Make uncommon profits from helping cure rare diseases

Treatments for medical conditions with only a small number of sufferers can still be very attractive for pharmaceutical companies and investors because of government incentives, says Dr Mike Tubbs.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

A “rare disease” is – by definition – something that only affects a small number of people. We can even put a specific number on this: the US considers a rare disease to be one that afflicts less than 200,000 and the EU uses a similar benchmark of 250,000. However, while each rare disease is uncommon, there are a relatively large number of different diseases that qualify – around 7,000. That means an estimated 25 million to 30 million Americans have a rare disease – although many will be undiagnosed because most doctors may never have seen patients having one of the rarer diseases.

However, diagnosis is only the first part of the problem when it comes to tackling some of these conditions. Providing effective treatments can be an even larger hurdle, because they are not an obviously attractive opportunity for pharmaceutical companies. First, small patient numbers make it difficult to mount sensibly sized clinical trials. Second, if a drug succeeds and is approved, it may have only a small market because of the small number of patients suffering from that disease. Given that companies must often spend a lot of money developing and testing drugs, it may be impossible to make a profit from their research at any reasonable price level.

This meant that only ten new treatments for rare diseases were brought to market in the decade 1973 to 1983. However, since 1983 over 730 new treatments have been developed and approved. This massive increase was driven by the US Orphan Drug Act of 1983, which gives a series of incentives to companies to develop rare or orphan disease treatments. Orphan drugs is the term for drugs that would not be profitable to produce without government assistance because the conditions are so rare (aka, “orphan diseases”). In 1993, Japan adopted a similar incentive scheme, and this was followed by the EU in 2000.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The US incentives include a seven-year marketing exclusivity period from approval for orphan products (ten years in EU and Japan), US tax credits of 50% for research and development (R&D), and R&D grants for clinical trials. These incentives have stimulated the development of new drugs for rare diseases that affect many thousands of people. Thus the market for orphan drugs is steadily growing: it should be around 18% of the overall pharmaceuticals market by 2024, up from 12% in 2016, according to Evaluate Pharma, a market-research firm.

A high-growth market

Unfortunately, there are still several diseases affecting only one in a few million people where the numbers affected are too small to encourage work on treatments, or to support sensibly sized clinical trials. One example is stoneman syndrome, where tendons, muscles and ligaments turn to bone, usually from the neck and shoulders downwards. This gradually restricts body movements, leading to death. Nothing can be done to halt or slow the disease. Stoneman syndrome is very rare and affects about one in two million people or around 160 in the whole US. An even rarer disease is HGPS (Hutchinson-Gifford progeria syndrome), a genetic disorder affecting one in four million people. Those born with HGPS age much more quickly than normal and typically die in their mid-teens to early twenties. There is no known cure.

However, there has been significant progress on many other conditions. Cystic fibrosis (CF) is an example of a less rare disease with tens of thousands of sufferers in the US that is now treatable. CF is a genetically inherited disease that causes persistent lung infections and makes it difficult to breathe. It is estimated that 30,000 Americans suffer from CF, with 1,000 new cases diagnosed each year. Vertex Pharmaceuticals is the leader in CF treatments, which it supplies to 83,000 patients worldwide earning CF revenue of $7.6bn in 2021 from four CF drugs.

As this suggests, orphan drugs can be a meaningful source of revenue. The overall worldwide market is expected to double from $107bn in 2017 to $217bn in 2024, according to Evaluate Pharma, with the US accounting for around 70% of that. The compound annual growth rate of 12% from 2020 to 2024 is twice the predicted growth rate of the non-orphan drug market. This is helped by the fact that orphan drugs tend – necessarily – to be relatively expensive: the average cost per patient per year is $150,000 for orphan drugs in the US, compared with $34,000 for non-orphan drugs. One of the most expensive is Alexion’s Soliris for PNH (paroxysmal nocturnal haemoglobinuria, which can cause blood clots) and aHUS (atypical haemolytic uremic syndrome, which also causes blood clots and organ damage), which costs over $400,000 per patient per year. PNH affects about one person in a million, with aHUS affecting about two per million.

Who’s who in orphan drugs

The orphan drug market is often split into oncology (cancer) and non-oncology drugs. By 2024, the non-oncology market is estimated to be 55% of total, with the oncology market 45%. The orphan oncology market is dominated by large pharmaceutical companies: the only two of the forecast top 15 for 2024 that are not divisions of big firms are Seagen and Ipsen. These are both oncology specialists developing treatments for a range of cancers, some of which are rare cancers. However, the non-oncology orphan market is expected to be more diverse, with eight smaller companies in the top 20.

While large pharmaceutical companies are big players in orphan drugs, revenues from these drugs will be just a modest proportion of their total sales in most cases. For example, if we consider a few major players, these proportions range from Pfizer and Sanofi with around 20%, Roche 26%, Novartis 28%, AbbVie and Johnson & Johnson 29% and Takeda 34%. A couple of large pharma firms have done deals in recent years to bulk up their orphan-drug portfolio, testifying to the attractiveness of some of these niches. Thus Bristol-Myers Squibb bought Celgene in 2019, lifting its share to 37%, and AstraZeneca bought Alexion last year. Alexion is expected to have $7.2bn orphan drug sales in 2024 and AstraZeneca was already on course to have about $4.1bn, giving a total of $11.3bn. This would make the combined company the fifth largest in the world by orphan drug revenues, and will take the contribution from orphan drugs to about 29% of sales.

Investors are attracted to the rare diseases sector in part because the revenue growth rate for rare diseases is much higher than that of pharmaceuticals generally. This suggests a focus on those companies that either only make rare disease drugs or have a high proportion of turnover from rare disease treatments. However, it is important to identify those companies with rare disease treatments likely to show high growth within their periods of marketing exclusivity and patent protection. We therefore look at several pipeline rare disease drugs and their likely growth rates.

Promising drugs in the pipeline

There are 137 orphan drugs in phase III trials or filing for approval with total potential sales of $32.6bn in 2024. Another 99 drugs are in phase II trials with potential 2024 sales of $10.3bn. Many of these are being developed by smaller companies, including Argenx, Bluebird Bio, BioMarin Pharmaceutical, Blueprint Medicines and Horizon Therapeutics. For example, Argenx (which had sales of $497m in 2021) has six pipeline drugs for rare diseases in clinical trials. The firm is still making losses ($408m in 2021) since it has only one approved drug on the market: Vyvgart for a form of generalised myasthenia gravis – a rare long-term condition causing muscle weakness. However, Vyvgart is in trials for five other conditions, and there are two other drugs in clinical trials with three pre-clinical candidates. Bluebird Bio (sales of $3.7m in 2021) has Zynteglo on the market for patients with beta thalassaemia (who cannot make enough beta-globin, a component of haemoglobin, and therefore have low red blood cell counts and require frequent blood transfusions). The drug releases patients from the need for lifelong regular blood transfusions. Pipeline treatments for severe genetic diseases include three in phase III for cerebral adrenoleukodystrophy, TDT (transfusion-dependant beta-thalassaemia, requiring lifelong blood transfusions) and sickle cell disease, plus a phase I drug for sickle cell disease and several pre-clinical projects.

Biomarin Pharmaceutical (sales of $1.85bn in 2021) has seven products on the market and a pipeline consisting of a phase III treatment for severe haemophilia A, two in phase I/II and four pre-clinical drugs. Blueprint Medicines (sales of $180m in 2021) has Ayvakit on the market for advanced systemic mastocytosis (a rare condition characterised by excess mast cells, which can cause inflammation leading to organ damage) and Gavreto for patients living with rare forms of advanced non-small cell lung cancer, or thyroid cancer caused by a faulty gene. The pipeline consists of four potential drugs in early-stage clinical trials for genomic-defined cancers, a cancer immunotherapy and several pre-clinical projects.

Horizon Therapeutics (sales of $3.2bn in 2021) has seven medicines on the market and six in clinical trials (two in phase III, four in phase I/II), each of which is aimed at two-to-five different diseases, and three pre-clinical. One phase III drug is for myasthenia gravis, which can cause double vision, difficulty swallowing, slurred speech and weak arms and legs. There are many other small biotech companies with modest sales and one or two potential drugs in their late stage pipelines.

Future prospects with gene therapy

There is optimism that gene therapy could eventually cure many rare diseases, since around three-quarters of known rare diseases are linked with one faulty or missing gene. There are formidable costs and risks in developing safe and effective gene therapies. One of the first successful gene therapies was carried out at Great Ormond Street Hospital where Rhys Evans was treated for severe combined immunodeficiency, a rare disease making babies vulnerable to the smallest infection so they usually died before age two. Rhys’s treatment was successful and he is now 21.

This and other early successes have led to 68 current active trials of gene therapies in the US, 28 in Europe and 12 in Asia, with the UK accounting for 12% of all global trials. Examples of companies active in this area are Alnylam (sales of $844m in 2021), Cellectis (sales of €57m in 2021), AveXis and Spark Therapeutics. AveXis’s cure for spinal muscular dystrophy was developed from a technology platform developed by Regenxbio, whose pipeline includes a phase III project for curing “wet” age-related macular degeneration retinal disease and four phase I/II treatments for retinal and neurological diseases.

AveXis was acquired by Novartis in 2018 and Spark Therapeutics by Roche in December 2019 in further examples of how the larger companies frequently bolster their pipelines by doing deals with small biotech companies. The number of such deals has increased dramatically from around 15 deals per year worth about $3.5bn in 2010-2012 to around 100 deals worth $25bn in 2020-2021. The top-ten deals in 2021 included four by Takeda with one each for Vertex, Incyte, AbbVie, Zai Lab of China, Bayer and Eli Lilly. The largest of these was the $1.1bn deal by Vertex Pharmaceutical with CRISPR Therapeutics to lead development and marketing of CTX001, a therapy for sickle cell disease and beta-thalassemia.

How to invest

The main biotechnology and healthcare investment trusts have relatively small exposures to rare disease companies. For example, Worldwide Healthcare Trust (LSE: WWH) has only Horizon Therapeutics in its top-ten investments, Biotech Growth Trust (LSE: BIOG) has only BioMarin Pharmaceutical and Horizon in its top ten, and International Biotechnology Trust (LSE: IBT) only has Alnylam in its top ten.

This means investors wanting to take advantage of the higher growth rate of rare disease treatments need to select a set of individual firms. Consequently, the best strategy will probably be a mix of some of the core big pharmas that have the highest percentages of turnover from such treatments, plus smaller rare disease firms with nearly all sales from rare disease treatments. I look at some of the main options for each below.

The best bets on rare diseases

Of the six big pharma firms with the highest proportions of orphan drug sales, only AstraZeneca (LSE: AZN) and Takeda (TSE: 4502) give separate rare disease sections in their pipelines, while Bristol-Myers Squibb (NYSE: BMY) has the highest proportion of sales coming from rare disease drugs. BMS is strong in oncology and also cardiovascular and rare diseases following its Celgene acquisition and has 50 compounds in development. However, although Celgene’s Revlimid for multiple myeloma is projected still to be the second best-selling orphan drug of 2024, with sales of $7.1bn, it faces generic competition from this year, while BMS’s Opdivo cancer immunotherapy faces strong competition from Merck’s Keytruda.

AstraZeneca has 12 orphan drugs in phase III clinical trials or filed for approval (most from Alexion), while Takeda has six in phase III or filed for approval (some from its acquisition of Shire). AstraZeneca also has a strong pipeline of cancer drugs, while Takeda has a fairly strong presence in gastroenterology, immunology and oncology. On balance, AstraZeneca is probably the preferable company. It’s on a price/earnings (p/e) ratio of 15.7 based on forecast earnings for 2023, falling to 13.3 for 2024, at the recent price of 10,030p. Takeda, which is Japan’s largest pharma company, saw its margins improve after the acquisition of Shire, since that deal gave it better access to the US market and a lower proportion of revenue from the more mature Japanese market where margins are lower. But it faces a number of patent expiries and its pipeline of new drugs is mainly early stage (the main risk of failures comes in late-stage clinical trials). The p/e is 16.3 for 2023, rising to 18.7 for 2024, at the recent price of ¥3,735.

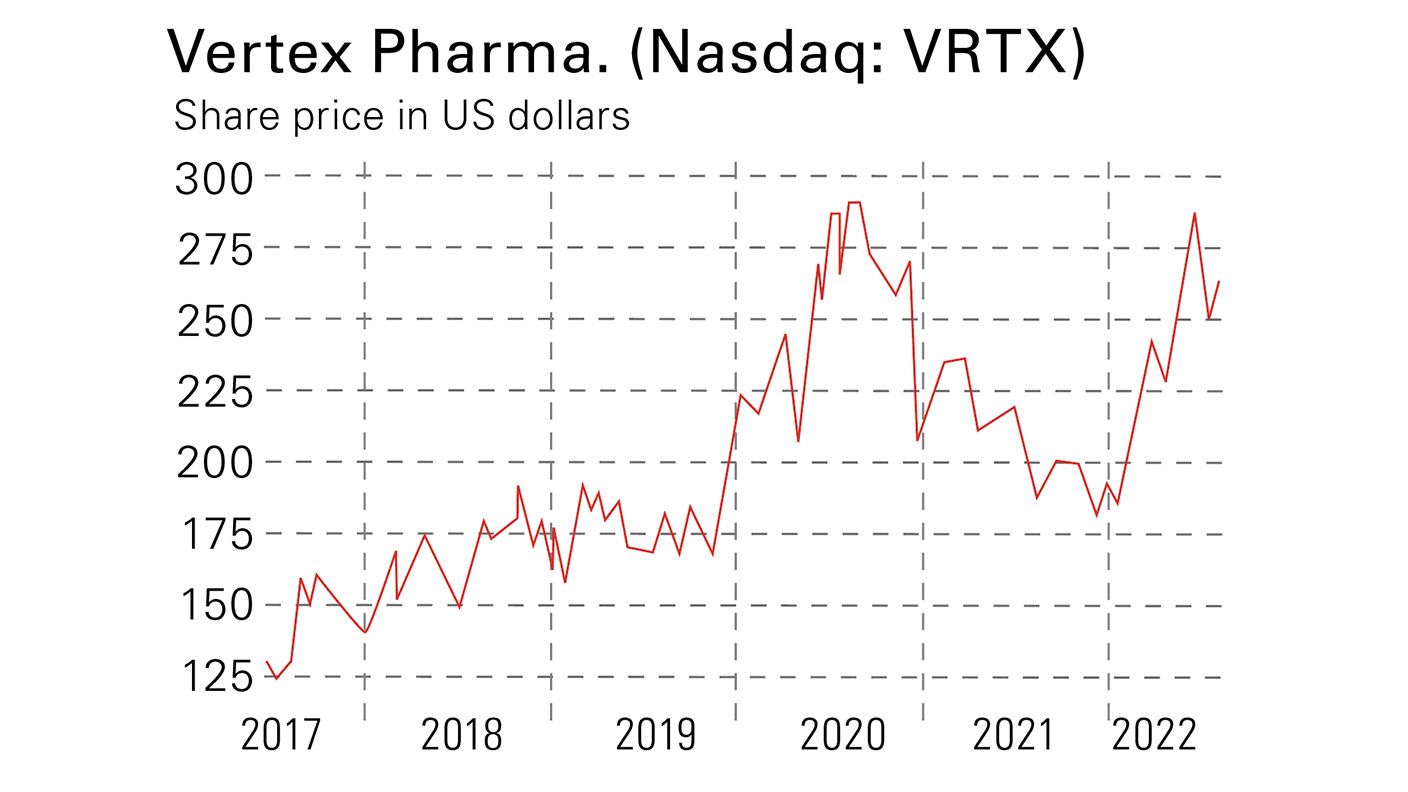

Vertex Pharmaceuticals (Nasdaq: VRTX) is the largest orphan disease specialist, with 2021 sales of $7.6bn from four drugs. It has a dominant position in cystic fibrosis drugs: its drug Trikafta, which is predicted to be the fourth best-selling orphan drug of 2024 with sales of $5.5bn, will raise the proportion of treatable CF patients from 50% to 90%. The pipeline has three drugs in phase III. Vertex’s p/e is 15.4 for 2023, falling to 14.6 for 2024, at the recent price of $235.

Of the smaller rare disease specialists, there are three main ones with substantial sales. BioMarin Pharmaceutical (Nasdaq: BMRN) has a monopoly position in several rare disease niches. The p/e for 2023 is 35 falling to 19.4 for 2024 at the recent price of $74.8. Horizon Therapeutics (Nasdaq: HZNP) has a 2023 p/e of 11.6 falling to 9.5 for 2024. Alnylam Pharmaceuticals (Nasdaq: ALNY) has a well-proven methodology for finding drugs to treat rare genetic diseases. The company will still be making a loss in 2023, but should make its first small profit in 2024.

Looking beyond these, Argenx (Nasdaq: ARGX) is making substantial losses and is unlikely to move into profit before 2025. Regenxbio (Nasdaq: RGNX) is also set to be making losses through to at least 2025.

Investors could choose AstraZeneca as a core holding, possibly supplemented by Takeda and/or Bristol-Myers Squibb and then add Vertex, BioMarin and Horizon with Alnylam, Argenx and Regenxbio as riskier further additions.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Highly qualified (BSc PhD CPhys FInstP MIoD) expert in R&D management, business improvement and investment analysis, Dr Mike Tubbs worked for decades on the 'inside' of corporate giants such as Xerox, Battelle and Lucas. Working in the research and development departments, he learnt what became the key to his investing; knowledge which gave him a unique perspective on the stock markets.

Dr Tubbs went on to create the R&D Scorecard which was presented annually to the Department of Trade & Industry and the European Commission. It was a guide for European businesses on how to improve prospects using correctly applied research and development.

He has been a contributor to MoneyWeek for many years, with a particular focus on R&D-driven growth companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.