What is happening to house prices?

House prices may have been slowing down, but asking prices are on the rise. We look at the latest on what is happening to house prices as ONS releases its latest annual data

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If you've been keeping a keen eye on house prices lately like we have been on MoneyWeek, you may have been left wondering what is actually happening with house prices in the UK or indeed if it is a good time to buy a house?

While one index reports a slowdown in house prices, another may suggest a rise - and if you’re reading into what asking prices are, then you will have seen Rightmove saying asking prices went up last month by £3,000 and recent HMRC data shows property transactions were down.

We look at what the latest is with UK house prices as the Office for National Statistics (ONS) today releases its latest data on where house prices are heading.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

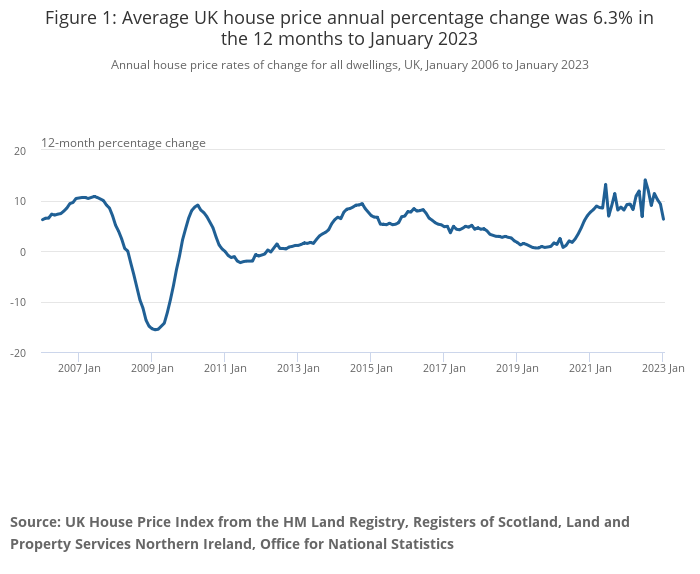

ONS: house prices increase 6.3% over 12 months

According to today’s ONS data, the average UK house prices increased by 6.3% in the 12 months to January 2023, down from 9.3% in December 2022.

So, while we are seeing a slowdown, prices have increased in a 12 month period.

The average UK house price was £290,000 in January 2023 - £17,000 higher than 12 months ago.

Average house prices increased over the 12 months to £310,000 (6.9%) in England, £217,000 in Wales (5.8%), £185,000 in Scotland (1.0%) and £175,000 in Northern Ireland (10.2%).

And if you’re looking to buy a house in London, you may find the average price tag at around £534,000, though ONS data shows that the rise was up just 3.2% in a year in the capital.

Here's How house prices have been moving since 2006.

Source: ONS

What will happen to house prices in 2023?

The ONS data does not paint a clear picture of what will happen to house prices in 2023. The last 12 months saw extreme turbulence, such as the disastrous mini-Budget headed by then chancellor Kwasi Kwarteng which saw a spike in borrowing costs. Both buyer and seller confidence has been dented, especially as borrowing rates remain high compared to 12 months ago.

According to Tom Bill, head of UK residential research at Knight Frank: “Annual price falls are almost inevitable in the coming months but demand and supply have recovered strongly since Christmas, which means a double-digit price crash this year feels unlikely.”

Sarah Coles, head of personal finance, Hargreaves Lansdown, adds: “Affordability calculations reveal just why rising rates have taken such a toll on buyer confidence. With the average full-time employee in England spending 8.3 times their annual income in order to buy a typical home, we’re being forced to take on ever-larger mortgages. It means a small change in mortgage rates has a far larger impact on our monthly payments.

“On the positive side, from October onwards, mortgage rates started to drop back, and while there were no sudden movements, there’s the hope that as they kept falling, confidence will have started to rebuild a little. We’ve seen a bit more volatility recently, but rates are still expected to trend downwards through the rest of the year as inflation eventually drops back.”

However, it doesn’t alter overall predictions that annual house price inflation will turn negative; the Office for Budget Responsibility expects them to drop 10% from the peak.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Kalpana is an award-winning journalist with extensive experience in financial journalism. She is also the author of Invest Now: The Simple Guide to Boosting Your Finances (Heligo) and children's money book Get to Know Money (DK Books).

Her work includes writing for a number of media outlets, from national papers, magazines to books.

She has written for national papers and well-known women’s lifestyle and luxury titles. She was finance editor for Cosmopolitan, Good Housekeeping, Red and Prima.

She started her career at the Financial Times group, covering pensions and investments.

As a money expert, Kalpana is a regular guest on TV and radio – appearances include BBC One’s Morning Live, ITV’s Eat Well, Save Well, Sky News and more. She was also the resident money expert for the BBC Money 101 podcast .

Kalpana writes a monthly money column for Ideal Home and a weekly one for Woman magazine, alongside a monthly 'Ask Kalpana' column for Woman magazine.

Kalpana also often speaks at events. She is passionate about helping people be better with their money; her particular passion is to educate more people about getting started with investing the right way and promoting financial education.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.