Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

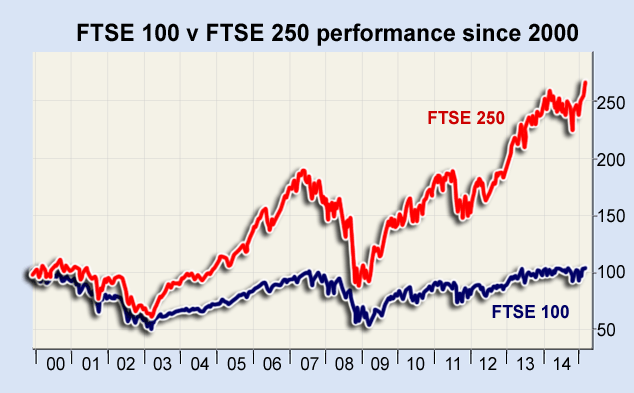

Investors have been busy this week assessing the implications of the FTSE 100 hitting record highs. But equally intriguing is the startling scale of divergence that has developed between the FTSE 100 and FTSE 250.

On Tuesday the FTSE 100 closed 6949.43, surpassing its previous peak of 6930.2 set 15 years ago on 30 December 1999. Yesterday it closed at 6,946.

MoneyWeek looked closely at the FTSE 100's rise towards the new peak and the lessons to be gleaned by investors from its advance. Similarly, the eye-catching deviation that has been taking place in recent years between the FTSE 100 and FTSE 250 also demands some explanations.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Over the last five years the FTSE 100 has put on nearly 30%, while the FTSE 250 has advanced by 84%, according to Google Finance charts. Indeed, this latest period of heavy divergence between the two began towards the end of the 2007-2008 financial crisis. Since the beginning of 2009, the FTSE 100 has gained around 60% while the FTSE 250 has powered ahead by 170%.

Having said that, it is also true that the FTSE 250 has outperformed the FTSE 100 since the turn of the century, as well as in the last five years. Since 2000, the blue-chip index has risen by less than 1% while the FTSE 250 has gained 166%.

But for investors today, it is the current divergence and the behaviour of the two in recent years that is most important, especially in the wake of the financial crisis of 2007-2008. What are reasons behind such a heavy parting of ways between the two indices since the crisis and where might they be headed over the near to medium term?

Investors sticking close to home

Michael Hewson, chief market analyst at CMC Markets, says that the outperformance of FTSE 250 in recent years is largely down to the fact that the FTSE 100 has a much more global footprint, and is heavily geared towards the banks as well as basic resource stocks.

He explains: "The decline in commodity prices since 2011 has resulted in mining and oil and gas shares underperforming the broader market while the low interest rate environment as well as increased regulatory scrutiny of financial services has hit bank profitability."

A look at the FTSE 100 index weightings for the resource sectors and banks underlines Hewson's point. There are five oil and gas stocks with a total FTSE 100 weighting of 14.49%; seven mining stocks with 9.22%; and five bank stocks accounting for 12.67%. Combined, these three global-oriented sectors account for 36.4% of the FTSE 100 by weight.

By contrast the FTSE 250 is more domestically biased, comprising many household names that UK consumers feel more comfortable with. Hewson reckons investors' more intense buying interest in FTSE 250 constituents boils down to the fact that UK investors feel more comfortable buying stocks in shares that have a recognisable brand presence in the UK. It is also easier to obtain information about how well UK-based companies are doing, than global mining companies who have no real presence on these shores.

FTSE 250 weightings for resource and banking stocks are pretty non-existent: there are six oil and gas stocks accounting for just 1.12% of the index by weight; seven miners combined make up 1.5% and two banks 0.36%. The biggest sector in the FTSE 250 is equity investment instruments such as Alliance Trust and 3i. The index ended yesterday's session at 17,273, down 0.1%

Commenting on the outlook for the two indices, Hewson thinks their paths could well continue to widen over the short to medium term, although investors will likely exercise caution in the run-up to the election. "Having said that I don't see why FTSE250 can't head towards 20,000. For FTSE100, the 7,000 level could be a tough nut to crack," he says.

Laith Khalaf, senior analyst at Hargreaves Lansdown, echoes Hewson's analysis. He says there are lots of factors behind the recent strong performance of mid caps compared to their large-cap cousins. Like Hewson, Khalaf points in particular to the recent oil price slump as having hit the big oil and mining companies of the FTSE 100 pretty hard. Likewise, the strength of sterling has impaired the foreign earnings of the big international blue chips.

But Khalaf believes it is important not to overplay these points: "We live in a global market, even for medium sized companies while around two thirds of FTSE 100 earnings come from overseas, around half of FTSE 250 earnings come from overseas too.

"The mid cap [FTSE250] success story is not just a recent phenomenon, it has been going on for many years. The reality is these companies may be more volatile than the big blue chips, but they offer the prospect for much greater reward too: just looking back to the turn of the century they have returned over £26,000 on a £10,000 investment since, compared to £6,600 from the FTSE 100 [on a total return, dividends reinvested basis]."

He adds: "They [FTSE250 constituents] are also a fertile hunting ground for talented active managers to add value, seeing as they are less well analysed than the big blue chips. The strong performance of mid-caps means long term investors would be well-advised to consider maintaining a healthy proportion of mid-cap names in their portfolio.

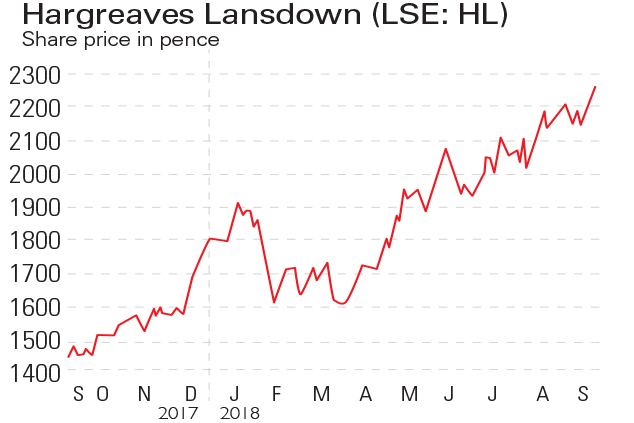

In terms of investor sentiment currently, he says it is "relatively buoyant without being excessively exuberant". Meanwhile, Hargreaves' monthly investor confidence index stands at 101, in line with its long term average: "That fits with the fact the valuation on the UK market is not far of its long term average either, suggesting DIY investors have fairly reasonable expectations from the stock market right now."

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Kam is a former deputy editor at Hemscott Invest and online editor, City A.M and he was also previously the Digital Editor at IFA Magazine. Kam is currently a senior journalist at The Global Treasurer and contributes to MoneyWeek. Kam shares expertise on the FTSE 100, investing and global stocks.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Hargreaves Lansdown takeover: what it means for your money

Hargreaves Lansdown takeover: what it means for your moneyBritain’s biggest investment platform has agreed a £5.4 billion takeover. What does it mean for shareholders and customers?

-

Neil Woodford, fund managers, and the systemic risk to the financial system

Neil Woodford, fund managers, and the systemic risk to the financial systemFeatures The consequences from the Neil Woodford debacle aren't limited to his fund's investors. He and his ilk could pose a systemic risk to the financial system, says Merryn Somerset Webb.

-

After the Woodford fallout, is it time to buy Hargreaves Lansdown and Patient Capital?

After the Woodford fallout, is it time to buy Hargreaves Lansdown and Patient Capital?Features Two of the biggest casualties from Neil Woodford’s fall from grace are his investment trust - Woodford Patient Capital - and broker Hargreaves Lansdown. John Stepek looks at whether you should snap them up or leave them well alone.

-

What Neil Woodford’s woes mean for your money

What Neil Woodford’s woes mean for your moneyFeatures With the suspension of dealing in Neil Woodford's Equity Income fund, John Stepek looks at where it all went wrong for the “star” fund manager, and what it means for you.

-

If you'd invested in: Hargreaves Lansdown and Alfa Financial Software

If you'd invested in: Hargreaves Lansdown and Alfa Financial SoftwareFeatures Hargreaves Lansdown, the UK’s biggest investment platform, has seen profits rise, while Alfa Financial Software has suffered two profit warnings and share-price slump.

-

Investment platforms are great, but they need to up their game

Investment platforms are great, but they need to up their gameFeatures Investment platforms have opened up investing for many people. But their pricing structures are obscure and switching between them is expensive and slow.

-

‘Don’t buy our sector’ says Aberdeen boss – but he’s wrong

‘Don’t buy our sector’ says Aberdeen boss – but he’s wrongFeatures The chief executive of Aberdeen Asset Management believes fund managers’ share prices are too high. But there are some good stocks in the sector, says Ed Bowsher.

-

Hargreaves Lansdown share price jumps as annuity companies slide

Features The Budget announcement on annuities has triggered some major share price carnage. Ed Bowsher looks at the winners and losers.