How to position your portfolio for higher inflation

UK inflation hit 6.2% this week, Merryn Somerset-Webb explains what is behind it and how investors can position themselves to combat it.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

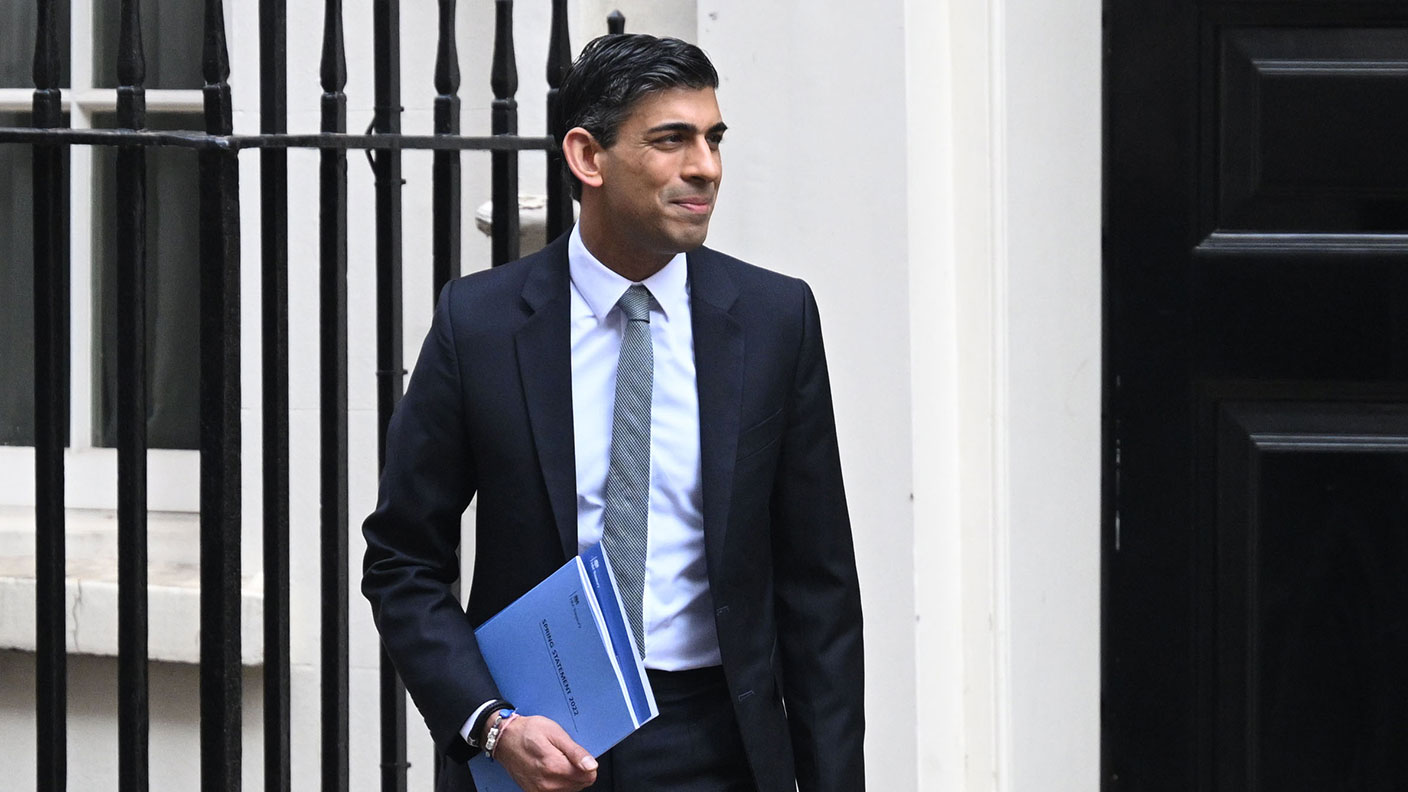

If the chancellor wasn’t worried about his spring statement on Tuesday night, I think we can be pretty sure that he was very worried indeed by 7.01am on Wednesday morning. At 7am, the Office for National Statistics released the UK’s latest inflation numbers.

Thanks mostly to rising energy and fuel prices, UK inflation (as measured by the consumer price index) hit 6.2%, a 30-year high. The retail price index (RPI), the old measure, is rising at 8.2%. A reminder: the Bank of England inflation target (hitting it is its main job) is 2%. The worst, as Rishi Sunak knows, is yet to come.

There is a view in the UK that there are elements of Brexit in this. There aren’t (EU-wide inflation is also 6.2%). This is about war (which always brings inflation) turboboosting an inflationary environment created by the money printing and supply disruptions of the pandemic (we spent £400bn on pandemic policy costs) meeting the energy supply constraints created by the drive to net zero.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Energy prices look set to rise by well over 10% this month and food prices have surged, too. The Bank of England now expects inflation to peak at 8%-plus. That makes double figures almost a given.

A genuine crisis

Here, then, is a genuine cost of living crisis. Sunak, who has presided over a rise in the UK tax burden equivalent to 2% of GDP, would have eaten breakfast over a pile of newspapers jammed with demands about the many somethings to be done. He was told to raise the National Insurance (NI) threshold to protect lower earners; to delay or abolish the pending 1.25 percentage point rise in NI; to postpone the freezing of income tax allowances (a tax rise by any other name); to abolish the £70 about to hit household bills to pay for compensating energy companies that have gone bust; to bring forward the rise in benefits to reflect the sharp rise in inflation (low income households cannot be expected to cope with RPI at 8.2% without some immediate assistance); and to reduce fuel duty. He could, said almost everyone, one way or another, make the pain go away.

But of course in the end he could not. Those who wanted the NI threshold to rise got what they wanted – and it is a neat way to protect some lower earners. The fuel duty cut will please some, too – but given the volatility in energy prices, it is more symbolic than anything else. Overall he had no real rabbits in his hat. And with growth likely to slow into rising inflation, he is unlikely to find any.

In short, the government cannot protect you from this financial mess. You have to do that yourself. So stay in work if you can. In times of inflation you need as many income streams as possible, and if we are entering a period in which some power returns to labour, the returns to capital will surely fall – so best to have earned income as well as unearned. When it comes to the latter, choose wisely.

Few fund managers have been preparing for inflation (the transitory story was far too easy for them to work with). Look for those that have (our podcast this week with Charlotte Yonge of Troy Asset Management is a useful start) – and make sure you own some of them. It isn’t too late to prepare. Think Personal Assets Trust, Capital Gearing, Ruffer, BH Macro and JP Morgan Core Real Assets for starters.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

Why it might be time to switch your pension strategy

Why it might be time to switch your pension strategyYour pension strategy may need tweaking – with many pension experts now arguing that 75 should be the pivotal age in your retirement planning.

-

Star fund managers – an investing style that’s out of fashion

Star fund managers – an investing style that’s out of fashionStar fund managers such as Terry Smith and Nick Train are at the mercy of wider market trends, says Cris Sholto Heaton

-

How to add cryptocurrency to your portfolio

How to add cryptocurrency to your portfolioA new listing shows how bitcoin might add value to a portfolio if cryptocurrency keeps gaining acceptance, says Cris Sholto Heaton

-

Investing in forestry: a tax-efficient way to grow your wealth

Investing in forestry: a tax-efficient way to grow your wealthRecord sums are pouring into forestry funds. It makes sense to join the rush, says David Prosser

-

The MoneyWeek investment trust portfolio – early 2026 update

The MoneyWeek investment trust portfolio – early 2026 updateThe MoneyWeek investment trust portfolio had a solid year in 2025. Scottish Mortgage and Law Debenture were the star performers, with very different strategies

-

Pundits had a bad 2025 – here's what it means for investors

Pundits had a bad 2025 – here's what it means for investorsThe pundits came in for many shocks in 2025, says Max King. Here is what they should learn from them

-

New year, same market forecasts

New year, same market forecastsForecasts from banks and brokers are as bullish as ever this year, but there is less conviction about the US, says Cris Sholto Heaton