What the Hargreaves Lansdown price cuts mean for you

Fund supermarket Hargreaves Lansdown has launched a new pricing structure. Ed Bowsher explains what it means for investors.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Hargreaves Lansdown has used its market muscle to pressure some fund managers to cut their charges.

Hargreaves is also cutting its own charges for some customers. We can now expect to see a flurry of price cuts from the investment platform's rivals. (Platforms are also known as fund supermarkets.)

New regulations known as RDR2 have forced Hargreaves to launch a new pricing structure. Under the current rules, Hargreaves typically charges 1.5% a year for an actively-managed unit trust or OEIC..

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

From that original charge, Hargreaves typically rebates 0.17% to the customer, so the effective charge is 1.33% a year. The fund management company then typically receives an 0.75% annual management charge (AMC) from that 1.33% fee.

Under its new pricing structure, Hargreaves has ensured that the average AMC on its Wealth 150 platform will fall from 0.75% to 0.65%. What's more 27 core' funds will charge as little as 0.54%.

It's worth noting that the Wealth 150 supposedly comprises the best funds on the market as chosen by Hargreaves Lansdown. Yet 70% of these top funds are cutting their AMC.

It will be interesting to see if any funds outside the Wealth 150 cut their AMC. As Justin Modray of Candid Money points out, if no fund outside the 150 cuts its AMC, it would "suggest the Wealth 150 list is more a commercial negotiating tool than a serious research process".

In other words, don't assume that any fund in the Wealth 150 is definitely one of the best funds on the market.

On top of the AMC, most customers will pay a 0.45% fee to Hargreaves. However, wealthy customers will pay less in a tiered structure:

Fund Investments

Tiered Fee (per account)

Up to £250,0000.45% p.a.From £250,000 to £1m0.25% p.a.From £1m to £2m0.1% p.a.From £2mNo charge

Hargreaves charges no trading fee when you buy or sell a fund. (Trading fees still apply for shares and ETFs.)

Hargreaves Lansdown is also increasing the loyalty bonus' for existing funds on its investment platform to 0.75%.

So it's pretty clear that RDR 2 is good news for investors in actively managed funds. However, the new rules aren't so good for many investors in passive funds where a fund replicates an index such as the FTSE 100.

That's because passive investors on most platforms have been able to benefit from very low AMCs sometimes as low as 0.2% - and they haven't had to pay any fee to the platform/fund supermarket. (Hargreaves has been the exception and charged a £2 monthly fee for passive funds.)

Thanks to RDR, all platforms are now obliged to charge the same platform fee for passive and active funds, which will make passive investing more expensive.

However, Hargreaves has persuaded Legal & General and BlackRock to launch passive funds on its platform where the AMC is just 0.06% a year. That's an astonishingly low charge. Hargreaves is also dropping its £2 monthly charge for passive funds.

Investment trusts

Going forward, the annual charge is being cut from 0.5% to 0.45% but there will now be separate caps for investment trusts and shares. In other words, you could end up paying a £90 charge rather than the current £45. So good news for small investors, but bad news for folk with larger holdings.In personal pensions or Sipps, the maximum charge for both investment trusts and shares is £200 a year. So some Sipp investors could end up paying a £400 annual charge.

So what is the competition doing?

Well, Barclays Stockbrokers and Fidelity haven't yet announced their post-RDR pricing structures. They've probably been waiting for Hargreaves to make the first move.

However, Alliance Trust Savings and Charles Stanley Direct have revealed their hands.

Alliance Trust Savings isn't charging a percentage fee, just a £90 annual charge for all portfolios on its platform. It also charges a £12.50 fee every time you trade a fund. So clearly Alliance Trust is most attractive for investors with relatively large portfolios who don't trade very often.

Charles Stanley has a platform charge of 0.25% with no dealing charges so it should work out cheaper than Hargreaves Lansdown with the exception of a small number of funds where Hargreaves has secured an especially large AMC discount from the fund management company.

What we've learned today is that Hargreaves is cutting its existing charges and has secured some AMC discounts. But it's pretty clear that it's not going to be the cheapest player in the platform market.

That's not a surprise. Hargeaves Lansdown has never really competed on price, it's secured a market-leading position through excellent customer service and effective marketing.

What really interests me is to see whether any rival platform can secure AMC discounts from the fund managers. If that happens, competition should really hot up.

This article was amended on 16 January to include details about investment trusts.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ed has been a private investor since the mid-90s and has worked as a financial journalist since 2000. He's been employed by several investment websites including Citywire, breakingviews and The Motley Fool, where he was UK editor.

Ed mainly invests in technology shares, pharmaceuticals and smaller companies. He's also a big fan of investment trusts.

Away from work, Ed is a keen theatre goer and loves all things Canadian.

Follow Ed on Twitter

-

MoneyWeek Talks: The funds to choose in 2026

MoneyWeek Talks: The funds to choose in 2026Podcast Fidelity's Tom Stevenson reveals his top three funds for 2026 for your ISA or self-invested personal pension

-

Three companies with deep economic moats to buy now

Three companies with deep economic moats to buy nowOpinion An economic moat can underpin a company's future returns. Here, Imran Sattar, portfolio manager at Edinburgh Investment Trust, selects three stocks to buy now

-

Hargreaves Lansdown takeover: what it means for your money

Hargreaves Lansdown takeover: what it means for your moneyBritain’s biggest investment platform has agreed a £5.4 billion takeover. What does it mean for shareholders and customers?

-

Neil Woodford, fund managers, and the systemic risk to the financial system

Neil Woodford, fund managers, and the systemic risk to the financial systemFeatures The consequences from the Neil Woodford debacle aren't limited to his fund's investors. He and his ilk could pose a systemic risk to the financial system, says Merryn Somerset Webb.

-

After the Woodford fallout, is it time to buy Hargreaves Lansdown and Patient Capital?

After the Woodford fallout, is it time to buy Hargreaves Lansdown and Patient Capital?Features Two of the biggest casualties from Neil Woodford’s fall from grace are his investment trust - Woodford Patient Capital - and broker Hargreaves Lansdown. John Stepek looks at whether you should snap them up or leave them well alone.

-

What Neil Woodford’s woes mean for your money

What Neil Woodford’s woes mean for your moneyFeatures With the suspension of dealing in Neil Woodford's Equity Income fund, John Stepek looks at where it all went wrong for the “star” fund manager, and what it means for you.

-

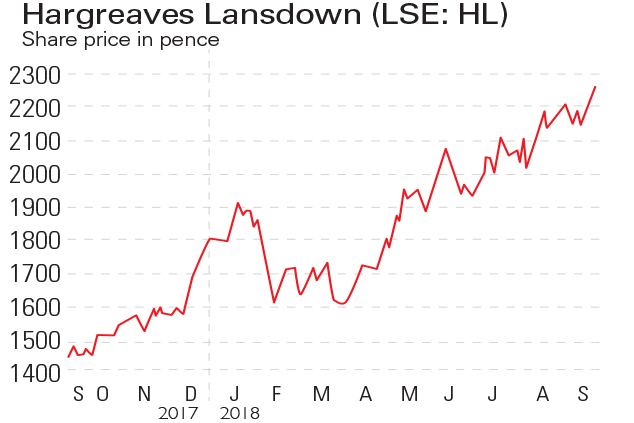

If you'd invested in: Hargreaves Lansdown and Alfa Financial Software

If you'd invested in: Hargreaves Lansdown and Alfa Financial SoftwareFeatures Hargreaves Lansdown, the UK’s biggest investment platform, has seen profits rise, while Alfa Financial Software has suffered two profit warnings and share-price slump.

-

Investment platforms are great, but they need to up their game

Investment platforms are great, but they need to up their gameFeatures Investment platforms have opened up investing for many people. But their pricing structures are obscure and switching between them is expensive and slow.

-

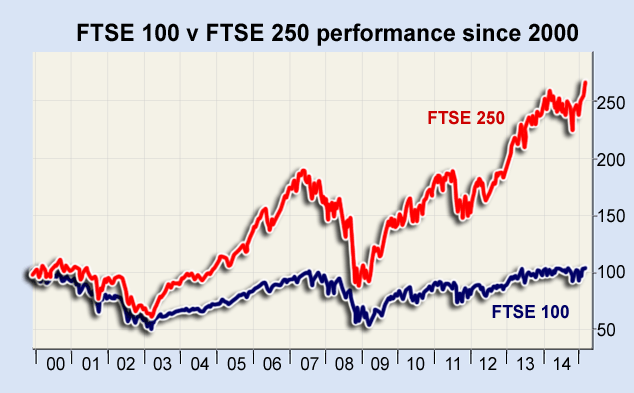

FTSE 100 v FTSE 250: why have they diverged by so much?

FTSE 100 v FTSE 250: why have they diverged by so much?Features Kam Patel examines the reasons behind the heavy parting of ways between the FTSE 100 and the FTSE 250, and asks where they might be heading next.

-

‘Don’t buy our sector’ says Aberdeen boss – but he’s wrong

‘Don’t buy our sector’ says Aberdeen boss – but he’s wrongFeatures The chief executive of Aberdeen Asset Management believes fund managers’ share prices are too high. But there are some good stocks in the sector, says Ed Bowsher.