Is Google parent company Alphabet in the soup?

Investors in tech giants such as Alphabet were happy to drive up the valuations, says John C Burford. But now patience has run out.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

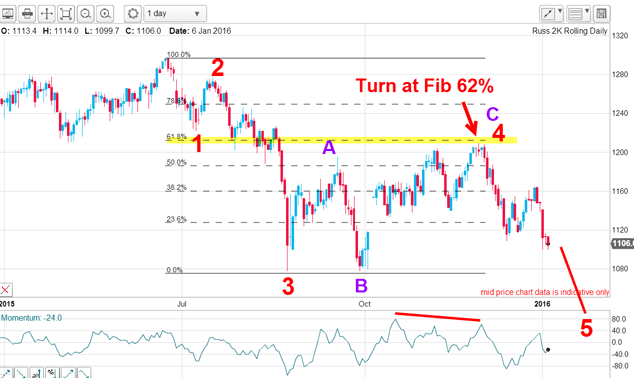

Today, I will veer a little off-piste and cover the huge declines in shares of many of the darlings of the US tech boom. These shares form the backbone of many portfolios but will come unstuck as they join the bear trends already in force in many other shares.

The famous four nicknamed 'Fang' have been responsible for keeping the S&P 500 index elevated almost single-handedly in recent months. Some pundits even include Apple, which makes the fabulous five 'Faang'.

These four are the dominant players in their industries Facebook, Amazon, Netflix and Google (now named Alphabet).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

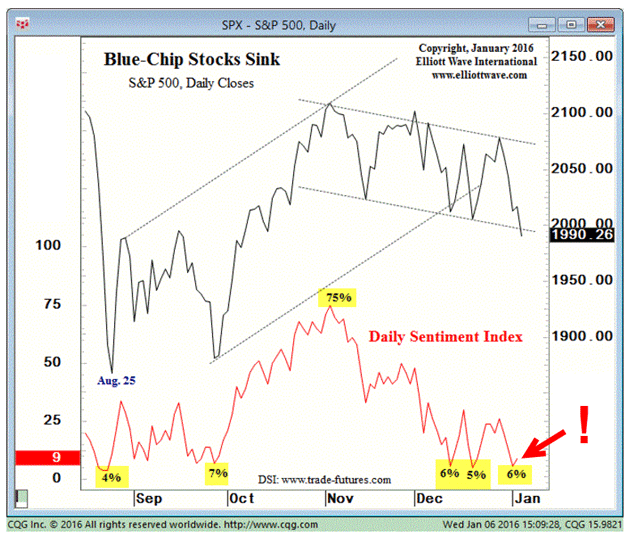

From mid-2015 to December, this quartet was up 40% on average, while the S&P 500 index was essentially flat. In other words, without Fang, the market would have been much lower than it was. The average non-Fang share was well into negative territory and that is where the vast majority of investors are invested. And since December, that divergence has grown even wider with the worst start for a new year in financial history.

The mania that drove this famous four to such giddy heights resulted in some incredible price/earnings (p/e) ratios on an almost Shanghai stock exchange (AKA, 'the Chinese casino') scale.

Facebook reached a p/e of 107,Amazon at 952,Netflix at 131,and Google was a steal at only 36.

Is it any wonder they would start falling to earth when the mania faded?

Amazon

After the fourth quarterearnings report was released last month, the earnings per share (EPS) figure was $1 a share. And you had to pay up to $700 for that privilege.

How did the market react to this good report? Of course, it plunged. That's what happens at the end of a long and tired story. For those who believe the news makes the markets, this is all very puzzling.

Since the start of 2015, the shares have rocketed up from $300 to the recent $700 high as investors bought into the story that with its dominant position, the company would at last return profits to shareholders after years of ploughing profits into new ventures.

But it was inevitable that investors would eventually lose patience and they have been voting with their feet in recent days. The shares have lost $200 (28%) so far this year.

But even if you knew nothing about the company, the chart itself would be flashing great warning signals in December. I have a terrific tramline pair working and a huge momentum divergence going into the $700 high.

And when my pink tramline gave way at the $650 level on the very first trading day of the year with a big gap down, that was the clear signal all was not well and provided an escape route, and a shorting opportunity.

The rally into the day of the latest results was the perfect "buy the rumour, sell the news" opportunity.

But here, I am unable to draw highly reliable tramlines and this is the best fit I can make. I like the upper tramline, which now has three accurate touch points when last week's post-results spike hit it (thus validating it as a solid line of resistance).

In trading terms, the shares remain in a bull market that will end when my lower tramline is breached.

Netflix

Here is the post-split daily chart showing upper tramline and two alternatives for my lower tramline. There has been a clear breach of both lower tramlines a bearish sign.

Despite pretty impressive numbers, this was another "buy the rumour, sell the news" event.

Alphabet/Google

The shares poked to a new high at $800, but note that they did not reach my upper tramline. This was a clear sign of weakness, and now with the shares having lost $100 in four days (12%) they are vulnerable to further weakness if the market can close below my lower tramline. They are now testing that critical line of support.

So, has the Fanglost its bite and is Alphabet in the soup? Despite impressive fourth quarterFang results, the shares are declining. And that suggests those results are about at the top, and may not be repeated for a very long time.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

DR Horton: US housebuilder that's piling up profits

DR Horton: US housebuilder that's piling up profitsTips US housebuilder DR Horton’s stock rests on firm foundations and looks cheap. Matthew Partridge looks at the best way to play it.

-

DoorDash won't deliver for investors. Here's how to short it

DoorDash won't deliver for investors. Here's how to short itTips American food-delivery app DoorDash can’t even make money in a pandemic. Matthew Partridge explains the best way to short it.

-

Trading: it’s time for investors to dump Match.com

Trading: it’s time for investors to dump Match.comTips The dating group is grappling with regulators and looks absurdly expensive.

-

Build profits with this industrial equipment rentals company

Build profits with this industrial equipment rentals companyTips United Rentals is poised to benefit from higher spending on infrastructure. Matthew Partridge explains the best way to play it.

-

Stocks surge in massive short squeeze

Stocks surge in massive short squeezeFeatures Speculators are dumping their short bets in droves, says John C Burford. That spells opportunity in the charts for swing traders.

-

Which stockmarket is down 99.986% since 2007?

Which stockmarket is down 99.986% since 2007?Features One European stockmarket has lost virtually all its value since the financial crisis. We'll see more of the same before the current crash is out, says John C Burford.

-

Bad news isn’t good news for stocks anymore

Bad news isn’t good news for stocks anymoreFeatures Last year, the mantra was “bad news is good for stocks”. Now, it looks like traders have finally switched their thinking around, says John C Burford.

-

Spread betting: A tax-free way to trade

Features Spread betting is Britain's favourite way of using borrowed money to play the stockmarket. And you don't have to pay on your profits. Here's how it works.