Emerging Markets

The latest news, updates and opinions on Emerging Markets from the expert team here at MoneyWeek

-

Exciting opportunities in biotech

Biotech firms should profit from the ‘patent cliff’, which will force big pharmaceutical companies to innovate or make acquisitions

By Max King Published

-

The state of Iran’s economy – and why people are protesting

Iran has long been mired in an economic crisis that is part of a wider systemic failure. Do the protests show a way out?

By Simon Wilson Published

-

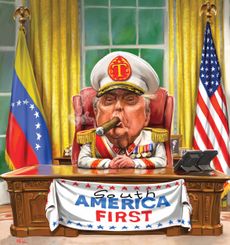

The rise and fall of Nicolás Maduro, Venezuela's dictator

Nicolás Maduro is known for getting what he wants out of any situation. That might be a challenge now

By Jane Lewis Published

-

Three Indian stocks to buy for long-term profit growth

Opinion Rita Tahilramani and James Thom, co-managers at the Aberdeen New India Investment Trust, highlight three Indian stocks to buy now

By Rita Tahilramani Published

Opinion -

Why does Donald Trump want Venezuela's oil?

The US has seized control of Venezuelan oil. Why and to what end?

By Simon Wilson Published

-

Is US stock market exceptionalism over?

US stocks trailed the rest of the world in 2025. Is this a sign that a long-overdue shift is underway?

By Cris Sholto Heaton Published

-

Metals and AI power emerging markets

This year’s big emerging market winners have tended to offer exposure to one of 2025’s two winning trends – AI-focused tech and the global metals rally

By Alex Rankine Published

-

Quality emerging market companies with consistent returns

Opinion Mark Hammonds, portfolio manager at Guinness Global Investors, selects three emerging market stocks where he'd put his money

By Mark Hammonds Published

Opinion -

Key lessons from the MoneyWeek Wealth Summit 2025

Our annual MoneyWeek Wealth Summit featured a wide array of experts and ideas, and celebrated 25 years of MoneyWeek

By MoneyWeek Published