Investment platforms are great, but they need to up their game

Investment platforms have opened up investing for many people. But their pricing structures are obscure and switching between them is expensive and slow.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

At a panel I chaired a few weeks ago, a representative of a well-known investment platform took the chief executive of a well-known fund management firm to task for the high fees his sector charges. "Glass houses", came the reply, "glass houses" (I paraphrase).

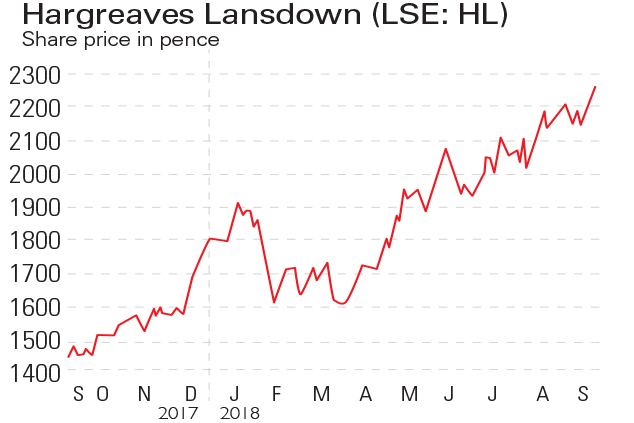

The audience considered this to be fair comment. After all, the granddaddy of the platform sector, Hargreaves Lansdown, regularly reports profit margins of upwards of 40% to its happy shareholders. None of the others, as far as I know, gets to those heady levels of profit, but they have a pretty good stab at it as anyone who has attempted to figure out how much their investment platform charges them every year will know.

Investment platforms need greater transparency

There are admin charges, dealing charges, regular investment charges, dividend reinvestment charges, charges for holding cash, charges for withdrawing cash and, of course, exit fees for those who try to leave. But it is all made more complicated by the fact that all the platforms offer different structures.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Some have minimum monthly charges, while others cap the monthly charges. Some give you a number of "free" trades a year or waive the admin fee if you trade in any given month. Some charge flat fees and others charge percentage-based fees. It's all horribly confusing and there is no one way through it.

You can't just look at the basic platform fee, figure it gives you enough of a signal and take it from there: you have to factor in your own behaviour. The price, you see, will be different depending on how you invest how often you trade and which products you trade in and out of, such as shares, exchange-traded funds, funds or retail bonds.

A half-percentage point difference in expenses on a £500,000 self-invested personal pension (Sipp) growing at 6% over a ten-year period will make a difference to your retirement wealth of £40,000. But it also isn't just about cost. You will also want to factor in your own ideas of what constitutes value.

Is it purely tip-top service? Is it research and portfolio tools? Is it the certain knowledge that the platform is solvent? No one wants the admin hell of a bankrupt Sipp provider. Or perhaps, as it is for me, is it the ability to exercise what should be your rights as a shareholder (some platforms are better than others at making it relatively easy for you to vote at AGMs, for example)?

Enter the Financial Conduct Authority (FCA). Its interim report on investment platforms, published this week, has looked at the market, come to some tentative conclusions and offered some tentative recommendations. It's all focused, quite rightly, on value for money. The FCA is bothered by lack of transparency and complications when it comes to charges. It points out that some platforms charge double that of the cheaper alternatives (from 0.22% to 0.54%) and that the uninitiated can have some trouble working out how that happens.

These are valid concerns, particularly given that the FCA found that 29% of users do not know whether they pay platform charges, or think they do not pay any.

However I am not sure any regulatory action is required here and certainly there is no reason to make everyone have the same fee system. As long as providers are encouraged to make their fees transparent, comprehensible and comparable, that side of things is fine.

I don't mean that they shouldn't be nagged relentlessly about their fees. Of course they should. They could be encouraged to charge the same for trading and holding all asset classes; to stop charging people for holding cash (this is just plain wrong); and to lay everything out on their websites rather more clearly, for example.

However it is worth noting this nagging is well under way and that services already exist that allow you to work out your total charges. Comparefundplatforms.com gives you total annual costs of investing your particular mixture of funds and shares. Yourbroker.info does something similar. You can also go to AJ Bell's youinvest.co.uk, take a stab at what kind of assets you might hold and how much you might trade them and check out what their charges will come to compared with those of the "market leader" (always Hargreaves Lansdown and always more expensive). None of this is 100% easy, but the market is providing (as usual) and it isn't that hard either.

Transfers between investment platforms should be cheap, quick and easy

What really matters, then, is not how each platform operates. It is that if we don't like how it operates and want to switch, we can do it quickly, easily and cheaply.

Competition in the fintech market might mean that a new platform suddenly looks better than the old. You might decide you want to use managed portfolio tools that come cheaper elsewhere. You might want better service. You might be shifting from being a stock investor to being a fund investor. Whatever. You have to be able to make that decision and check out.

Successful and honest competition relies on customers being able to switch products as and when they like. That doesn't happen now. Instead, the FCA report tells us that the switching process is "complex and time consuming". It is possible to complete a transfer in a few weeks, and some do. But I am told that very often it takes two months and in the worst cases sometimes five months. Imagine the stress of either being out of the market (when all providers tell you endlessly how risky that is) or having your assets in limbo for that long.

Transferring can also be bizarrely expensive: to shift a £500,000 Sipp portfolio from one platform to another can cost up to £1,300. No wonder that 7% of consumers have tried to switch and failed.

So what should the FCA do? Lay down the law very firmly on transfers. Platforms should be allowed to charge only for the admin of shifting assets or cash. They should be given a pretty tight time window in which to do it, say ten days at most. Let's not forget that you can now move a bank account with all its attendant complications of standing orders and direct debits in a maximum of seven days. If that can be done for platforms, the market will, I think, sort the rest out.

This is a very competitive sector full of incumbents and entrepreneurs working to improve it all the time. To be a better sector it needs customers to be able to take advantage of that fast.

This article was first published in the Financial Times

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Pitch to Portfolio: Lioness Jill Scott's investing game plan

Pitch to Portfolio: Lioness Jill Scott's investing game planPodcast After bringing football home as a Lioness, Jill Scott discusses how she transformed her finances and became an investor in this latest episode of MoneyWeek Talks.

-

Hargreaves Lansdown takeover: what it means for your money

Hargreaves Lansdown takeover: what it means for your moneyBritain’s biggest investment platform has agreed a £5.4 billion takeover. What does it mean for shareholders and customers?

-

Neil Woodford, fund managers, and the systemic risk to the financial system

Neil Woodford, fund managers, and the systemic risk to the financial systemFeatures The consequences from the Neil Woodford debacle aren't limited to his fund's investors. He and his ilk could pose a systemic risk to the financial system, says Merryn Somerset Webb.

-

After the Woodford fallout, is it time to buy Hargreaves Lansdown and Patient Capital?

After the Woodford fallout, is it time to buy Hargreaves Lansdown and Patient Capital?Features Two of the biggest casualties from Neil Woodford’s fall from grace are his investment trust - Woodford Patient Capital - and broker Hargreaves Lansdown. John Stepek looks at whether you should snap them up or leave them well alone.

-

What Neil Woodford’s woes mean for your money

What Neil Woodford’s woes mean for your moneyFeatures With the suspension of dealing in Neil Woodford's Equity Income fund, John Stepek looks at where it all went wrong for the “star” fund manager, and what it means for you.

-

If you'd invested in: Hargreaves Lansdown and Alfa Financial Software

If you'd invested in: Hargreaves Lansdown and Alfa Financial SoftwareFeatures Hargreaves Lansdown, the UK’s biggest investment platform, has seen profits rise, while Alfa Financial Software has suffered two profit warnings and share-price slump.

-

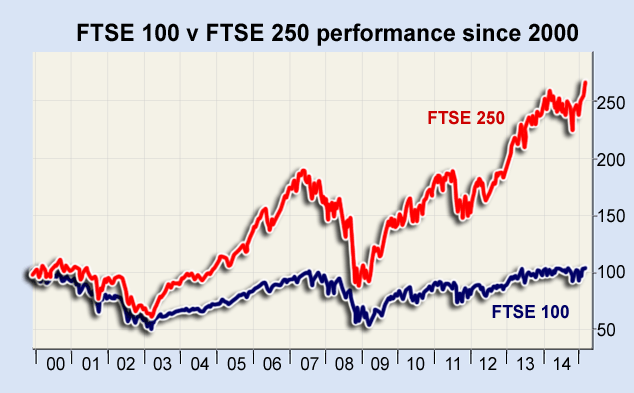

FTSE 100 v FTSE 250: why have they diverged by so much?

FTSE 100 v FTSE 250: why have they diverged by so much?Features Kam Patel examines the reasons behind the heavy parting of ways between the FTSE 100 and the FTSE 250, and asks where they might be heading next.

-

‘Don’t buy our sector’ says Aberdeen boss – but he’s wrong

‘Don’t buy our sector’ says Aberdeen boss – but he’s wrongFeatures The chief executive of Aberdeen Asset Management believes fund managers’ share prices are too high. But there are some good stocks in the sector, says Ed Bowsher.

-

Hargreaves Lansdown share price jumps as annuity companies slide

Features The Budget announcement on annuities has triggered some major share price carnage. Ed Bowsher looks at the winners and losers.