Inflation-linked bonds – lock in a real yield

Inflation-linked bonds look more compelling than they have done for many years, especially in the US

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I recently said that even though conventional bond yields have risen a long way from their lows, we’re not yet tempted by them for our asset-allocation portfolio, except perhaps very short-dated bonds.

We’re not forecasting that rates are going much higher in the short term (we forecast as little as possible), but it seems clear that yields don’t offer much compensation for the risk that they do. They seem pretty much at the lower end of where you’d expect them to be.

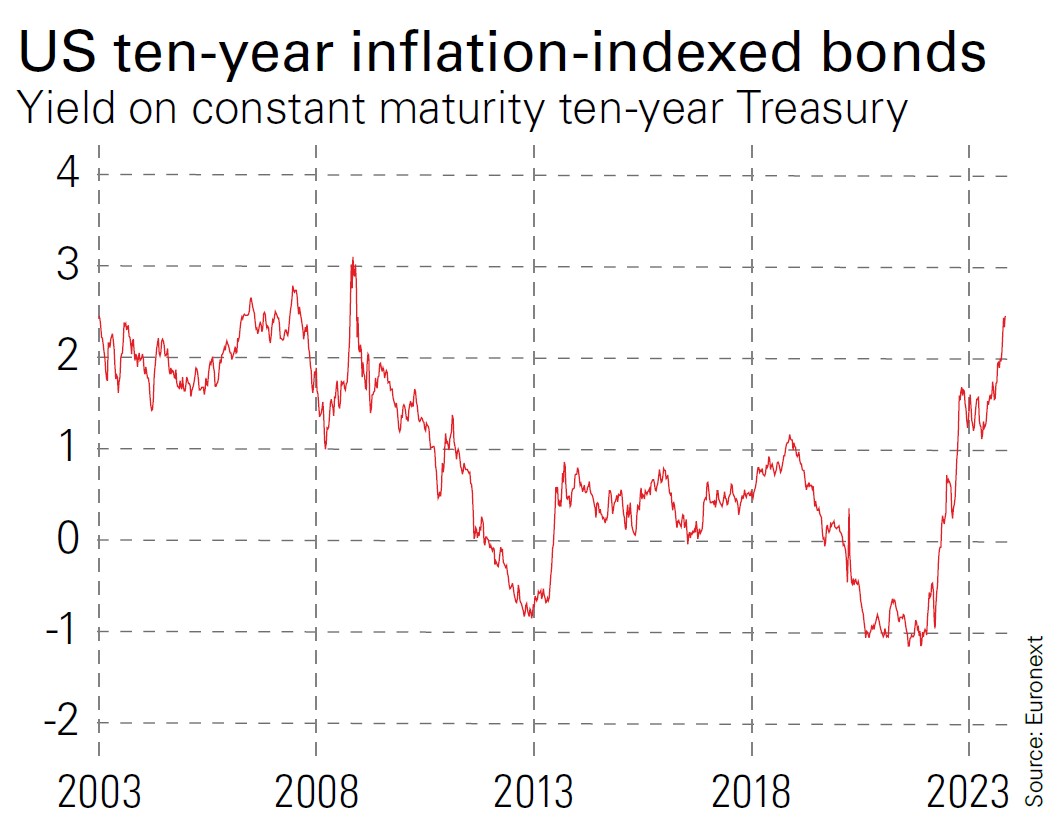

Inflation-linked bonds are rather different. At present, ten-year US Treasury inflation-protected securities (TIPS) pay a real yield of about 2.5%, which is almost as high as they’ve been for 20 years (see chart).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

When they were first issued in the late 1990s, enthusiasm was surprisingly low and real yields were higher – above 4% at times – but it would be optimistic to expect that again. Perhaps investors would again demand higher yields in a very high-inflation world (to compensate for greater uncertainty and the risk of the government fiddling the inflation figures), but on the face of it, Tips yields are not terrible by historical standards.

Meanwhile, the ten-year break-even inflation rate (the implicit forecast for inflation calculated from the difference between yields on Tips and on conventional bonds) is also now roughly 2.5% (since the yield on conventional ten-year bonds is currently about 5%).

When break-evens are high relative to probable inflation, it could be a good time to buy conventional bonds; when they are low, it could be a good time to buy linkers. Actual US inflation over the past 20 years has, in fact, been around 2.5% per year, so markets are implying more of the same.

We have no way of knowing whether that will be right, but note that conventional ten-year bonds have returned 1.7% per year after inflation over the past 25 years and 2.6% per year over 50 years. There were periods of higher returns in the 1980s, 1990s and 2000s, but that was with the tailwinds of higher nominal rates and falling inflation. In today’s world, locking a 2.5% real yield via Tips looks at least reasonable value.

The problem with gilts

As a British investor, why am I focusing on Tips and not UK index-linked gilts here?

In short, because the UK linker market is messy. First, UK linkers are indexed to the old retail price index (RPI), not the consumer price index (CPI) – but most investors use CPI as a benchmark, so market prices have to reflect expectations for the likely difference between RPI and CPI.

Second, the link will switch – without compensation – from RPI to CPI, including housing (CPIH), in 2030 creating further complications in valuing them. Third, the prices are distorted by the huge appetite that pension funds have for linkers. At present, real yields on ten-year UK linkers are around 1%. The difference between RPI and CPI is unstable but averages about 1%. So likely returns seem worse and complications abound. Thus we favour Tips in the portfolio.

However, I’ll look at the choice of exchange-traded funds for both US and UK linkers in my next column.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Can US small caps survive the software selloff?

Can US small caps survive the software selloff?US stocks have made their worst start to a year since 1995 relative to a global benchmark. But experts think some sectors of the market are still worth buying.

-

Review: Eliamos Villas Hotel & Spa – revel in the quiet madness of Kefalonia

Review: Eliamos Villas Hotel & Spa – revel in the quiet madness of KefaloniaTravel Eliamos Villas Hotel & Spa on the Greek island of Kefalonia is a restful sanctuary for the mind, body and soul

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton