Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

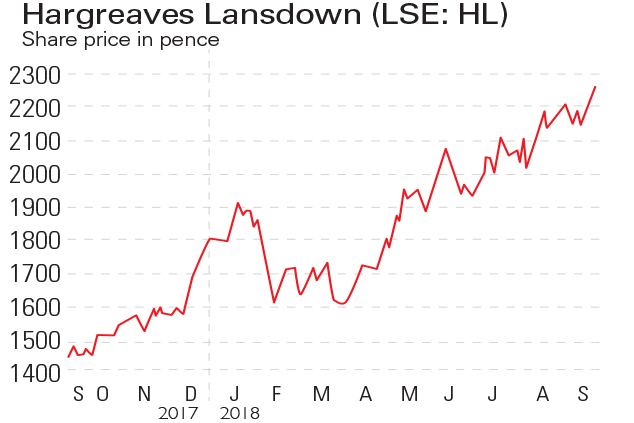

Hargreaves Lansdown (LSE: HL) is the UK's biggest investment platform, with over £90bn under management on behalf of more than a million customers. Over 130,000 new customers brought in net new business of £7.6bn in the year to 30 June, driving pre-tax profits up by 10% to £292m. Some of the increase is due to transfers relating to what Hargreaves termed "operational issues on competitor platforms": the fallout from Barclays Stockbrokers' botched new broker service Smart Investor. Hargreaves Lansdown's share price has risen by almost 60% in a year.

Be glad you didn't...

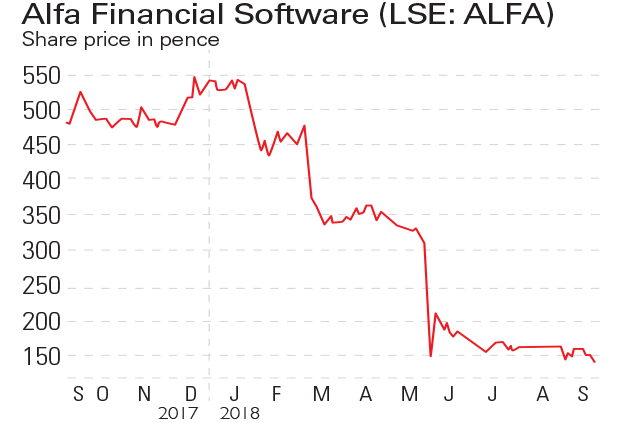

Alfa Financial Software (LSE: ALFA) provides software for the financial services industry and made its debut on the London stockmarket in May 2017. Shares initially jumped by 32% and by the end of 2017 the company's value had risen to £1.6bn. But 2018 has not been kind to Alfa. The strength of the US dollar and delays in some major contracts led to a fall in sales. And despite what the CEO calls a "healthy pipeline", two profit warnings did further damage to the share price, which is now down by 70% in the last year. Alfa could fall out of the FTSE 250.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Hargreaves Lansdown takeover: what it means for your money

Hargreaves Lansdown takeover: what it means for your moneyBritain’s biggest investment platform has agreed a £5.4 billion takeover. What does it mean for shareholders and customers?

-

Neil Woodford, fund managers, and the systemic risk to the financial system

Neil Woodford, fund managers, and the systemic risk to the financial systemFeatures The consequences from the Neil Woodford debacle aren't limited to his fund's investors. He and his ilk could pose a systemic risk to the financial system, says Merryn Somerset Webb.

-

After the Woodford fallout, is it time to buy Hargreaves Lansdown and Patient Capital?

After the Woodford fallout, is it time to buy Hargreaves Lansdown and Patient Capital?Features Two of the biggest casualties from Neil Woodford’s fall from grace are his investment trust - Woodford Patient Capital - and broker Hargreaves Lansdown. John Stepek looks at whether you should snap them up or leave them well alone.

-

What Neil Woodford’s woes mean for your money

What Neil Woodford’s woes mean for your moneyFeatures With the suspension of dealing in Neil Woodford's Equity Income fund, John Stepek looks at where it all went wrong for the “star” fund manager, and what it means for you.

-

Investment platforms are great, but they need to up their game

Investment platforms are great, but they need to up their gameFeatures Investment platforms have opened up investing for many people. But their pricing structures are obscure and switching between them is expensive and slow.

-

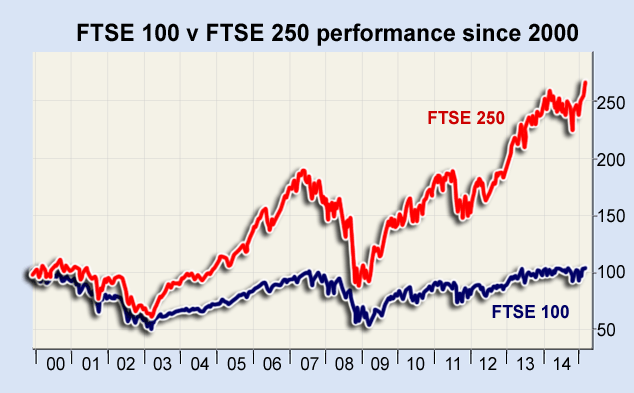

FTSE 100 v FTSE 250: why have they diverged by so much?

FTSE 100 v FTSE 250: why have they diverged by so much?Features Kam Patel examines the reasons behind the heavy parting of ways between the FTSE 100 and the FTSE 250, and asks where they might be heading next.

-

‘Don’t buy our sector’ says Aberdeen boss – but he’s wrong

‘Don’t buy our sector’ says Aberdeen boss – but he’s wrongFeatures The chief executive of Aberdeen Asset Management believes fund managers’ share prices are too high. But there are some good stocks in the sector, says Ed Bowsher.

-

Hargreaves Lansdown share price jumps as annuity companies slide

Features The Budget announcement on annuities has triggered some major share price carnage. Ed Bowsher looks at the winners and losers.