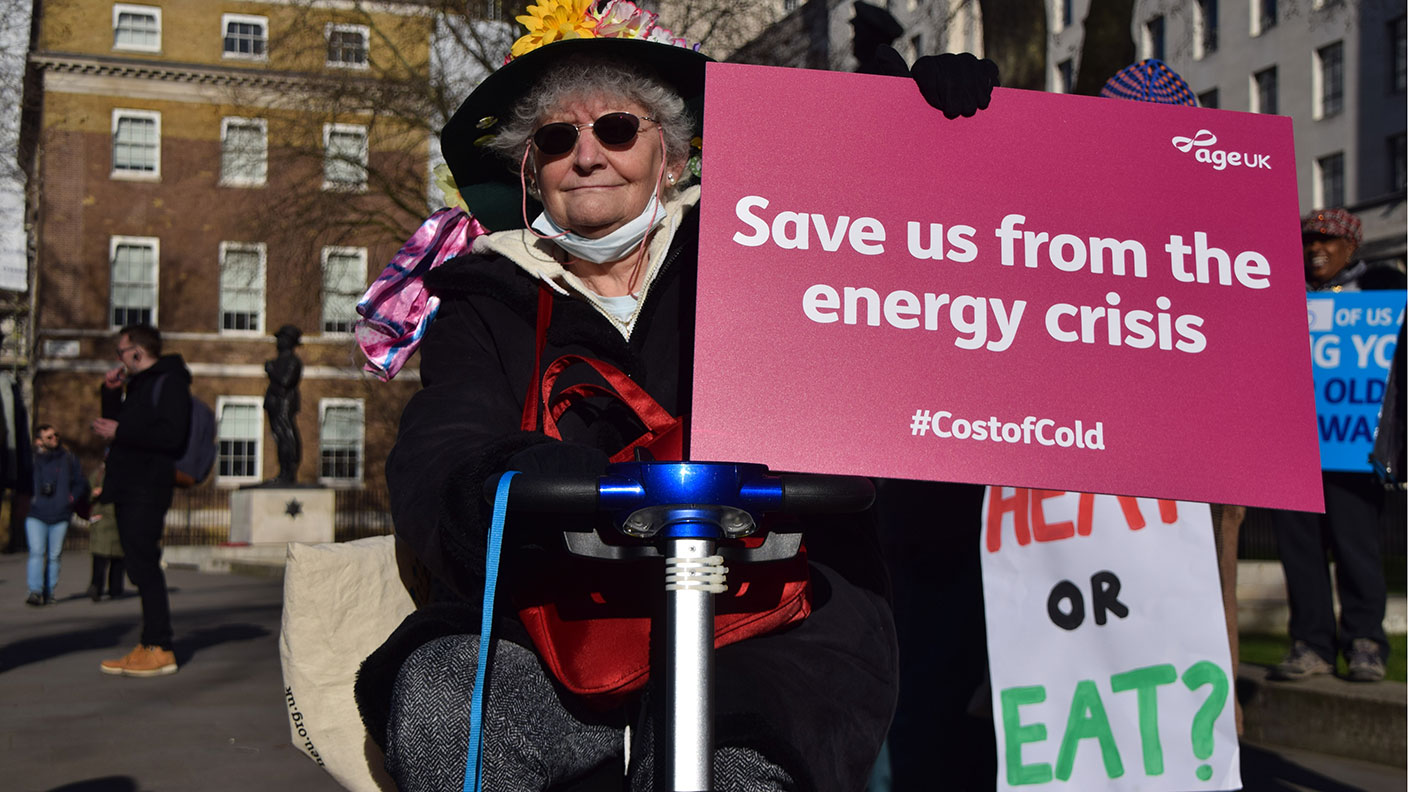

The cost of living crisis just got worse – happy Bleak Friday

Today is "Bleak Friday", when your energy bill goes up along with big rises for council tax, food and petrol. There's no easy solution to the cost of living crisis, says John Stepek. So what should you do?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Happy Bleak Friday!

That’s the nickname being given to this particular April Fool’s Day because – quite apart from the weather – it’s grim out there.

The average household energy bill is going up by 54% today. So obviously, it’s the ideal time for it to start snowing.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And then there’s all the other things driving up the cost of living, from petrol prices to food prices.

So what can you do and how much worse will it get?

Your cost of living has probably just gone up by rather a lot

Today the energy price cap has been pushed up by 54%. The price cap is set by the regulator Ofgem. It was a stupid idea when it was introduced (it’s only been around since 2019) – it’s yet another bit of the political short-termism which has helped to paddle us up the unappealing creak in which we’re now circling haplessly.

Moaning aside, what does this actually mean? The price cap is often expressed in a rather confusing manner. The average household on a standard variable energy tariff will go from paying £1,277 a year to paying £1,971 a year.

Just to be clear though – because that term “cap” is very confusing in this context – that’s the average household, using the average amount of energy. What the price cap actually is, is a cap on the cost per unit.

So yesterday, the price cap was 4p per kilowatt hour for gas, and 21p/kWh for electricity. Today, it’s gone up to 7p/kWh for gas and 28p/kWh for electricity.

However you express that, it’s a big rise. But it does mean that there’s a lot of variance around that average.

Anyway, it means that if you’re on a variable energy tariff rather than a fixed one, your energy bill just went up by a lot.

So that’s one component of “Bleak Friday”.

Your other bills will be going up too. I got a note from my mobile provider earlier this year pointing out that from 31 March, my bill would be going up by December’s CPI (consumer price index) inflation reading plus 3.9%.

With CPI at 5.4% in December, that’s a 9.3% increase. It’s on a relatively small bill but that’s chunky. I’m just grateful that it wasn’t linked to RPI of 7.7%, or my bill would have seen a double-digit increase.

Meanwhile, Hargreaves Lansdown points out that council tax bills are going up by an average of 3.5% (to an average of £1,966 for Band D homes).

Now, in the context of a 54% energy bill jump, and current inflation at 6%-8% (depending on your preferred measure), that almost sounds like a bargain – but every little hurts. And – just asking – have your wages gone up by 3.5% this year?

This is before we even start on fuel prices, or Rishi Sunak’s hike in National Insurance contributions, and his freeze on every tax allowance and threshold going, all of which will be munching into any pay rise you have managed to secure this year.

There is no easy solution to the cost of living crisis

So what can you do about all this? On the energy bill front, there are no easy solutions. As the team at Martin Lewis’ MoneySavingExpert points out, “there’s nothing meaningfully cheaper than the new price cap – so for most, switching won’t save you money”.

My usual reaction when someone says “put on another jumper” is a surge of irritation. But the reality is that if you want to spend less on energy, there’s no other option but to use less energy.

That involves either turning down thermostats and putting on thermal pants or investing some of your savings in better insulation, alternative heating systems, or those little carpet snakes that sit in front of your doors, keeping out draughts while tripping the unwary.

There is a bit of relief available for the less well-off, including a bit of money off council tax for those in bands A to D. And a rise in the National Insurance threshold from July should be a net gain for anyone earning roughly £30,000 or less.

But while that’ll take the edge off the price rises, it by no means offsets them. Sky’s Ed Conway – doing a rough and ready calculation – reckons that it all amounts to “roughly half the increase in the cost of the average energy bill.”

And if you are among the ranks of the better off, then life is going to get significantly more expensive.

As Chris Giles points out in the FT, Sunak’s decision to freeze allowances – given current inflation rates – is now expected (by the Office for Budget Responsibility) to see him rake in £18.8bn a year by 2026-2027, versus £8.2bn a year when it was first announced in 2021.

That’s not a stealth tax, that’s an inflation tax. And it explains why Sunak’s penny-off-income-tax promise is essentially hollow politicking (though I still want to give him a tarnished gold star for harmonising the NICs and personal allowance thresholds, any nod to tax simplification should be gratefully welcomed these days).

And this is all happening at a time when inflation is also giving your investments an absolute mauling.

Merryn has some thoughts on funds that might help to protect you from inflation in her editor’s letter last week. And my colleague Cris made some changes to the exchange-traded funds that comprise our model passive portfolio – that’s worth reading about here.

Other than that, make sure you use your tax-efficient allowances, and keep your cost of investing down, because every percentage point you can save today is going to make a difference.

Oh, and maybe invest in some of the only industries to benefit from all this. In the latest issue of MoneyWeek magazine, out today, we look at how to invest in the industries which will be providing us with the energy we’ll be needing for the foreseeable future. If you’re not already a subscriber, sign up now and get your first six issues free, plus a free report on how to invest for more inflationary times.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.