Fine wine offers pockets of opportunity for cautious investors – how to buy

Fine wine has sold off in recent years, but cautious collectors are buying back in.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Many luxury products can be considered a Veblen good – one for which, counterintuitively, demand intensifies even as prices rise. But wine enjoys another attribute that is harder to replicate among, say, watches or cars – its inherent scarcity increases over time, simply because people drink it.

According to wine investment firm WineCap’s recently published Wealth Report, 96% of UK wealth managers expect demand for fine wine to increase in 2025 – more than for fine art (94%), watches (90%), luxury handbags (86%) or coins (78%). Collectors, it adds, are attracted to fine wine by its proven long-term price appreciation and intrinsic scarcity. And should those cases of first-growth Bordeaux fail to gain in value as expected, you can at least open them and drink them. So, where to begin?

Fine wine is a complex and increasingly diverse marketplace, with investment-grade products coming from a number of regional sources – the traditional French strongholds of Bordeaux and Burgundy, but also Champagne and the Rhône Valley, and Tuscany and Piedmont in Italy, along with many more regions from California to Australia. The sector has also been progressively democratised over the past 25 years, thanks to the emergence of the likes of Liv-ex and Wine-searcher.com, which offer their users constantly updated pricing information, critic scores and market intelligence of ever greater granularity.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Nonetheless, expert help is a must, particularly for those who are new to the sector, or who lack the time to research it in detail. “The most important thing is to find a well-reputed wine merchant, ideally who can source both new releases and older vintages in order to put together a balanced cellar, rather than have to wait years to drink the wine – or, if financial gain is a motivation, to provide some diversification across vintages/profile,” says Matthew O’Connell, head of investment at fine wine and spirits merchant Bordeaux Index, and CEO of the company’s recently expanded LiveTrade trading platform.

Balance your wine cellar

“Merchants should have expertise in the market and wine as an asset, and also be able to provide up-to-date valuations and ability to sell, as well as buy, wines. Trading platforms such as Bordeaux Index’s LiveTrade allow for best-in-class collection/portfolio monitoring and instant buying/selling of key wines,” says O’Connell. Clearly, if the main motivation is to build a collection for personal consumption, then you should buy what you like, with an eye on balancing your cellar in terms of maturity and drinking windows.

Even here, however, choosing wines that are likely to appreciate in value can free up funds to expand and refine your collection in the future. “It is important to focus on blue-chip-type wines if the aim is to combine having a good wine collection with potential future value gain and portfolio traceability,” advises O’Connell. “This will be the higher-end wines from Burgundy, Bordeaux, Champagne, Tuscany and the Rhône. Too often, people make the mistake of buying too far down the quality/price spectrum, where there is far less of a market for reselling, and investment performance is far less proven.”

Beyond merchants, there are regular auctions from the likes of Christie’s, Sotheby’s and Bonhams, which can provide specific opportunities to source particular wines. Single-producer sales – offering a selection of vintages direct from a property’s own cellars – offer impeccable provenance and, sometimes, the chance to buy vintages that rarely appear on the secondary market.

The potential downside of auctions can be a lack of certainty about the source and condition of the wine and, at worst, the presence of fakes – an ongoing issue for the industry. Provenance and condition are key aspects of collecting wine and safeguarding its future value. For this reason, as tempting as it may be to keep bottles in your own cellar, should you have one, it’s important to store wine professionally and on an “in bond” basis (ie, before the payment of excise duty and VAT). Professional wine storage facilities, such as Octavian and London City Bond, are highly recommended.

Prices are currently on a long-term downward spiral following a peak towards the end of 2022, impacted by challenging macroeconomic trends, especially in the Far East, and large stocks of unsold vintages sitting in merchant warehouses. Liv-ex’s Fine Wine 100 index, which charts the price movements of 100 of the most sought-after fine wines on the secondary market, is now about 25% below its peak in November 2022, and has fallen 3.6% year-to-date (as at 5 May).

The broader Liv-ex Fine Wine 1000 displays a similar downward trend, and although trading activity is higher than it was a year ago, this is yet to translate into price rises or even stability. Calling the bottom of any market slump is never easy, but many observers increasingly believe that opportunities are now emerging. Burgundy – where prices had previously risen further and faster – is seeing renewed activity, particularly among top producers such as Domaine de la Romanée-Conti and Armand Rousseau.

Collectors who had been content to sit on the sidelines while prices fell are now beginning to re-enter the market, wary of missing their chance to buy pristine, high-quality stock before prices take off again. “There are definitely attractive market pockets at the moment,” says O’Connell. “We see the most opportunity in Burgundy in the short term, where key assets look too cheap, given their rarity.”

This reinforces the conviction that fine wine is an asset that repays patience, rather than speculation, especially given that many of these wines may take decades to hit their peak in terms of quality. At a time of such short-term uncertainty, there’s comfort in that. As O’Connell points out: “Understanding that wine is a medium-term investment, so you need to wait for performance to show through in a collection, is important.”

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Richard Woodard is a freelance wine and spirits writer based in the UK. Aside from Decanter, he writes for several wine trade and media outlets including Imbibe, The Drinks Business, Harpers and Drinks International.

Since 2015 he has been the magazine editor of Scotchwhisky.com. He has formerly worked as a wine news reporter at Imbibe and a feature writer for Halycon Magazine.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Nine of the best luxury Christmas hampers to buy

Nine of the best luxury Christmas hampers to buyWe take a look at the best luxury Christmas hampers – an indulgent selection of the finest cheeses, wines, chocolates and puddings for a quality celebration

-

Six of the best Christmas wines to buy this festive season

Six of the best Christmas wines to buy this festive seasonMatthew Jukes tips the best Christmas wines for a festive tipple

-

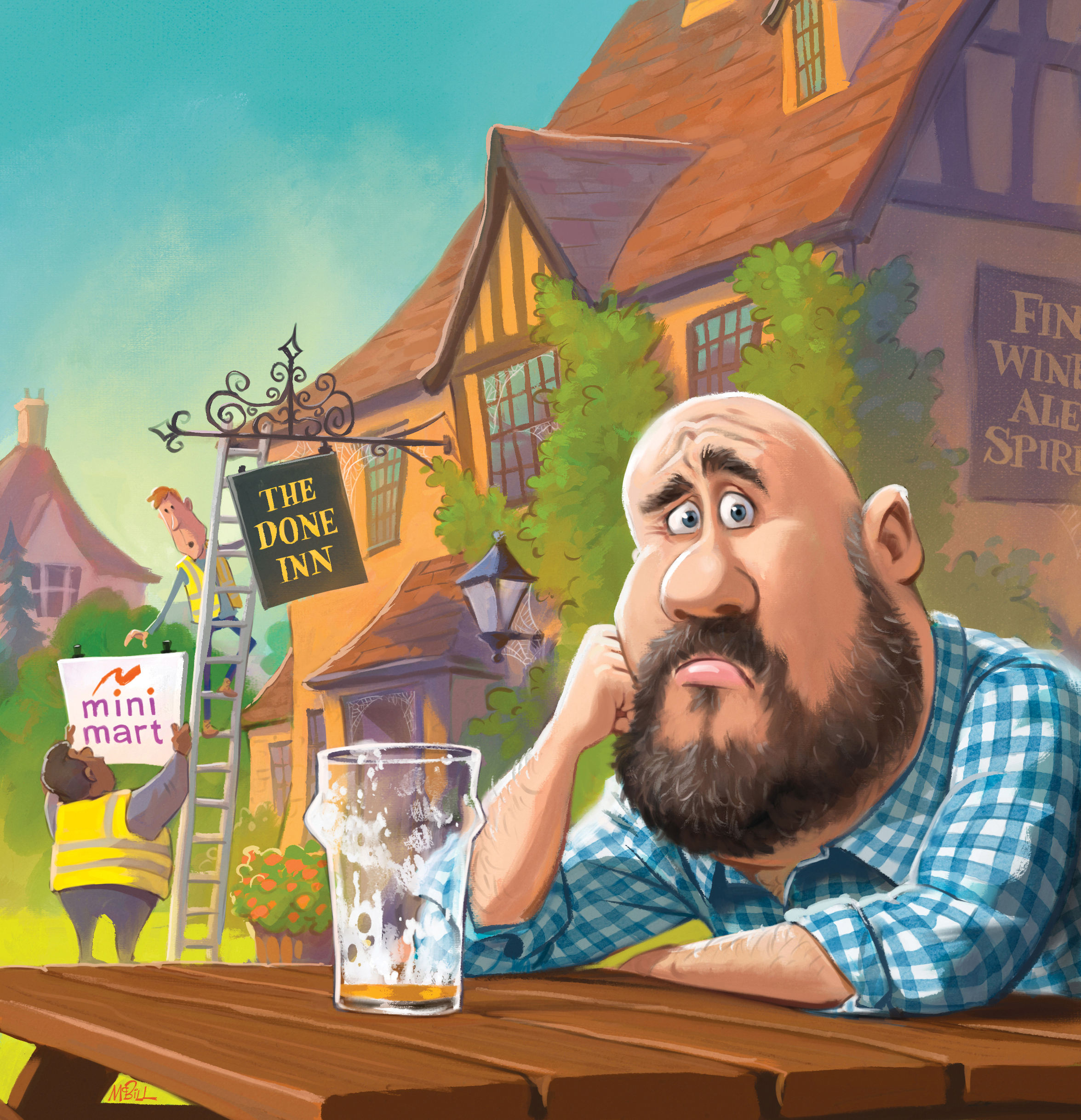

Last orders: can UK pubs be saved?

Last orders: can UK pubs be saved?Pubs in Britain are closing at the rate of one a day, continuing and accelerating a long-term downward trend. Why? And can anything be done to save them?

-

The alcohol industry is suffering as consumers sober up – is it still worth investing in the sector?

The alcohol industry is suffering as consumers sober up – is it still worth investing in the sector?Changing consumer tastes are rocking the alcohol industry, but the best players are adapting their strategies. Buy them while their shares are still cheap

-

England’s sparkling wine industry has potential for early investors

England’s sparkling wine industry has potential for early investorsGlobal warming has changed the game for England’s sparkling wine industry – even growers in Champagne are planting in England. Brave investors might like to join the party early.

-

Wine of the week: two cunning Australian blends

Wine of the week: two cunning Australian blendsReviews Matthew Jukes tastes a pair of gorgeous Australian reds – a fruity shiraz mixed with glossy zibibbo, and a three-way combo of montepulciano, nero d’Avola and barbera.

-

A secret list of beauties for your cellar

A secret list of beauties for your cellarReviews Matthew Jukes looks at the offering from Swains, a stunning new wine shop by Hampstead Heath

-

Wine of the week: a tremendously juicy and spicy fellow

Wine of the week: a tremendously juicy and spicy fellowReviews This hearty red is tremendously juicy and spicy with a wicked price tag.