Hargreaves Lansdown share price jumps as annuity companies slide

The Budget announcement on annuities has triggered some major share price carnage. Ed Bowsher looks at the winners and losers.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Today's unexpected Budget announcement on annuities has triggered some major share price carnage.

Shares in Partnership Assurance (LSE: PA.) have slumped 55% to 138p, while Just Retirement (LSE:JRG) has tumbled 42% to 154p.

Both companies are specialist annuity providers, and so their business is threatened by George Osborne's planned reforms. However, I think these share price falls are overdone.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

That's because Parternership and Just Retirement are both good guys' in the annuity world.

The real scandal with annuities has been that too many retirees were given a poor deal when they bought an annuity. They didn't realise they could shop around between annuity providers and get the best deal. Instead they took the annuity they were offered by their pension pot provider.

If these pensioners had shopped around and declared all their health problems, they might have been able to boost their pension income by 40%.

Partnership and Just Retirement are specialist annuity companies, they don't provide pension saving products. So if you end up with an annuity from either company, either you or your adviser has shopped around.

Under the chancellor's new plan, everyone will be offered free financial advice when they retire, so that should mean more people will shop around at retirement.

Granted, many folk will decide not to bother with an annuity. Instead they'll either go into drawdown or just take all the money from their pot after paying some income tax.

But some people will still want an annuity, and I believe a higher percentage of annuity buyers will end up at Partnership or Just Retirement.

So yes, I can see both companies' share prices have fallen. I just think the falls are too large.

The real losers will be the big pension providers

It's interesting to note that shares in Legal & General (LSE: LGEN) are down 25.5p this afternoon to 205p. Prudential (LSE: PRU) is down 37p to £13.31 while Standard Life (LSE: SL) is down 11p at 354p.

And the winner is...

Hargreaves Lansdown

I can understand the rationale for that. If people take out large lump sums from pension pots, they may want to invest them, and Hargreaves Lansdown offers the largest investment platform for private investors in the UK. The company also offers advice for anyone who wants to shop around for an annuity.

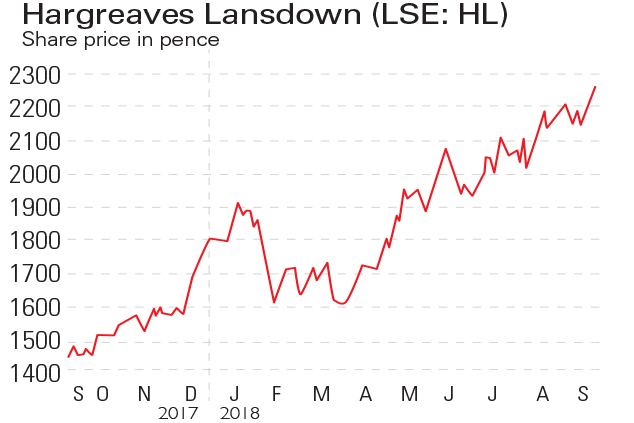

I'm in no doubt that Hargreaves will get more business as a result of today's news. My struggle with Hargreaves is its valuation. Even before today's share price rise, the company was trading on a historic price/earnings ratioof 40, and today's news won't deliver a big enough boost to earnings to justify a £15 share price.

It's also worth noting that the margins at Hargreaves Lansdown are very high. That's obviously great news for current shareholders, but at some point, competitive pressures may force Hargreaves to cut its prices.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ed has been a private investor since the mid-90s and has worked as a financial journalist since 2000. He's been employed by several investment websites including Citywire, breakingviews and The Motley Fool, where he was UK editor.

Ed mainly invests in technology shares, pharmaceuticals and smaller companies. He's also a big fan of investment trusts.

Away from work, Ed is a keen theatre goer and loves all things Canadian.

Follow Ed on Twitter

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

-

Hargreaves Lansdown takeover: what it means for your money

Hargreaves Lansdown takeover: what it means for your moneyBritain’s biggest investment platform has agreed a £5.4 billion takeover. What does it mean for shareholders and customers?

-

Neil Woodford, fund managers, and the systemic risk to the financial system

Neil Woodford, fund managers, and the systemic risk to the financial systemFeatures The consequences from the Neil Woodford debacle aren't limited to his fund's investors. He and his ilk could pose a systemic risk to the financial system, says Merryn Somerset Webb.

-

After the Woodford fallout, is it time to buy Hargreaves Lansdown and Patient Capital?

After the Woodford fallout, is it time to buy Hargreaves Lansdown and Patient Capital?Features Two of the biggest casualties from Neil Woodford’s fall from grace are his investment trust - Woodford Patient Capital - and broker Hargreaves Lansdown. John Stepek looks at whether you should snap them up or leave them well alone.

-

What Neil Woodford’s woes mean for your money

What Neil Woodford’s woes mean for your moneyFeatures With the suspension of dealing in Neil Woodford's Equity Income fund, John Stepek looks at where it all went wrong for the “star” fund manager, and what it means for you.

-

If you'd invested in: Hargreaves Lansdown and Alfa Financial Software

If you'd invested in: Hargreaves Lansdown and Alfa Financial SoftwareFeatures Hargreaves Lansdown, the UK’s biggest investment platform, has seen profits rise, while Alfa Financial Software has suffered two profit warnings and share-price slump.

-

Investment platforms are great, but they need to up their game

Investment platforms are great, but they need to up their gameFeatures Investment platforms have opened up investing for many people. But their pricing structures are obscure and switching between them is expensive and slow.

-

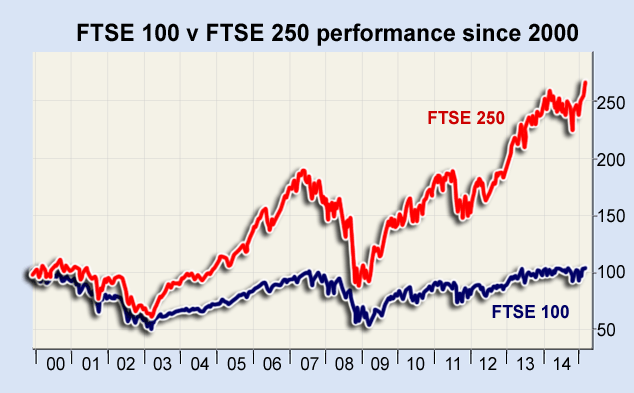

FTSE 100 v FTSE 250: why have they diverged by so much?

FTSE 100 v FTSE 250: why have they diverged by so much?Features Kam Patel examines the reasons behind the heavy parting of ways between the FTSE 100 and the FTSE 250, and asks where they might be heading next.

-

‘Don’t buy our sector’ says Aberdeen boss – but he’s wrong

‘Don’t buy our sector’ says Aberdeen boss – but he’s wrongFeatures The chief executive of Aberdeen Asset Management believes fund managers’ share prices are too high. But there are some good stocks in the sector, says Ed Bowsher.