Three foreign exchange companies to buy

New entrants in the global foreign exchange market present opportunities for investors, says Bruce Packard

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Business doesn’t get much bigger than foreign exchange (forex): in 2020 roughly $20trn moved across borders.

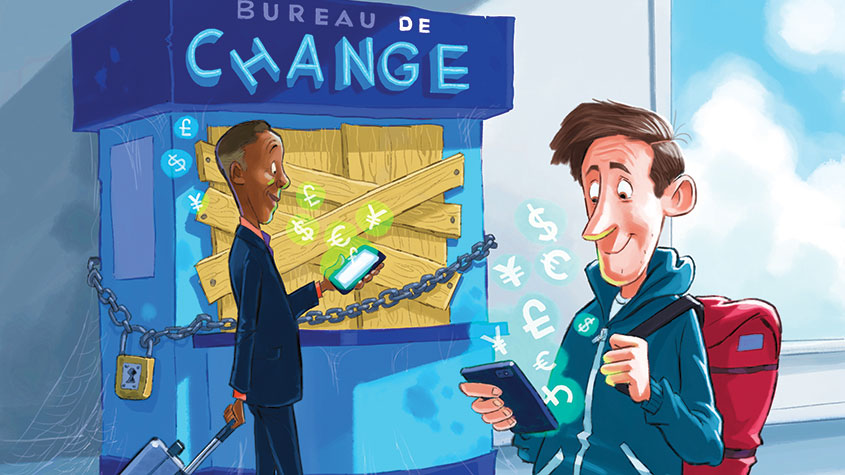

The forex market used to be the preserve of banks, but in recent years specialist companies have sprung up, creating an opportunity for investors. Two key trends are responsible for this development.

A couple of decades ago policymakers assumed that creating “financial supermarkets”, whereby customers could buy everything from the same bank, would create greater efficiency and convenience. It turned out, however, that rather than share the benefits of scale by offering consumers better-value financial services, universal banks tried to use their current account relationships to cross-sell poor value or unwanted products, often resulting in “mis-selling” scandals.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Though customers trust their banks to look after large balances on deposit, they don’t trust them to offer the best deals on ancillary financial services. That’s why online price-comparison sites such as Go.Compare have become so popular.

After the financial crisis, meanwhile, regulators began to question the logic of encouraging banks to grow ever bigger and systemically important, so they created separate licences for the global payments system. New legislation included the Payment Services Regulations in the UK and the E-money payments licence in the EU, which were intended to separate the risks in the payment system (transferring money) from the banking system (deposit taking and lending). Payments companies were given a licence to operate with lower capital requirements, as long as they did not lend money or expose themselves to credit risk.

Enter the new players. The hundreds of billions of dollars of potential revenue in forex attracted the attention of venture-capital firms such as Andreessen Horowitz.

On the consumer side, financial-technology (fintech) companies such as Revolut and Wise (previously TransferWise) are the largest. Revolut is not listed, but its most recent funding round valued it at $33bn. Wise (LSE: WISE) floated in London in July last year at 800p per share, valuing the company at more than £8bn.

Foreign exchange firm Wise gains wisdom

Wise started out as a “peer-to-peer exchange”, with customers being able to exchange money between each other, but with the wholesale market’s rates as a reference point. As the business grew it became apparent that it was not always possible to match buyers and sellers, so the business began to take on some risk, becoming a market maker to facilitate liquidity. In the year to the end of March their two largest long exposures were £17m to the Australian dollar and £15m to the Indian rupee, offset with a short US dollar exposure of £28m and euro £11m position.

Wise is known for its aggressive marketing, claiming to be over six times cheaper and more transparent than UK high street banks. The company estimates that its 13 million customers use it to move £8bn a month, which saves them £3m a day, or £1bn a year, compared with using a bank.

When it floated, Wise was valued at a whopping 19 times sales and more than 100 times earnings for the year to 31 March 2021. At today’s price of 652p the shares cost a more reasonable 40 times forecast earnings for the year to 31 March 2025 and five times the same year’s sales.

One concern is that the co-founder, Taavet Hinrikus, sold 11 million shares last year and entered a loan agreement with Goldman Sachs whereby up to 49.6 million shares would be pledged as security. There is also a dual-share structure common to many US tech stocks, but more unusual in London. The founders hold B shares that have nine times more votes than the A shares. That lets them keep control even if they decide to cash out their A shares.

Three corporate forex companies

Wise currently has a £1m transaction limit and makes 80% of sales from personal customers rather than businesses. However, companies have also been receiving poor foreign-exchange service from banks.

Three companies listed on Aim, the London Stock Exchange’s junior market, help small and medium-sized businesses (SMEs) manage their foreign-exchange needs, including Alpha FX (Aim: AFX), Equals Group (Aim: EQLS) and Argentex (Aim: AGFX).

All three were founded a decade ago and have solid records of growth and profitability. Given the currency volatility this year, they ought to benefit as firms seek to navigate their way through difficult markets.

The investment case is slightly different to Wise, as SMEs tend to manage their currency exposure using the futures market as well as the spot rate. Unlike Wise, they operate as a matched principal, meaning that when they execute a trade (either spot or forward contract) for a company, that trade is immediately offset by a transaction with a counterparty (normally a global bank trading the “flow” of foreign exchange transactions). That means the Aim-listed groups require healthy cash balances to provide collateral to those counterparties to reduce settlement risk.

Unlike Wise, the likes of Alpha FX, Argentex and Equals Group also offer a more personalised service, with an experienced dealer to talk to, similar to an old fashioned private bank. If you are a finance director of a company needing to hedge millions of pounds of currency exposure, then having someone to talk through your trades with can be invaluable.

One risk to their business model, however, is that Wise could begin to target higher-value transfers and larger companies, and they can serve these clients more efficiently. Despite the higher cost of servicing their customers, however, Alpha FX and Argentex report high levels of profitability, with a three-year average return on capital employed (RoCE) of 24% and 33% respectively.

Alpha FX: the forex market’s biggest player

With almost £100m of revenues forecast for this year, and a market value of £685m, Alpha FX is the largest of these companies. It was founded by Morgan Tillbrook, the current CEO, in 2010 and listed in 2017.

Alpha FX is split into two divisions. Risk Management, which comprises two-thirds of revenue, helps SMEs manage their currency volatility. This arm generates income from the spread in spot or futures-market transactions, and revenue per average client is £66,000.

The second division, Alternative Banking Solutions, is for firms wanting to manage high-volume but smaller payments and to open local-currency accounts. Alpha FX charges an annual fee, as well as margins on spot trades, and revenue per client is about £9,000. Live accounts rose by 75% to 3,061 between December and June. Sales are forecast to grow by 27% this year to £98m. That puts the shares on a 2023 price/earnings (p/e) ratio of 26, and a price/sales ratio of seven. That’s not cheap, but it reflects management’s ability to execute and the size of the opportunity.

Equals Group’s successful turnaround

Equals Group, meanwhile, has reported three years of losses, as the business was previously dependent on travel cash and currency cards (pre-paid cards loaded with balances to be used abroad), which made up 46% of sales before the pandemic. These areas were badly hit when travel ceased.

Equals Group has restructured its cost base and is enjoying a strong recovery. Sales jumped by 84% year on year to £31.3m in the first half of 2022 and earnings before tax reached £0.9m, the first profit since 2018. Throw in the favourable market backdrop in September, and it looks as though management has succeeded in turning the business around.

Like Alpha FX and Argentex, Equals Group offers spot or forward trading and dealer support, but it also sells pre-paid cards and foreign-currency current accounts. Unlike high street banks, it can provide customers with a multi-currency account with a unique international bank account number (IBAN). Banks can only provide one account per currency, each with a unique IBAN. Having one IBAN for all currencies enables a customer to provide one single account identifier to all its customers and suppliers, thereby simplifying both sales and procurement processes.

Equals Group shares are trading on 2023 p/e of 14 and twice that year’s sales.

Argentex: the pick of the forex bunch

Argentex originally operated a personalised service, but it is now building an online-trading platform for smaller transactions, similar to Alpha FX’s Alternative Banking Solutions division. Earlier this month Argentex announced that it was benefiting from “exceptional short-term trading conditions”, with revenues up by an annual 75% to £27.4m in the six months to 30 September.

Annualised revenue per client at £39,000 was up by 55% year on year. The top-20 clients generate 36% of group revenue, implying that those high-value clients deliver on average £621,000 per year, with a long tail of customers generating less than £15,000 per year. For context, Alpha FX, with forecast 2022 revenue of roughly £100m, reports £66,000 per client in its Risk Management division. Argentex says it takes a couple of years for customers to feel comfortable directing more business its way.

Argentex has struggled to retain enough sales people recently. It says that it takes several years for new hires to become productive – a first-year salesperson generates an average of £42,000 in revenue, later growing to £1.8m in year five. The pandemic didn’t help matters, but neither did the departing co-CEO selling his 10% shareholding. Growing the top line looks a surmountable problem, though, and the group did stay profitable during Covid-19. Argentex is establishing a presence in the Netherlands and Australia.

Argentex’s broker, Singers, is forecasting revenue growth of 22% in 2023 and 2024. That means the shares are trading on 2.5 times next year’s sales, and 16 times 2023 earnings. That looks good value for a profitable company that has averaged a RoCE of 32.7% over the past three years. Of the three I prefer Argentex, for the more attractive valuation and a younger management team.

(The author owns shares in Argentex.)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Bruce is a self-invested, low-frequency, buy-and-hold investor focused on quality. A former equity analyst, specialising in UK banks, Bruce now writes for MoneyWeek and Sharepad. He also does his own investing, and enjoy beach volleyball in my spare time. Bruce co-hosts the Investors' Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.