quotes a bid price for this index of 1,949 and an offer price of 1,951. Since we want to bet on the index going up, we buy at the offer price of 1,951. We then need to decide how big our bet is going to be.

This is determined in pounds per point how much we'll gain or lose for every point the index moves. We bet £10 per point. Our provider demands that we put up margin' to cover the risk of losing money.

Margin requirements vary, but let's assume that we initially need to put up 2% of the face value of the bet. So the minimum we'll need available will be 1,950 x £10 x 2% = £390.

The market opens. Unfortunately the S&P 500 drops like a stone. We realise we've made a bad call and close our trade as fast as possible by selling at the latest bid price, which is 1,921. Our total loss is (1,951-1,921) x 10 = £300. This loss has eaten deep into our margin.

If we'd decided to keep the trade open and hope for a recovery, our provider would have demanded more cash. Also note that we should have set a stop loss to cut the loss sooner. A few more trades like this and we'll be broke!

If you compare this bet to afutures trade, you'll see many similarities. But there are some key differences that will determine which is most suitable tool in any given situation.

Spread betting versus futures

Firstly, spread betting is simpler. Working out your total exposure and gains or losses is easy, because you bet in terms of pounds per point. With a futures trade, the calculation can be less intuitive it depends on the contract size and number of lots being traded, as well the price of the contract.

Also, spread-betting firms largely try to make their platforms as easy to use as possible. Some offer tools such as guaranteed stop losses, where a trade will be closed at a certain price even if the market gaps' past the stop loss point. So for less experienced traders, spread betting is the obvious choice.

Spread betting can also offer more flexibility. Futures trading is based on standardised contracts with specific maturity dates. Spread-betting firms can customise the bets on offer to meet client demand. So you will find a wider range of contract types, maturity dates and underlying asset classes on a good spread-betting platform than on any futures exchange.

In particular, spread betting is likely to offer more choice of individual stocks. The futures market focuses on instruments such as indices, commodities and currencies; while single stock futures exist, they are generally not very liquid.

Where futures have an advantage is for traders making larger, more frequent trades. The spreads on futures contracts are generally tighter than spreads from spread-betting firms (although this varies according to the instrument you're trading).

For small trades, this is offset by the fact that you can only trade futures via a broker, and so need to pay dealing commissions to them. But above a certain trade size, it will become more cost-effective than spread betting.

It's also vital to understand that when you trade futures, you are using a broker to trade an independent product on a regulated exchange. When you spread bet, you are entering directly into a transaction with your spread-betting provider.

They may offset their exposure by taking a matching position in futures, stocks or other assets, but your trade does not go directly through these markets. So the futures markets offers greater transparency on prices and volume, which will be an important consideration for some traders.

Match your tax position

Lastly, one key difference is the tax treatment of spread betting versus futures and instruments such as contracts for difference (CFDs). In the UK, spread betting is viewed as a form of gambling and winnings are tax-free. Profits from futures trading are taxable.

Of course, the flip side is that losses from futures can be offset against other capital gains to cut your tax bill, whereas those from spread betting can't. So you need to match your choice of product to your tax situation.

If you're looking to make trading profits, spread betting could be more tax-efficient. But for hedging investments in a taxable account, use a taxable product, such as futures or CFDs.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

DR Horton: US housebuilder that's piling up profits

DR Horton: US housebuilder that's piling up profitsTips US housebuilder DR Horton’s stock rests on firm foundations and looks cheap. Matthew Partridge looks at the best way to play it.

-

DoorDash won't deliver for investors. Here's how to short it

DoorDash won't deliver for investors. Here's how to short itTips American food-delivery app DoorDash can’t even make money in a pandemic. Matthew Partridge explains the best way to short it.

-

Trading: it’s time for investors to dump Match.com

Trading: it’s time for investors to dump Match.comTips The dating group is grappling with regulators and looks absurdly expensive.

-

Build profits with this industrial equipment rentals company

Build profits with this industrial equipment rentals companyTips United Rentals is poised to benefit from higher spending on infrastructure. Matthew Partridge explains the best way to play it.

-

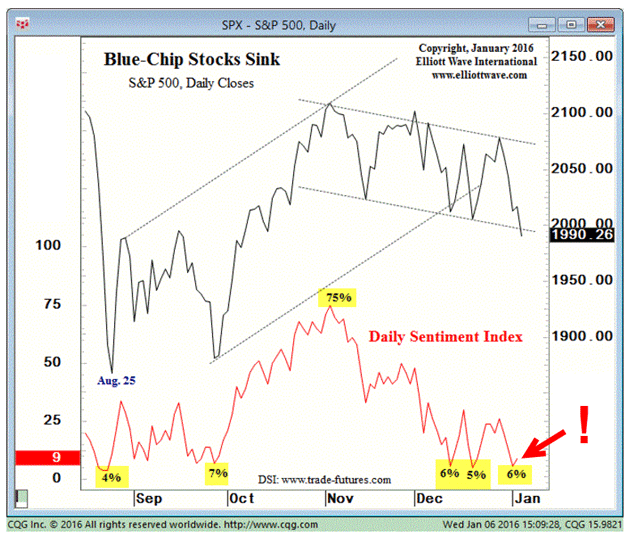

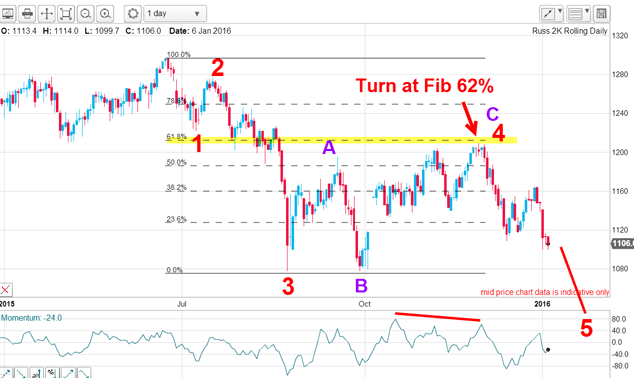

Stocks surge in massive short squeeze

Stocks surge in massive short squeezeFeatures Speculators are dumping their short bets in droves, says John C Burford. That spells opportunity in the charts for swing traders.

-

Is Google parent company Alphabet in the soup?

Is Google parent company Alphabet in the soup?Features Investors in tech giants such as Alphabet were happy to drive up the valuations, says John C Burford. But now patience has run out.

-

Which stockmarket is down 99.986% since 2007?

Which stockmarket is down 99.986% since 2007?Features One European stockmarket has lost virtually all its value since the financial crisis. We'll see more of the same before the current crash is out, says John C Burford.

-

Bad news isn’t good news for stocks anymore

Bad news isn’t good news for stocks anymoreFeatures Last year, the mantra was “bad news is good for stocks”. Now, it looks like traders have finally switched their thinking around, says John C Burford.