US stocks are more expensive than ever after Trump's tariffs

We don’t need to second-guess the effect of Trump's tariffs to think that the rest of the world offers better value

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

When Donald Trump began unveiling his tariff plans in April, investors feared we were entering a sharp and sudden bear market. Stocks dropped sharply around the world, with the US down 10% in two days. Yet the plunge was short-lived: stocks rallied as abruptly as they had dropped. The US and other major global markets have gone on to new highs. So did investors get rattled too easily – or are they too sanguine now?

On the optimistic side, the deals that the US is striking with trading partners look less damaging than everybody feared in April. Yes, tariffs are unwelcome. They bring complexity and friction to global trade and add costs. Those costs will be borne to varying extents by the entire supply chain between foreign exporters and US consumers. Yet these deals still reduce the risks of a wider and more damaging trade war.

The pessimistic take is that America’s views on the rest of the world have changed. It is backing away from principles that it has championed for decades to become insular and mercantilist. Policymaking is more arbitrary and unpredictable. We can’t even be confident that these deals – which are still broad frameworks – will be honoured, let alone what might come in the next three-and-a-half years and beyond.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

US stocks vs the world

So the rest of the world is reacting in a rational way. Countries are striking deals with the US to minimise immediate disruption, but over the longer term they will have to recognise that the world is changing. Trade patterns and alliances will shift. CEOs are also trying to flatter Trump by announcing large investments in the US to avoid being targeted – we are seeing plenty of this from pharma firms in an effort to ward off threats of high tariffs on imported drugs. Yet it remains to be seen how much will be puffing up investment that was already in the pipeline and how much actually materialises.

We will be looking at how all this could play out at Turmoil, Tariffs and Trump 2.0, our next annual MoneyWeek Wealth Summit on 7 November (tickets have just gone on sale at moneyweekwealthsummit.co.uk/2025). However, in stock market terms, there is one obvious idea for managing these risks.

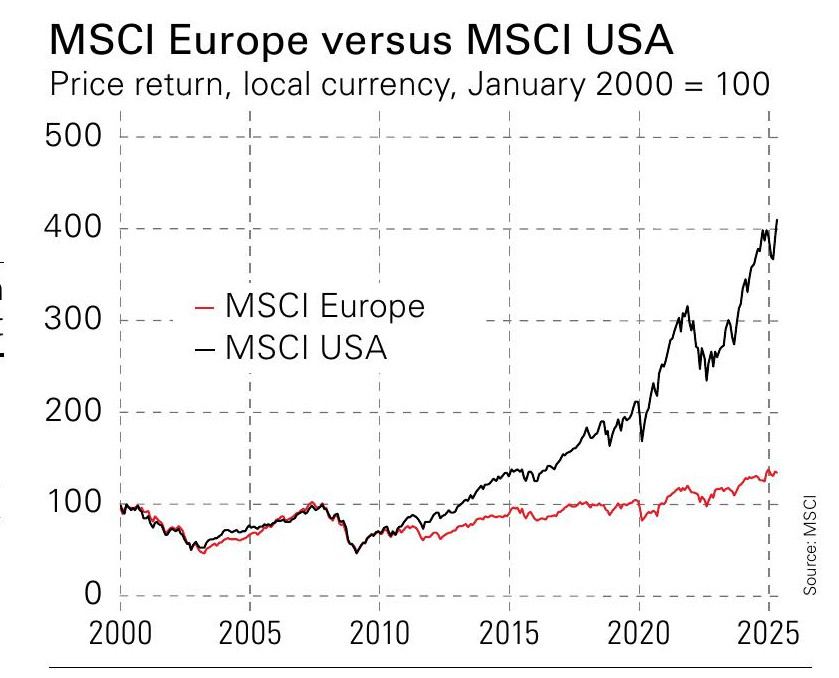

US stocks have so far outstripped the rest of the world over the past 15 years that they now make up 60%-70% of the global market, depending on which index you track. This has been driven by superior earnings growth, but valuations have also diverged much more than many investors realise.

The MSCI USA trades on 23 times forecast earnings, while the MSCI Europe is on 14. Look back to mid 2016 – about the time the divergence accelerated – and the MSCI USA was on 17 times forward earnings, while the MSCI Europe was on 15 times. So striking a better balance between the US and the rest of the world than a typical global tracker fund doesn’t need to be a bet on whether Trump’s policies will ultimately hurt the US. Doing so is increasingly justified by the growing gulf in valuations.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?