Thinking of joining a private sector union? Now’s the time

The balance between profits and wages is out of whack. But wages for workers in unions are growing faster than those not in unions.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

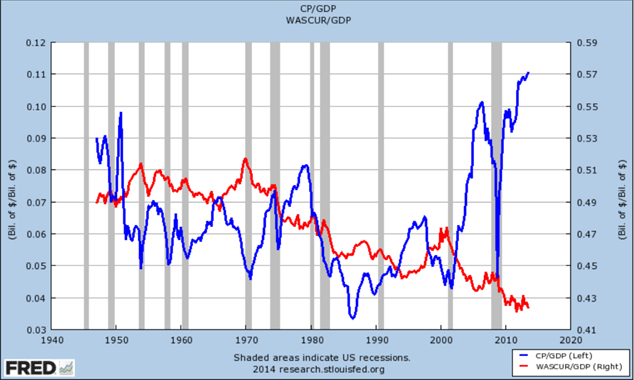

We've written several times here that we don't think the current balance between corporate profits and ordinary salaries is sustainable. The chart below makes the point nicely.

Profits in the US have risen hugely as a percent of GDP in the last decade or so. Wages have fallen as a percentage of GDP from near 50% to near 40% and are now far from their historical average level.

If you believe at all in reversion to the mean, you will wonder how long this can last. The answer might be not as long as the deflationistas might think.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

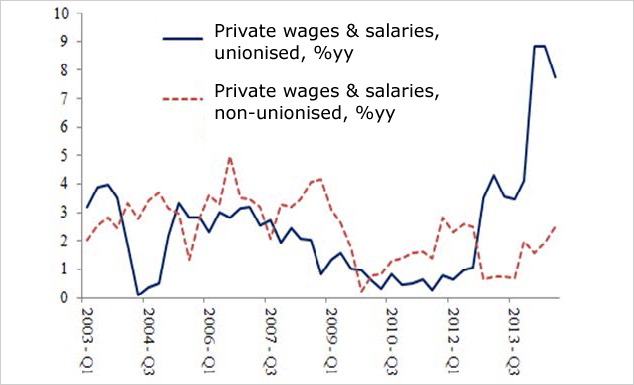

In his recent letter to investors, Crispin Odey looks at "how differently private sector wages are growing in America for unionised labour forces and non-unionised". The second chart (from Odey) shows this.

It suggests, as Odey puts it, "that there is huge value in being in a union at the moment." It also suggests that those who are not in unions don't yet appreciate the negotiating power they have with their employers given that unemployment is currently sitting at only 5.6% in the US. Surely they soon will.

This is good news for workers why should their share of GDP keep falling?

But, as I have said before, it is very bad news for investors: it guarantees falling profits margins and that is something that US stock market valuations are definitely not pricing in.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Adventures in Saudi Arabia

Adventures in Saudi ArabiaTravel The kingdom of Saudi Arabia in the Middle East is rich in undiscovered natural beauty. Get there before everybody else does, says Merryn Somerset Webb

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

Beating inflation takes more luck than skill – but are we about to get lucky?

Beating inflation takes more luck than skill – but are we about to get lucky?Opinion The US Federal Reserve managed to beat inflation in the 1980s. But much of that was down to pure luck. Thankfully, says Merryn Somerset Webb, the Bank of England may be about to get lucky.

-

Rishi Sunak can’t fix all our problems – so why try?

Rishi Sunak can’t fix all our problems – so why try?Opinion Rishi Sunak’s Spring Statement is an attempt to plaster over problems the chancellor can’t fix. So should he even bother trying, asks Merryn Somerset Webb?

-

Young people are becoming a scarce resource – we should value them more highly

Young people are becoming a scarce resource – we should value them more highlyOpinion In the last two years adults have been bizarrely unkind to children and young people. That doesn’t bode well for the future, says Merryn Somerset Webb.

-

Ask for a pay rise – everyone else is

Ask for a pay rise – everyone else isOpinion As inflation bites and the labour market remains tight, many of the nation's employees are asking for a pay rise. Merryn Somerset Webb explains why you should do that too.

-

Why central banks should stick to controlling inflation

Why central banks should stick to controlling inflationOpinion The world’s central bankers are stepping out of their traditional roles and becoming much more political. That’s a mistake, says Merryn Somerset Webb.

-

How St Ives became St Tropez as the recovery drives prices sky high

How St Ives became St Tropez as the recovery drives prices sky highOpinion Merryn Somerset Webb finds herself at the epicentre of Britain’s V-shaped recovery as pent-up demand flows straight into Cornwall’s restaurants and beaches.

-

The real problem of Universal Basic Income (UBI)

The real problem of Universal Basic Income (UBI)Merryn's Blog April employment numbers showed 75 per cent fewer people in the US returned to employment compared to expectations. Merryn Somerset-Webb explains how excessive government support is causing a shortage of labour.

-

Why an ageing population is not necessarily the disaster many people think it is

Why an ageing population is not necessarily the disaster many people think it isOpinion We’ve got used to the idea that an ageing population is a bad thing. But that’s not necessarily true, says Merryn Somerset Webb.