Should you bet on US stocks?

You don’t have to be bearish on US stocks to worry that they are now such a large share of global indices

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

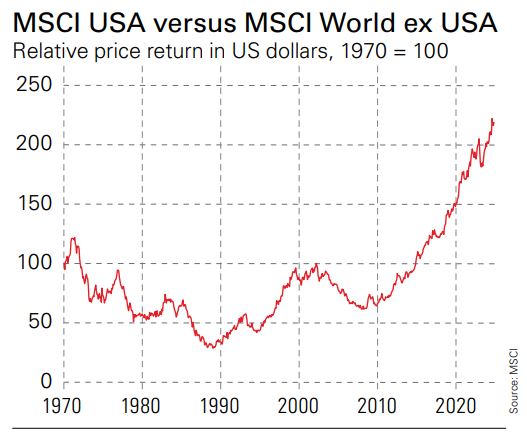

American stocks have become a headache for many investors. Over the past 15 years, they have raced ahead of other major markets, to the point where they now account for more than 70% of the MSCI World index.

If you manage a fund benchmarked against that, you cannot afford to have too little in the US, because if it keeps beating everything else, your performance will lag badly and your job will be on the line.

This may be why some managers are saying that Donald Trump’s threats of raising tariffs on imports mean that the US will keep beating the world – they need a plausible reason to keep buying the US as it rises. In theory, tariffs should be bad news for growth and for stocks – being likely to hurt trade and push up inflation – but America is exceptional, they argue: it’s the world’s largest economy, the owner of the global reserve currency, the key source of import demand and so on. The rules that apply to other countries don’t apply to the superpower and its companies should suffer less than those in a trade war.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This feels one-sided. Setting aside economic arguments around the impact of tariffs, note that US firms have been huge beneficiaries of globalisation, which could now make them equally huge targets for other governments. Domestically, there are obvious dangers in Trump’s arbitrary policies and whether he or some of his appointees will take aim at sectors such as tech or healthcare, or at any company that annoys him. Yes, the US could still beat the world – it remains the most innovative economy – but there are also reasons to fret about the tail risks that come with having 70% of assets in one country. So paring back the US can be about managing risk rather than being outright bearish.

How to hold US stocks

While most global funds, passive or active, are likely to have around 70% in the US, there are alternatives with lower exposure. The recently launched Invesco MSCI World Equal Weight ETF (LSE: MWEQ) invests the same amount in each stock, rather than weighting by market capitalisation. Since America has more giant companies and higher like-for-like valuations across the market, this brings the US share of the index down to 45%. The downside of equal-weighted strategies is that turnover is higher. Until there’s a real-world performance record for this ETF, we can’t see how well the manager manages to optimise the portfolio-management process to reduce the drag of trading costs from this.

I’d like to have the option of a GDP-weighted index fund, which uses capitalisation weighting on a country level but sets each country’s share of the index in line with its share of world GDP. The MSCI World GDP Weighted has 49% in the US, while the MSCI ACWI GDP Weighted (which includes emerging markets) has 30%. Both have beaten the equal-weighted indices over 10 years, but there are still no ETFs that track them. But we can combine regional or country ETFs to get closer to these weights. At its simplest, you could hold a US fund alongside the Xtrackers MSCI World ex US ETF (LSE: EXUS) in a 30%/70% or 50%/50% mix, or whatever ratio you prefer.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton