Rightmove: property asking prices hit record high

Rising buyer demand for top of the ladder home is boosting asking prices, Rightmove research shows. Is now a good time to sell a property?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Asking prices for UK homes have hit a record high as sellers become more confident amid the typically busier spring market, Rightmove figures released today suggest.

The property website’s latest house price index shows the average price of property coming to the market for sale rose by 0.8% at the start of this month to a record £375,131.

May is typically a strong month for price growth anyway, with new price records having been set in May in 12 of the previous 22 years, Rightmove said.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The previous asking price record was set last year and are now up 0.6% annually.

It comes despite buyers facing higher mortgage rates and tough affordability criteria due to the cost of living crisis.

The number of sales being agreed during the first four months of the year is 17% higher than last year, Rightmove said, outstripping the 12% increase in the number of new sellers coming to market

Rightmove’s figures are just asking prices though so there is no guarantee that sellers will get the offers they want and house price data that reflects sold prices from Nationwide and Halifax shows growth has slowed annually and is even down on a monthly basis in some cases.

Tim Bannister, director of property science for Rightmove, warns that the market is highly price sensitive, which is made worse by the time it takes to complete a sale or purchase as buyers and sellers may get nervous and pull out.

“The lengthy time to complete a sale after finding a buyer remains a challenge for both agents and movers,” he says.

“The average time between agreeing a sale and legal completion is a painful five months, or 154 days. In total, it is taking more than seven months on average from a seller coming to market to completing their move, meaning that as early as it may seem, would-be sellers hoping to celebrate Christmas in a new home need to be coming to the market about now.”

The state of the spring selling market

Asking prices may be rising but Rightmove said price growth is led by the largest-homes, top-of-the-ladder sector, with typical values up 1.3% compared with last year.

“A lack of available homes for sale in this sector during the pandemic years, together with the rapid rise, and subsequent volatility of mortgage rates in the post-mini-Budget period, meant that activity in this sector was particularly susceptible to some potential movers taking a step back,” adds Bannister.

“Now, with mortgage rates more stable albeit still high, and greater buyer choice, many who had postponed their moving plans in this sector appear to be returning.”

In contrast, asking prices for a typical first-time buyer home are up just 0.4% on a monthly basis and by 0.2% for those making the next step.

On a regional basis, sellers in the North East of England appear the most bullish, with asking price up 5.8% annually.

Asking prices in the West Midlands were up the most on average on a monthly basis by 1.2%.

Meanwhile, the South East and East of England have since average asking prices drop by 0.1% and 0.6% respectively.

Is now a good time to sell a property?

Many analysts had predicted that house prices would fall this year due to high mortgage rates and falling demand, making it a tricky time for homeowners who want to sell a home or buy a property.

Price growth on sold prices has slowed and demand may improve further due to hopes of an interest rate cut in the coming months, which could push down the overall cost of borrowing and boost buyer budgets.

“Some predicted that property prices would suffer sharp falls and take a while to recover following the Bank of England increasing the base rate up to 5.25%, where it has remained since August 2023,” adds Bannister.

“However, the momentum of the Spring selling season has exerted enough upwards price pressure to reach a new record asking price.

“It’s important to remember that prices overall are still only 0.6% ahead of this time last year. The market remains price-sensitive, and with prices reaching new records in the majority of regions and mortgage rates remaining elevated, affordability for many home-buyers is still stretched.”

Matt Thompson, head of sales at estate agent Chestertons, says some house hunters waited for the Bank of England to cut interest rates earlier this month but as this did not happen, buyers quickly resumed their search.

“As an increasing number of lenders are now cutting mortgage rates, buyers feel slightly more confident about their financing options,” he says.

“We expect this shift in the market to fuel buyer demand this summer – particularly in London where the volume of buyers still outweighs the number of available properties."

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Marc Shoffman is an award-winning freelance journalist specialising in business, personal finance and property. His work has appeared in print and online publications ranging from FT Business to The Times, Mail on Sunday and the i newspaper. He also co-presents the In For A Penny financial planning podcast.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Rightmove: Asking prices rise by 0.3%, but increase is lower than typical for October

Rightmove: Asking prices rise by 0.3%, but increase is lower than typical for OctoberOctober saw asking prices grow by £1,165 on average, Rightmove says, but the increase is far below the usual autumn bump as the property market braces for next month’s Budget.

-

Three UK stocks for long-term growth

Three UK stocks for long-term growthUK Stocks Professional investor Nick Train picks three UK stocks to invest in the British boom.

-

Rightmove will go wrong

Rightmove will go wrongFeatures Rightmove, the online property portal, is too pricey given the poor outlook for housing.

-

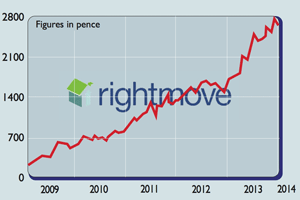

Shares in focus: The Google of Britain's housing boom

Shares in focus: The Google of Britain's housing boomFeatures Property website Rightmove has enjoyed tremendous success, says Phil Oakley. But can it deliver for shareholders?