Halifax: House prices surge for the fifth consecutive month

The property market remains resilient as house prices grow for the fifth month in a row, latest Halifax data shows

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

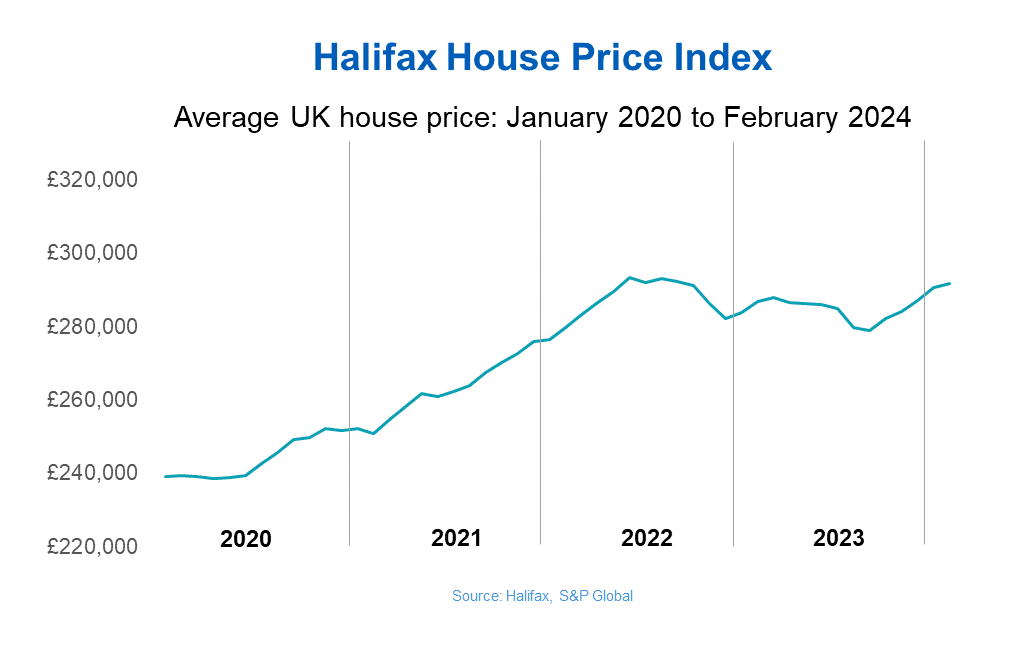

The house price growth in 2024 has continued as Halifax's latest house price index shows yet another rise.

UK house prices were up 1.7% in a year to February, and 0.4% higher than the previous month, marking the fifth monthly rise according to new data by Halifax.

Annual growth is slightly behind the 2.5% recorded in the year to January, but continues on an upward trajectory.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The shift takes the average UK property price to £291,699 - £670 more than last month. Though, it's worth noting the rise is not as substantial to that seen between December and January, where we saw prices shoot up by £4,000.

The average property price is also only £1,800 behind the June 2022 peak.

It shows resilience in the property market has filtered through the economic turmoil in the past year, with sky-high interest rates and unaffordable mortgage rates, keeping buyers and sellers at bay.

But buyer confidence returned since last month with the recent mortgage rate cuts and interest rate pause.

Kim Kinnaird, director at Halifax Mortgages, said: "These figures continue to suggest a relatively stable start to 2024 and align with other promising signs of increased housing activity, such as mortgage approvals."

Where did house prices rise in the UK?

Northern Ireland remains the strongest region in the UK for strong growth, with house prices up 5% annually. The average property price in Northern Ireland now stands at £195,956.

The North of England also saw house prices rise, with 4.4% annual growth in the North West and a 4.2% rise in property prices in the North East.

London continues to hold the top spot for the highest average property price, currently at £536,996. This is based on a 1.5% rise in the city compared to the previous month.

In contrast, Eastern England saw house prices dip by 0.8% in February, now costing an average £329,927.

Is the property market heading for a crash?

Whilst increasing house prices is benefiting buyers and sellers, a fifth upward trend is sparking the question, could the market be heading for a crash in 2024?

Sarah Coles, head of personal finance at Hargreaves Lansdown said: “The power of momentum has helped keep house prices rising into February.

“It’s a slower rise than January, as mortgage rate cuts eased, and there’s every chance this could peter out in the face of higher rates. However, after five months of house price growth, optimism is building that this could be the new normal.”

But Kinnaird at Halifax Mortgages believes the future of the property market is still unpredictable. “While it is encouraging that we’ve seen growth in recent months, what happens next remains uncertain.

“Although lower mortgage rates, alongside expectations of Bank of England interest rate cuts this year, should help buyer confidence in the short term, the downward trend on rates is showing signs of fading," she adds.

According to data from Moneyfacts, the average two-year fixed mortgage rate fell from 5.93% to 5.56% at the start of the new year.

But the downfall came to a halt when the average two-year rate upped to 5.75% at the end of February.

Coles puts this down to “concerns that the Bank of England wouldn’t cut rates as fast as it hoped.”

Though the outlook among most experts still remains that the base rate could plummet as early as Spring.

After Hunt’s Spring Budget yesterday, the impact of the wider economy will be a positive one on the property market.

“We may well be out of a recession, and as the second National Insurance cut of the year filters through into people’s pockets, it could fuel a bit more spending, and consumer optimism,” Coles adds.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Vaishali has a background in personal finance and a passion for helping people manage their finances. As a former staff writer for MoneyWeek, Vaishali covered the latest news, trends and insights on property, savings and ISAs.

She also has bylines for the U.S. personal finance site Kiplinger.com and Ideal Home, GoodTo, inews, The Week and the Leicester Mercury.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how