House prices rise 4.1% in last year - but fall monthly for fourth consecutive time

The latest house price index show finds that house prices are slowing

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

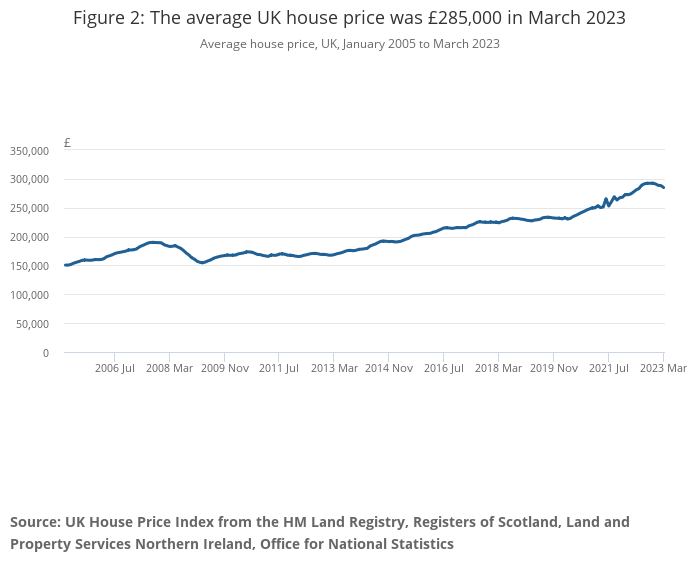

The value of the average property in the UK rose 4.1% in the 12 months to March 2023, adding £11,000 to a typical home, according to the latest ONS house price index.

But on a monthly basis, property prices have fallen for the fourth consecutive time, decreasing 1.2% in March 2023, following a fall of 0.1% in February 2023. This could be further indication that house prices could finally come down further in 2023.

It means that the average value of a UK property now stands at £285,000. That’s down from a recent peak of £293,369 in November 2022.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Where are house prices rising the fastest?

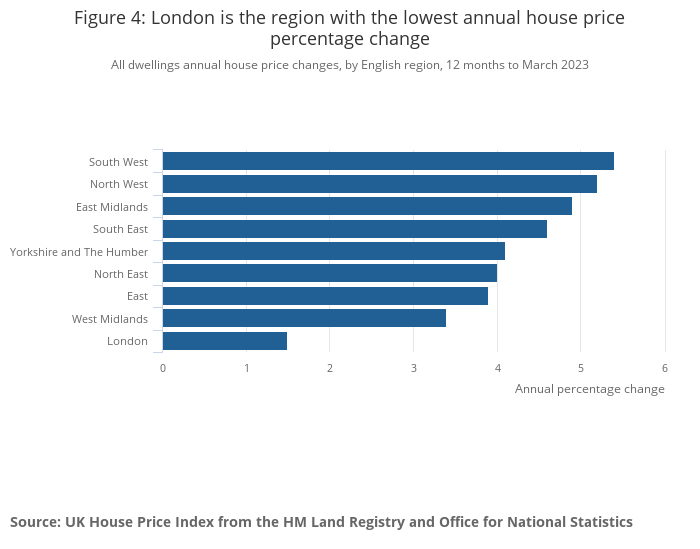

There are regional differences too: The average price in England was £304,000, up 4.1%, while in Wales it was £214,000 and up 4.8%. Meanwhile, prices rose 3% to £185,000 in Scotland and 5% to £172,000 in Northern Ireland.

In England, the highest annual increase was in the South West, up 5.4%, while London’s house prices only rose 1.5%.

The annual price increase is a considerable slowdown from July last year when the cost of a property had soared 14.4% in just 12 months.

The ONS said that there had been some 89,560 residential house purchases last month, nearly 19% lower than a year earlier, but up slightly by 1.3% from February.

“Rising interest rates and economic pressures have not stood in the way of many buyers or sellers’ ambitions as the housing market shows strong resilience and house prices rise in March,” said Emma Cox, managing director of real estate at Shawbrook Bank.

“And while buyers are likely to remain relatively cautious moving forward, as mortgage rates remain high in line with rising interest rates, it’s encouraging to see these signs of optimism back in the market.

“The well-documented lack of supply within the rental market could prompt professional landlords to snap up properties and expand their rental portfolios before any further price rises.

“This should help to provide an injection of quality stock, with demand currently being starved of good, available properties for renters.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Katie is deputy editor of Times Money Mentor and long-time contributor to the Sunday Times where she started on the Irish desk in 2012 and spent 10 years covering news, culture, travel, personal finance and celebrity interviews.

Her investigative work on financial abuse has examined the response of banks, the Financial Ombudsman and the child maintenance service to victims, and resulted in a number of debt and mortgage prisoners being set free - and a nomination for Best Finance Story of the Year at the Headline Money awards in 2021 and 2022.

Katie was also shortlisted for Freelance Journalist of the Year at the Headline Money awards in 2022, 2023 and 2024 and won Personal Finance Journalist of the Year at The British Bank Awards 2022.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.