Next has stopped buying its own shares – but don’t sell yours

High-street fashion retailer Next is ending its share buyback programme. Here, Ed Bowsher explains what that means for investors, and why you should hang on to the shares.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Unlike some big-name rivals, clothing chain Next (LSE: NXT) had a great Christmas.

On Friday, it put out an upbeat trading statement sales were up 12% - that had the stock market cheering.

But it was another part of the statement that really caught my eye. Next is suspending its share buyback programme and will pay a special dividend instead.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

You might think this is bad news for shareholders. After all, it means a big buyer is leaving the market.

But in fact, I think it's good news. Share buybacks are often very damaging especially when the share price is high. The fact that Next's management team is smart enough to stop now is yet another good reason to hang on to your shares.

Here's why...

How buybacks work

It can invest the cash back into the business. Or it can stick it in the company bank account, and just sit on it. Or it can return it to shareholders.

Traditionally, this was done via a dividend. But an increasingly popular way to return cash is through a share buyback. This is when a company buys some of its shares back from shareholders. Most of the time, this is done during ordinary market trading.

How does this work? Let's imagine you own 100 shares in Company ABC. Over the course of a month, ABC buys back 1% of its share capital, but you don't sell any of your shares.You might think that nothing has changed for you, but you'd be wrong.

On the downside, you own shares in a company that has less cash in its bank account (or is perhaps even borrowing more to buy its own shares). But on the upside, you now own a slightly larger percentage stake in the company.

So why do companies buy back shares, rather than pay dividends? The most persuasive argument for buybacks is that they save tax. If you're a shareholder and you receive a dividend, you're probably going to have pay income tax on that dividend. But you don't have to pay any tax when there's a buyback.

A buyback can also cut a company's tax bill. By buying back shares, a company is altering its capital structure (the way it's funded).

Sometimes companies borrow to fund buybacks, so the company increases its debt and reduces its outstanding equity (shares). It's cheaper to fund a company using debt because interest payments can be deducted from a company's corporation tax bill that's not true for dividends.

The dark side of buybacks

Company bosses often like buybacks because they can boost the share price. That makes bosses feel good, and can also trigger share option payments.

But a craftier wheeze is that share buybacks are also a way to effectively manipulate the profit figures so they look better than they really are. That's because a share buyback can boost a company's earnings per share (EPS).

You see, a share buyback in itself won't boost a company's profits apart from any tax savings. But it will reduce the number of shares outstanding, which means that earnings per share will go up.

So by buying back shares, a chief executive can give the impression that the company is growing when really, it isn't. Many bosses also have bonus deals that are linked to EPS, so they're keen to do anything that can drive that earnings figure up. This leads to the short-termist decisions that economist Andrew Smithers has been particularly scathing of (my colleague Merryn Somerset Webb has written a lot about this.

So share buybacks are often done for entirely the wrong reasons. And this means that they also often destroy shareholder value.

Just as with any other investment, if a company pays too much for its own shares, the remaining shareholders suffer, because some of their money has been wasted on an over-priced investment. These shareholders would have been better off if the money had been returned in a dividend.

Indeed, US investor Warren Buffett is very clear that share buybacks are only justifiable if the share price is below the intrinsic value of the company. At most, he's prepared to pay 110% of the company's net asset value.

It's a shame that more companies' management teams aren't as strict in their criteria. Plenty of research shows that companies often do buybacks at the wrong time - when the share price is too high. For example, recent research from Thomson Reuters suggested that more often than not, share buybacks precede a period of poor returns for remaining shareholders.

This is why it's good news that Next has ditched the buybacks

Next isn't prepared to pay more than £58 a share in a buyback. With the share price now at £60, purchases have been suspended. Instead the company is paying out a £75m special dividend, which works out at 50p a share. If the share price is still above £58 in three months' time, it will pay out another 50p special dividend. And so on.

If you're wondering why Next doesn't just add these 50p special payments to the regular dividend, it's because the company wants to avoid a situation where it has to cut the regular dividend in future. The City hates dividend cuts.

So as I say, I'm impressed that Next directors don't want to pay too much for their shares.

Of course, you could argue that this move is a clear sell' signal for Next shares. After all, the guys who run the company are effectively arguing that their shares are getting too pricey.

But I'm going to hang on to mine. Granted, a price/earnings ratio of 17 isn't cheap, but this is a company with a strong management team and an impressive track record.

And the fact that the directors are disciplined and far-sighted enough to suspend buybacks just makes the company all the more attractive.

So I'm holding on. And if you're looking to buy in the retail sector well, last October, I said that Next was "my favourite retail share". I have to say that even now, it still is.

Our recommended articles for today

Working full time? You could still be costing the taxpayer a fortune

Six experts tell us what to buy and what to avoid in 2014

Subscribers only

What should investors look out for in the months ahead? Our newsletter writers and experts give their views on the outlook and big themes for 2014.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ed has been a private investor since the mid-90s and has worked as a financial journalist since 2000. He's been employed by several investment websites including Citywire, breakingviews and The Motley Fool, where he was UK editor.

Ed mainly invests in technology shares, pharmaceuticals and smaller companies. He's also a big fan of investment trusts.

Away from work, Ed is a keen theatre goer and loves all things Canadian.

Follow Ed on Twitter

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Defeat into victory: the key to Next CEO Simon Wolfson's success

Defeat into victory: the key to Next CEO Simon Wolfson's successOpinion Next CEO Simon Wolfson claims he owes his success to a book on military strategy in World War II. What lessons does it hold, and how did he apply them to Next?

-

Next’s results stand out against a tough retail backdrop

Next’s results stand out against a tough retail backdropAnalysis FTSE 100 retailer Next is dealing well with the tough conditions on the high street, with rising profits and a plan that's working. Rupert Hargreaves looks at the numbers.

-

Why Next is the only retailer I’d want to own in my portfolio

Why Next is the only retailer I’d want to own in my portfolioNews The retail sector is brutally competitive. But high street stalwart Next is exploiting and building on its significant competitive advantages, says Rupert Hargreaves.

-

Next shares soar as sales smash expectations – is the stock a buy?

Next shares soar as sales smash expectations – is the stock a buy?News High street and online retailer Next has reported a big rise in sales and profits. John Stepek looks at its performance and asks if it's worth buying Next shares.

-

Little cheer on the high street

Little cheer on the high streetFeatures Profit warnings from Debenhams and Mothercare are more evidence that traditional retailers are fighting a losing battle against nimbler online competitors, says Ben Judge.

-

The cloud over retail has a silver lining

The cloud over retail has a silver liningCover Story A sense of gloom hangs over the retail sector – but pick the right stocks at the right price and there are still potential pots of gold out there for long-term buyers, says Phil Oakley.

-

Next: Out of fashion

Features Clothing retailer Next has released gloomy results, yet the firm’s shares rallied strongly. Why? Ben Judge reports.

-

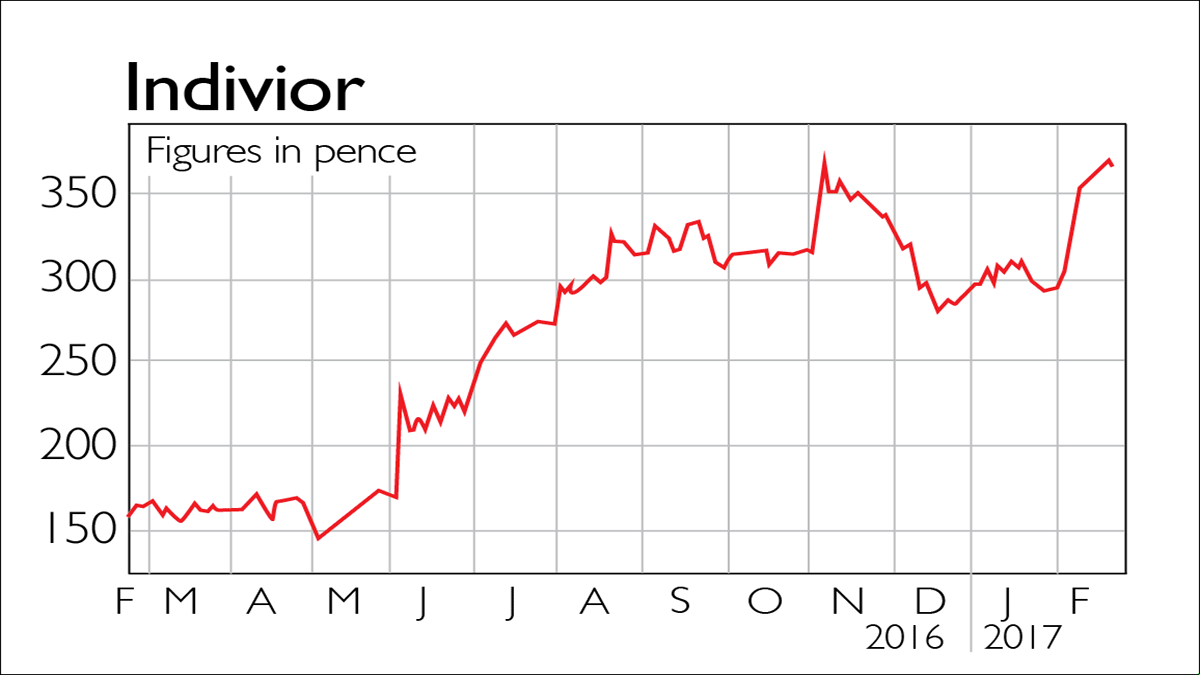

If you’d invested in: Indivior and Next

If you’d invested in: Indivior and NextFeatures Drugmaker Indivior is on the up, while retailer Next, once a favourite with investors, has lost its way.