Spring Budget: what does it mean for your finances?

From energy and childcare help to pension changes and frozen tax bands – what does the Spring Budget mean for you?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

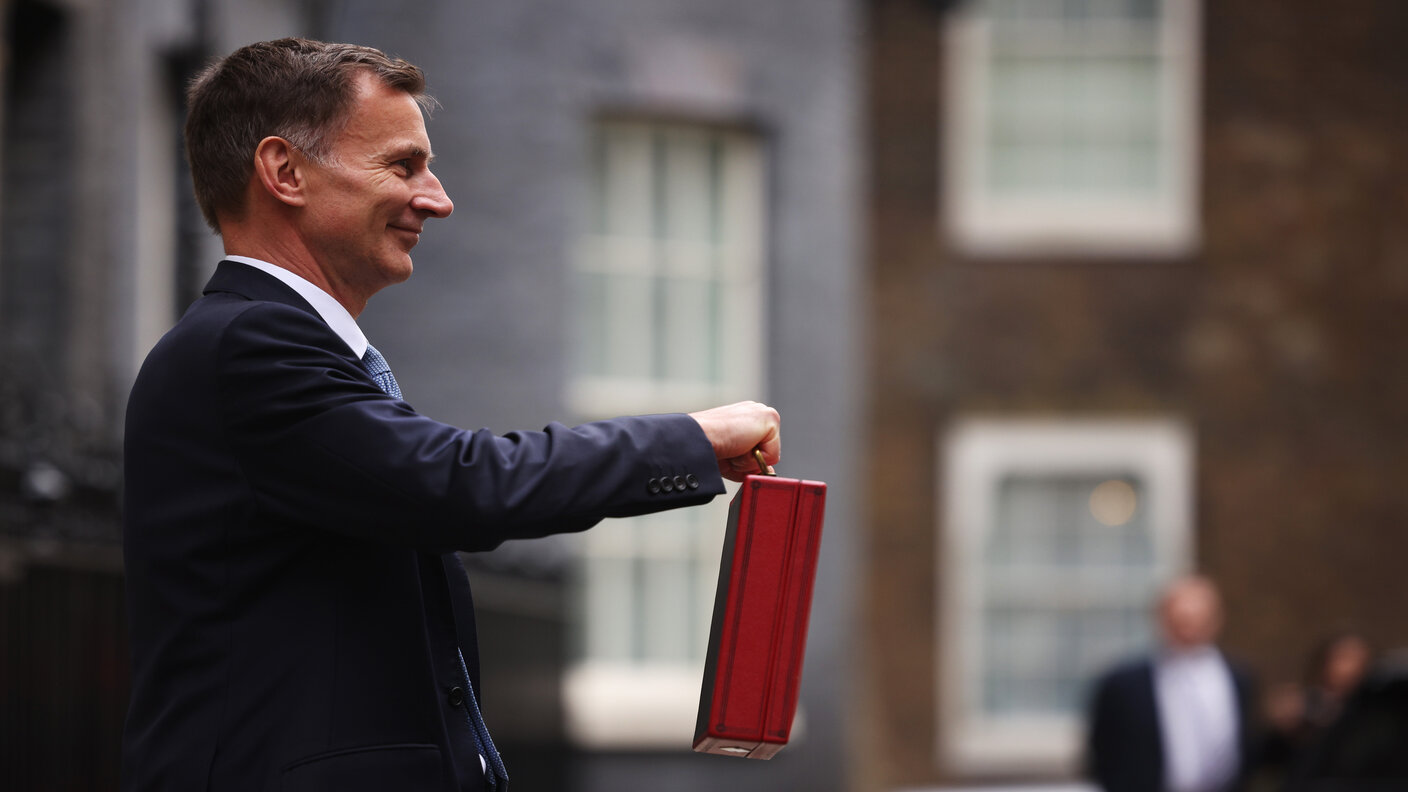

The Chancellor, Jeremy Hunt, has delivered his first budget today against a mixed outlook for the UK economy.

Billed as a ‘growth budget’, Hunt’s focus has been on getting the UK back to work.

Incentives to encourage workers to return are sorely needed as the UK economy has seen one of the slowest recoveries from the pandemic, among the group of OECD nations.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

According to the latest data, the economy is still 0.2% smaller than it was in February 2020, when the pandemic started to move around the world.

Economists have blamed the high number of inactive workers in the economy for this sluggish recovery. High levels of long-term sickness, coupled with early retirement among those over 50, have been singled out as key contributors to the economy’s sluggish performance.

Hunt wants to encourage workers back into the workforce by changing pension allowances, improving access to childcare and devoting more money to training.

However, the Chancellor does not have much fiscal room for manoeuvre. The office for budget responsibility (OBR) has warned that the country's borrowing is running at unsustainably high levels, and the government will either have to reduce spending or increase tax collection to balance the books.

Initial projections suggest that the country will only hit the Chancellor’s target of debt as a percentage of GDP falling, by the end of the next Parliament.

Here’s a round-up of the most important changes and what they mean for your finances.

Stay tuned as we’ll be updating this page throughout the day with more details from the announcement…

Economic outlook

According to the Office for Budget Responsibility (OBR) the country is no longer on track to plunge into a recession this year.

The OBR now expects the economy to contract by 0.2% this year, with unemployment expected to rise only modestly as a result. GDP growth is expected to return in 2024 and for the next five years.

"After this year the UK economy will grow in every single year of the forecast period: by 1.8% in 2024; 2.5% in 2025; 2.1% in 2026; and 1.9% in 2027,” said Hunt.

The OBR also expects inflation will fall to 2.9% by the end of 2023. Underlying debt is forecast to start falling in 2027/28. The deficit is set to fall every year over the next five years to 1.7% of GDP by 2027/28. Thanks to these growth forecasts, the overall tax burden is expected to be slightly lower than previous projections, although it’s still high by historic standards.

Energy Price Guarantee

One of the announcements made before Hunt stood up to deliver his speech is that the Energy Price Guarantee (EPG) will be held at its current rate of £2,500 until July 2023. Hunt was planning to let the energy subsidy rise by 20% on 1 April. However, he will now keep it at the current support level for another three months amid sliding energy prices. Wholesale energy prices have dropped by around 50% since October.

See our article for details on what the EPG extension means for energy bills.

“High energy bills are one of the biggest worries for families, which is why we’re maintaining the Energy Price Guarantee at its current level. With energy bills set to fall from July onwards, this temporary change will bridge the gap and ease the pressure on families, while also helping to lower inflation too,” Hunt said in a pre-Budget statement this morning.

Childcare

In another swift move to get more people back into work, Hunt has also extended free childcare to all children over nine months - it previously only kicked in when a child turns three.

A report this month from Coram Family & Childcare found childcare costs have shot up by 5.6% in the last 12 months; a part-time place for a child under age two costs on average around £148 a week.

Though the extension of free childcare is welcome for parents, there is still an issue around the availability of childcare, which has been declining - only 57% of local authorities have enough childcare places available for children under two, down from 72% in 2021. Only 59% report having enough childcare available for parents working full time, down from 68% last year, according to Coram’s report.

To that end, Hunt also announced more funding for schools to provide wraparound care for school-age children, incentive payments of £600 for childminders joining the profession and an increase in the funding to nurseries of £204 million from this September rising to £288 million next year, an increase of 30%.

"The extension of free childcare announced in today’s Budget is welcome news for working parents. These measures will go some way to help prevent women in particular from dropping out of the workforce to care for children," explains Alice Haine, Personal Finance Analyst at Bestinvest.

"Up to 30 hours of free weekly childcare for all one and two-year-olds – an extension to the current scheme for three and four-year-olds - offers a lifeline to working mothers who want to ensure a return to work makes financial sense. However, the support will be rolled out slowly so not everyone can instantly access the full 30 hours plus it will generally only apply within term time and to households where both parents work. However, on a positive note, from September 2025 every working parent with a child aged over nine months and under the age of five will be able to access up to 30 hours of free childcare per week."

Pension reforms

As part of his plan to get people back to work, Hunt said he’s hiking the pensions annual tax-free allowance from £40,000 to £60,000.

What’s more, the Chancellor has also decided to abolish the Lifetime Allowance - previously set at £1.07 million. Prior to the budget, there was speculation he’d hike the allowance to £1.8 million, but this goes much further.

He also confirmed that the Money Purchase Annual Allowance – the amount that someone can continue to contribute to a flexible money purchase pension once benefits have been taken - will be increased from £4,000 to £10,000.

However, there was a nasty surprise buried in budget notes regarding the tax-free lump sum. This sum is going to be frozen at £268,275, equivalent to 25% of the current lifetime allowance, and frozen thereafter.

Still, Hunt's changes are a boost for pension savers. As Jason Hollands, Managing Director of Bestinvest, the online investment platform says, “The scrapping of the lifetime allowance will mean that those who have halted pension savings entirely - for example because they took out fixed protection to preserve access to earlier lifetime allowances of £1.25 million or £1.5 million - are now in a position to potentially recommence pension contributions, at a time when more of their earnings are likely to be subject to the higher rates of tax."

"But in doing so they need to carefully consider whether this will mean forgoing access to a larger tax-free lump sum. For someone in that position who has not contributed to pensions for several years and whose adjusted earnings are below the level at which the horrendously complicated and punitive tapered pension allowance regime kicks in, they could potentially subscribe up to £180,000 in pensions next year. This could be achieved by using the new, larger £60,000 gross annual allowance and then mopping up unused allowances of £40,000 for each of the previous three years under pensions ‘carry forward’ rules. This is therefore an opportunity for some both to provide a massive boost to their retirement pots, and to take shelter from higher taxes."

Fuel and beer duty changes

As was widely expected, Hunt also postponed the 11p rise in fuel duty and extended last year's 5p a litre cut.

And amid a wide-ranging shakeup of alcohol duty changes, the government has "extended" the "generosity" of Draught Relief so the duty on an average pint of beer served in pubs will not increase this year. The duty on a pint from the pub will be up to 11p lower than supermarkets.

“Duties are one area where the government can raise or cut prices at a stroke, so it’s heartening to see they have stepped in on behalf of drivers. Frankly, after such a long freeze of fuel duty it would have been a surprise if they rose prices right now," notes Sarah Coles, head of personal finance, Hargreaves Lansdown.

"The tax on alcohol will rise 10.1% in August, but there will be a separate rule for draft beers in pubs, which will mean the duty on draft pints is 11p lower than in supermarkets. There’s also the hope that the delay in rising duty will protect the nation’s drinkers while inflation is so high, and only kick in when it has started to fall back."

Stimulating growth through investment

While Hunt didn't scrap the planned corporation tax hike as some businesses and MPs had hoped he might, he did unveil a range of tax changes for businesses to encourage investment,

These include full expensing, allowing companies to deduct 100% of the cost of certain plant and machinery from their profits before tax. This will be in place from 1 April 2023 to 31 March 2026.

The government has also introduced a 50% first-year allowance. This allows businesses to deduct 50% of the cost of other plant and machinery, known as special rate assets, from profits during the year of purchase.

A new R&D scheme for 20,000 SMEs was also published for R&D "intensive businesses." Eligible loss-making companies will be able to claim £27 from HMRC for every £100 of R&D investment.

Alongside these schemes, Hunt also announced billions of pounds in new funding for AI and supercomputer research as well as an additional £11 billion for the armed forces, taking the UK's total spending on defence to 2.25% of GDP by 2025.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Rupert is the former deputy digital editor of MoneyWeek. He's an active investor and has always been fascinated by the world of business and investing. His style has been heavily influenced by US investors Warren Buffett and Philip Carret. He is always looking for high-quality growth opportunities trading at a reasonable price, preferring cash generative businesses with strong balance sheets over blue-sky growth stocks.

Rupert has written for many UK and international publications including the Motley Fool, Gurufocus and ValueWalk, aimed at a range of readers; from the first timers to experienced high-net-worth individuals. Rupert has also founded and managed several businesses, including the New York-based hedge fund newsletter, Hidden Value Stocks. He has written over 20 ebooks and appeared as an expert commentator on the BBC World Service.

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson

-

Is Britain heading for a big debt crisis?

Is Britain heading for a big debt crisis?Opinion Things are not yet as bad as some reports have claimed. But they sure aren’t rosy either, says Julian Jessop

-

When is the Autumn Budget and what should you expect?

When is the Autumn Budget and what should you expect?Chancellor Rachel Reeves is set to deliver her second Autumn Budget next week – but what exactly does the fiscal event involve?

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?