Are corporate bonds a good bet?

Corporate bonds pay a slightly higher yield than governments, but spreads aren’t generous by past standards.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In recent updates, I’ve looked at the role of government bonds in the MoneyWeek exchange-traded fund (ETF) portfolio. Next, I’ll move on to review our equity positions. But first, let’s talk briefly about corporate bonds.

These aren’t a core part of the strategy, because they don’t generally add much. Conventional government bonds offer a safe haven. Inflation-linked bonds promise a guaranteed real return. Both reduce risks. Corporate bonds add credit risk: they pay higher yields than government bonds, but you lose part of that if some default.

Over the past 50 years, US corporate bonds have beaten ten-year Treasuries by around 1.2 percentage points per year. Equities have done a lot better. So we’d rather take our risks in equities.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

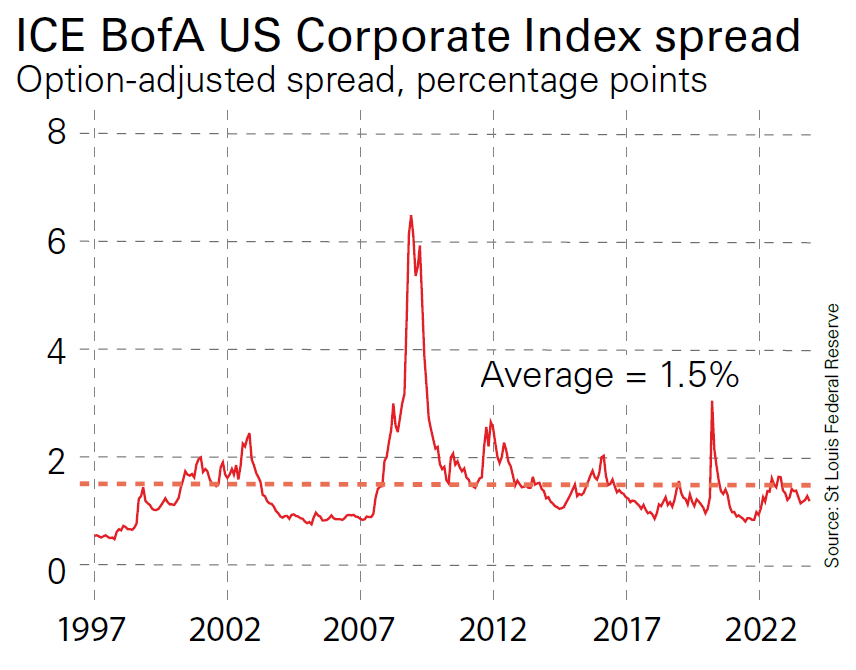

Of course, if corporate bonds were unusually cheap relative to other assets, they would become more attractive. Over most of the past decade, with yields heading ever lower, that was never the case. Yields today are higher – but so are yields on government bonds. The spread between the two has not expanded to an extent that makes corporate bonds look exceptionally compelling.

Credit spreads vary depending on the borrowers’ credit rating. For example, the spread for ICE BofA AAA US Corporate index (ie, top-rated borrowers) currently stands at 0.44 percentage points (pp). The spread for BBB borrowers, the lowest investment-grade rating, is 1.55 pp. Some groups are a bit higher relative to history than others, but none look generous.

The chart below shows a near three-decade history for a composite index of US corporate bonds of all ratings. This is probably a fair overall summary and shows the current spread is a little below the average over this period. Note also that after many years of low rates, many companies are carrying plenty of debt. Some will struggle as they need to refinance this on higher yields. Defaults are likely to rise – they are already ticking up.

All told it’s hard to feel that today’s spreads offer extra compensation for the risks. So there is little obvious opportunity here for the portfolio at present.

Fallen angels and higher yields

Perhaps the most interesting area for us is fallen angels – bonds that have been downgraded from investment grade to junk. Since some investors are forced sellers in this situation, these often trade cheaper than their fundamentals would justify.

Over the long term, fallen angels have outperformed corporate bonds as a whole. Anomalies like this can be a useful way to add value. With fallen-angel indices now yielding around 8%, they look a little tempting. There are a handful of ETFs in this area such as iShares Fallen Angels High Yield Corp Bond ETF (LSE: RISE). However, spreads on fallen angels are still tight compared to history, while this particular ETF has lagged its index by more than I’d expect over the past five years. I will be looking at this sector closely as the credit cycle turns – but I’m not yet convinced this is the time or way to invest.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Related articles

- Is it a good time to buy bonds?

- Is it time to buy gilts?

- Happy days are here again for equity investors

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton