Harry Potter publisher Bloomsbury should ride out the economic storm

Bloomsbury – publisher of the Harry Potter books – saw sales boom during lockdown, and it expects to ride out the cost of living crisis too. Rupert Hargreaves delves into the figures.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Investors have poured trillions of dollars into digital infrastructure over the past decade as the demand for cloud computing, online gaming, artificial intelligence and virtual reality services has exploded. We are all spending more time online in the digital world and less time doing mundane things like reading a hardback book.

Against this backdrop you might expect an old-fashioned publishing house like Bloomsbury (LSE: BMY) to be struggling. However, the company has seen its profits explode over the past couple of years. It doesn’t look as if its growth is going to slow down any time soon.

A company for changing times

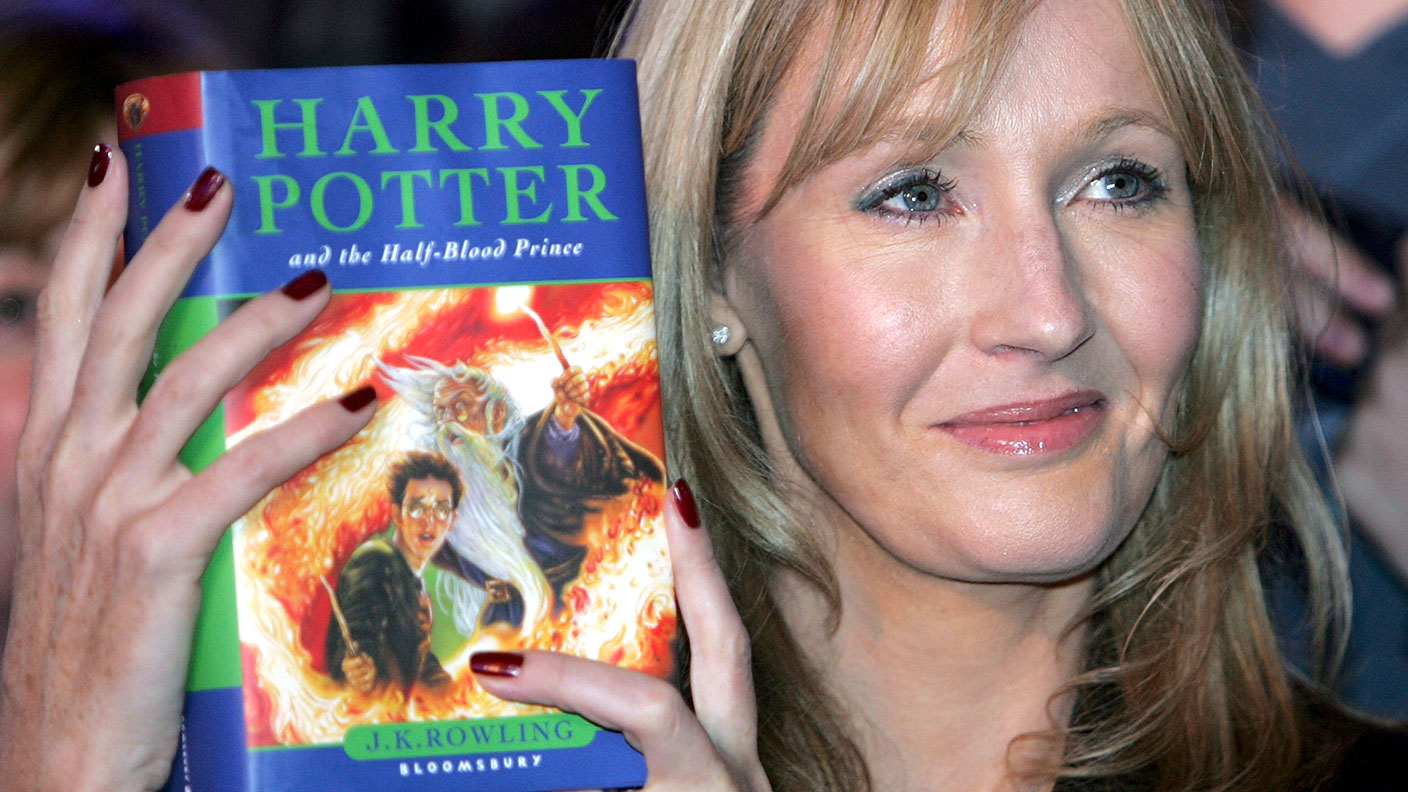

Bloomsbury emerged as one of the publishing industry’s biggest players in the mid-90s with the rights to the Harry Potter books – the best-selling book series in history. It has flogged more than 500 million copies, and is still dining out on the rights to this franchise (I’ll come back to this later on).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Bloomsbury’s association with Harry Potter became a bit of a double-edged sword. It generated vast profits, but there was always a question as to whether or not the company had a future away from the world of magic.

As it turns out, it does. Over the past decade, Bloomsbury’s management has successfully steered it away from dependence on Harry Potter by expanding its presence in the fiction and non-fiction book markets, all while building an educational arm.

The coronavirus pandemic was a boon for Bloomsbury. With consumers stuck at home, book sales jumped – the consumer books unit accounted for 61% of pre-tax profit in 2021 and new releases have helped carry that momentum into 2022.

According to Bloomsbury‘s results for the financial year to the end of February 2022, consumer revenue grew by 25%, while the non-consumer division reported a 23% increase in revenues. For the year as a whole, revenue increased by 24%.

Some analysts had been concerned that the pandemic consumer reading boom would not last as the world reopened. As it turns out, these concerns have not materialised: group sales are now around 41% higher compared to pre-pandemic levels.

Bloomsbury’s valuable intellectual property rights

One of the most attractive qualities of companies that own the rights to valuable intellectual property (IP), like Bloomsbury, is the fact that this property can continue to generate a recurring income for decades, without the need to invest heavily.

Indeed, most assets, such as the infrastructure required to maintain a cloud computing network or a container ship that serves vital trade routes around the world, require annual capital spending to keep them serviceable and reduce the risk of a severe breakdown. There is no need for such spending with IP such as book manuscripts. Once written these texts can be resold almost indefinitely without significant changes or spending.

As a result, Bloomsbury is still reaping the benefits of the Harry Potter franchise. As the 25th anniversary approaches, sales of the series grew by 5% last year. According to CEO Nigel Newton, more than half of the company’s sales are backlist titles, which are cheaper and easier to publish than new work.

As noted above, to complement its traditional business Bloomsbury has also made significant inroads into the educational market. To that end, towards the end of last year it acquired US-based publisher ABC-CLIO, which supplies schools and libraries.

This was just one of several deals. Others include Red Globe Press and London-based fiction publisher Head of Zeus. More are planned. “We have several acquisitions under consideration, and they are primarily academic,” Newton told the Financial Times in an interview after Bloomsbury published its full-year numbers.

It certainly has the resources to continue snapping up smaller peers. At the end of February, Bloomsbury reported a net cash balance of £41m. Even after spending something in the region of £25m on deals last year, and returning £15m to shareholders via dividends, Bloomsbury’s robust cash generation puts it in a strong position.

In fact, management is so confident that it has hiked the final dividend for the year by 24%. Together with the interim payout, the full-year dividend is 10.7p per share, a yield of 2.7%.

Past performance suggests the group’s future is bright

Bloomsbury has defied expectations over the past couple of years, but the question is, with economic headwinds growing, can it maintain its growth trajectory?

Newton believes it can. The cost of living crisis does not seem to be hitting sales with growth “suring” in May. Inflation is pushing costs higher, but the company is continually reviewing its pricing and consumers seem willing to pay higher prices (shareholders can beat inflation with a 35% discount on all titles).

The company believes that books are an “affordable luxury” that readers are likely to continue to buy even if disposable income falls. A higher share of digital sales at Bloomsbury’s academic division, as well as a push to expand into international academic markets, may also help it navigate growing economic headwinds – these sales tend to be more non-discretionary.

Management has done an excellent job of steering the group through the pandemic and diversifying into new growth markets over the past three years. I think the odds are they’ll be able to keep the momentum going over the next three years despite the uncertain macro backdrop.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Rupert is the former deputy digital editor of MoneyWeek. He's an active investor and has always been fascinated by the world of business and investing. His style has been heavily influenced by US investors Warren Buffett and Philip Carret. He is always looking for high-quality growth opportunities trading at a reasonable price, preferring cash generative businesses with strong balance sheets over blue-sky growth stocks.

Rupert has written for many UK and international publications including the Motley Fool, Gurufocus and ValueWalk, aimed at a range of readers; from the first timers to experienced high-net-worth individuals. Rupert has also founded and managed several businesses, including the New York-based hedge fund newsletter, Hidden Value Stocks. He has written over 20 ebooks and appeared as an expert commentator on the BBC World Service.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.