Halifax: house prices rise for the fourth consecutive month

UK house price growth has hit its highest annual level since January 2023 as confidence returns among buyers and sellers. Will house prices still fall in 2024?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

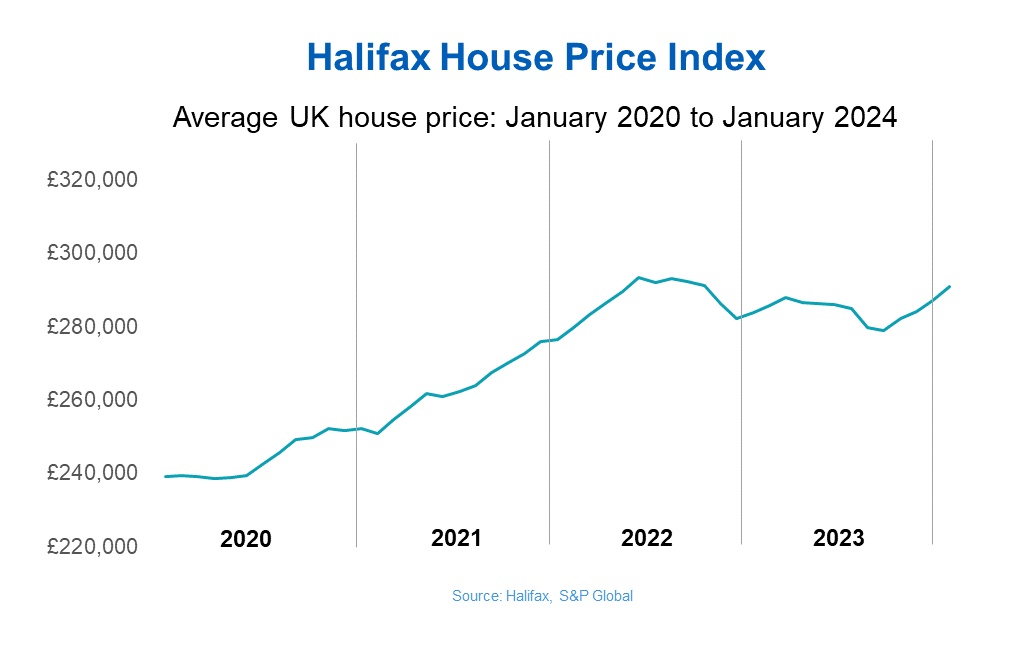

UK house prices rose by 1.3% in January, the latest data from Halifax reveals- marking the fourth consecutive increase and the highest annual rise of 2.5% since January 2023.

This puts the average property price at £291,029, which is almost £4,000 more than the previous month.

The upward trend follows a six-month streak of falling house prices between April and September last year.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The lender sees this as a ‘positive start to 2024’s housing market’ as competitive mortgage rates have returned, boosting confidence amongst buyers and sellers.

It comes as the Bank of England (BoE) held interest rates again at its latest MPC meeting at 5.25%, pushing some lenders to drop their mortgage rates.

Karen Noye, mortgage expert at Quilter, says: “This increase in house prices is a positive sign that the housing market is getting back on its feet, and it seems that the reduction in mortgage rates driven by a combination of competition between lenders and the pricing in of future Bank of England rate cuts lured in more buyers in the new year, feeding into the cautiously optimistic outlook for the housing market this year.”

That said, interest rates are still at a historic high compared to previous years which will impact buyer affordability, and this issue could linger for a while yet.

Kim Kinnaird, director at Halifax Mortgages looks to the future: “Affordability challenges are likely to remain and further modest falls should not be ruled out, against a backdrop of broader uncertainty in the economic environment.”

Where did house prices rise the most?

House prices grew the most in Northern Ireland by 5.3% annually. It means the average property price in the region is now £195,760- nearly £10,000 higher than a year ago.

Scotland and Wales join the hikes, with a 4% rise pushing average property prices in those areas to £206,087 and £219,609 respectively.

Although London only showed a 0.4% rise over the past year, as expected, it still comes out on top for the region with the highest house prices, with the average home selling just over the £500,000 mark.

Whilst the North West of the UK, Yorkshire and Humber, North East and the East Midlands recorded an upward trend in average annual property prices too, the South East of England saw the biggest fall.

House prices in the South East dropped 2.3%- an equivalent to around £8,800.

Where will house prices go in 2024?

Experts believe the housing market has ‘started with a bang’ in the new year as competitive mortgage rates and falling inflation (apart from last month’s surprise rise) mean potential home buyers are feeling more confident.

Plus, a flood of buyers and sellers are now entering the market in 2024 after holding off for a year due to economic uncertainty.

Tom Bill, head of UK residential research at Knight Frank said: “The number of new buyers registering and offers being submitted have increased since lenders dropped their prices last month, which suggests demand and activity levels will only get stronger, leading to a modest a single-digit price increase this year.”

Interest rate cuts expected later this year could also push for stronger buyer demand.

Despite a resilient start to the year though, some experts warn the good news might not last for the whole of 2024.

“January hasn’t altered the overall outlook for the property market, which is expected to hit tougher times later in 2024, as the overall economic picture weakens,” says Sarah Coles, head of personal finance, Hargreaves Lansdown.

“Prices are still expected to fall during the year. It means anyone buying and selling right now should focus on getting a good deal on a property they can comfortably afford and expect to be in for some time,” Coles advises.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Vaishali has a background in personal finance and a passion for helping people manage their finances. As a former staff writer for MoneyWeek, Vaishali covered the latest news, trends and insights on property, savings and ISAs.

She also has bylines for the U.S. personal finance site Kiplinger.com and Ideal Home, GoodTo, inews, The Week and the Leicester Mercury.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how