Trust in US TIPS to beat inflation

In an inflationary market TIPS, US Treasury Inflation-Protected Securities, are most compelling says Cris Sholto Heaton.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Bond yields have ticked down recently as investors conclude that central banks have finished hiking. Whether this is right remains to be seen, but my long-standing view is that central banks are always too quick to cut and too slow to hike and so I’d guess that markets are probably correct.

However, this has little immediate impact on the MoneyWeek asset-allocation strategy that I’ve been reviewing in the last few weeks, since we try not to forecast too much: our goal is to have a portfolio fit for all likely outcomes. With that in mind, the 2%-2.5% real yield on inflation-linked bonds still looks better than conventional bonds.

Government-backed linkers are an unusually generous gift to investors since they promise to pay you back in a money that retains its value, rather than money that is debased by inflation. It is true, of course, that politicians could potentially fiddle the inflation statistics to some extent, but if they are doing that, actual inflation is likely to be so bad that conventional bonds will lose even more value.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

There are fewer choices for inflation-linked bond exchange-traded funds (ETFs) than conventional bond ETFs because this is a smaller market, but what’s available is still as much as we need. Most obviously for the UK investor, we have iShares £ Index-Linked Gilts (LSE: INXG). Given that most of us will have liabilities and costs in sterling and be at risk from UK inflation, in principle, it makes sense to have our investment indexed against that. However, as I discussed last time, the UK linker market is structurally messy and so I prefer US Treasury Inflation-Protected Securities (TIPS).

US TIPS Funds

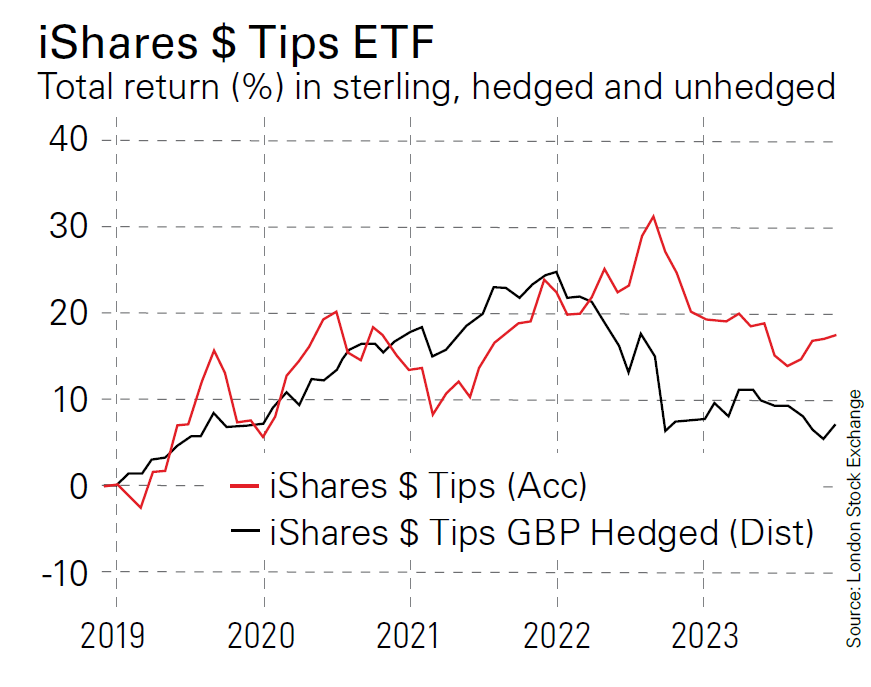

iShares $ Tips ETF Total return (%) in sterling, hedged and unhedged

With TIPS we have a choice of broad funds such as iShares $ Tips (LSE: ITPS), Lyxor Core US Tips (LSE: TIPG) and SPDR Bloomberg US Tips (LSE: UTIP).

There are also a few funds that break the market down by maturity, as with the conventional bond ETFs – for example iShares $ Tips 0-5 (LSE: TP05) or UBS Bloomberg Tips 10+ (LSE: UBTL).

There are also some euro ETFs, such as iShares € Inflation-Linked Government Bond ETF (LSE: IBCI), which is mostly French and Italian bonds and global ETFs, such as iShares Global Inflation-Linked Government Bond ETF (LSE: SGIL), which is around 50% US bonds. But for our purposes, these add little.

First, US linkers have the highest real yields. Second, US bonds are a safe-haven asset – they tend to rally during crises, which is another attractive reason to hold some.

Several of these ETFs are available as currency-hedged funds, such as iShares $ Tips GBP Hedged (LSE: ITPG). Hedging conventional bonds can make sense – the yield you get from bonds can easily be swamped by currency losses if exchange rates move against you. However, in this situation, I see a good argument to hold US linkers unhedged. If UK inflation turns out to be much worse than US inflation, we would expect sterling to weaken against the dollar over time. ITPS has beaten ITPG over five years for this reason (see chart above).

Put all this together, and we will continue to hold 10% in ITPS.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Related articles

- Index-linked bonds could prove a costly inflation hedge

- Are bonds bouncing back?

- What you need to know about investment funds

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change looms

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change loomsChanges to inheritance tax (IHT) rules for unused pension pots from April 2027 could trigger an ‘exodus of large defined contribution pension pots’, as retirees spend their savings rather than leave their loved ones with an IHT bill.

-

Why do experts think emerging markets will outperform?

Why do experts think emerging markets will outperform?Emerging markets were one of the top-performing themes of 2025, but they could have further to run as global investors diversify

-

Three Indian stocks poised to profit

Three Indian stocks poised to profitIndian stocks are making waves. Here, professional investor Gaurav Narain of the India Capital Growth Fund highlights three of his favourites

-

UK small-cap stocks ‘are ready to run’

UK small-cap stocks ‘are ready to run’Opinion UK small-cap stocks could be set for a multi-year bull market, with recent strong performance outstripping the large-cap indices

-

Hints of a private credit crisis rattle investors

Hints of a private credit crisis rattle investorsThere are similarities to 2007 in private credit. Investors shouldn’t panic, but they should be alert to the possibility of a crash.

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

Should you invest in energy provider SSE?

Should you invest in energy provider SSE?Energy provider SSE is going for growth and looks reasonably valued. Should you invest?

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive