Humana sees healthy growth in US healthcare

Humana is a major player in the American market and the stock’s valuation looks reasonable.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Investing in healthcare providers makes sense. People are living longer and need more support. The elderly are an increasingly influential demographic group of voters in many countries, and they are demanding that more is spent on their health.

How healthcare is provided can vary significantly. In the US, however, companies are at the forefront of delivery, with government support for the over-65s through a health benefits programme called Medicare, which funnels cash through to the private healthcare sector.

Benefiting from this scheme is Humana (NYSE: HUM), a $62.9bn US health insurer and care provider with more than 17 million customers. Customers buy insurance directly or indirectly (via an employer or the state), and Humana uses its takings to fund treatments, hospital stays and medication from healthcare operators or provides them in-house. Profitability is driven by increasing how much customers pay while remaining competitive and negotiating lower treatment provider costs because of its size.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

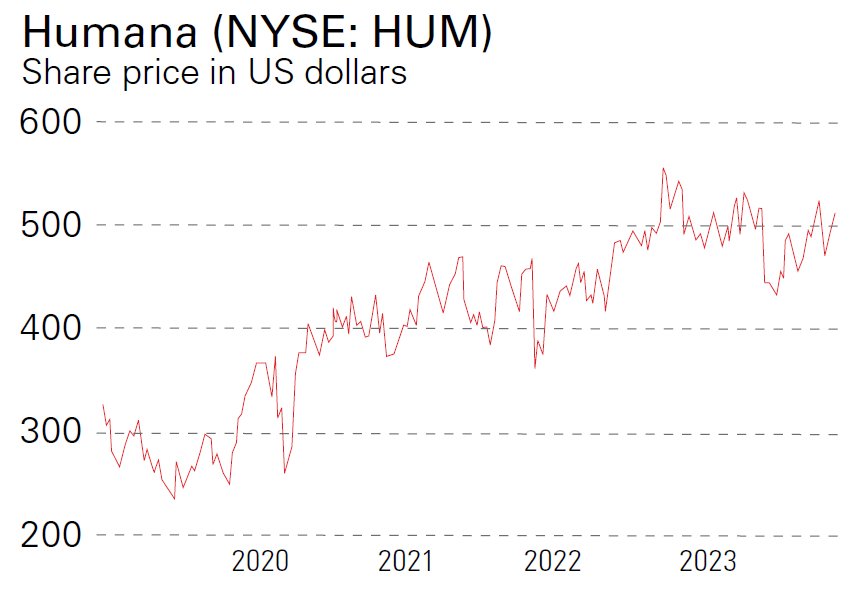

How well this has been working can be seen from the stock’s performance. It has risen by 400% over the past decade, versus a 150% gain for the US S&P 500 index. This comes despite flat and even negative returns from most healthcare providers and other sectors in 2023 as investors focused instead on a narrow group of big tech stocks.

This year has seen an uptick in procedures carried out to catch up on a backlog caused by Covid lockdowns. The surge increases the providers’ costs relative to customers’ payments. But it should clear soon and is already being factored into market expectations, making the lacklustre performance this year a long-term buying opportunity. Over the past decade, moreover, Humana’s sales have more than doubled to $92.8bn and reported earnings per share almost trebled to $20.28, an annualised growth rate of just over 10%.

While this long-term growth speaks for itself, an additional attraction for investors in companies like Humana is their perceived “defensive” quality. Not only do they receive a reliable and predictable portion of their revenue from the US government, individual consumers are less likely to cut back on health costs in a downturn than, say, postpone a holiday. Having some of this long-term defensive growth in a portfolio can’t be a bad idea when higher borrowing costs are hurting consumer and business confidence.

Meanwhile, the potential customer base is widely expected to keep expanding. The number of over-60s worldwide will jump nearly 40% from one billion today to 1.4 billion in 2030, according to the World Health Organisation. It will then rise a further 50% to 2.1 billion by 2050. In the US, there are now 59.4 million people eligible for Medicare and, by 2060 there will be 95 million over-65s, according to other research.

With earnings expected to hit $28.26 per share for 2023 as a whole and then $31.60 in 2024, the price/earnings (p/e) ratio stands at 18, falling to 16 next year. This is not demanding for a well-managed business with a strong track record of high single-digit, long-term sales growth.

This area of the health sector is not going to generate bumper returns enjoyed by some of the pharmaceutical businesses with their breakthrough drugs. But nor will it share in the high risk of product failure and heightened volatility in tougher years. Reliable growth with some insulation from the boom and bust of the economic cycle may just be the kind of tonic plenty of investors have been looking for.

Why Humana has a sweet spot in the US health sector

It would take a whole book to explain the labyrinthine options and permutations on offer in the US medical healthcare sector.

The key is that Medicare is open to all over-65s as well as others with disabilities or specific conditions, but there are choices that individuals can make to enhance their health coverage. For this reason, Medicare has come to be referred to as “traditional Medicare” and the flexibility comes with what are known as "Medicare Advantage” plans.

Advantage is the sweet spot for Humana, which is the second-largest provider after its biggest competitor, UnitedHealth Group. As with traditional Medicare, Advantage provides the hospital stay and treatment coverage but bundles them together with additions such as the cost of prescribed drugs and eyesight and dental care.

In short, Humana is a dominant player in one of the fastest-growing health consumer groups – the over-65s – with the scale to offer a broad product range to maximise sales and offset costs.

While almost all revenues come from insurance premiums, it’s worth adding that it is developing its own primary care centres branded as CenterWell. Growing in-house offerings should mean further cost reductions, boosting profit margins. Innovative use of new medical technologies will enhance this trend.

The firm only recently said that 2023 gains in its individual Advantage membership will be a sector-beating 19% versus the year before. And it does not disagree with the market’s expectation of 37% growth in 2023 adjusted earnings per share. Some 25 Wall Street analysts cover the stock. The consensus 12-month price target is $585 and there’s plenty of scope to build on this, as annual results are released in February.

This article was first published in MoneyWeek's magazine and all information was correct at the time of writing. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Related articles

- The top healthcare funds to buy

- Three healthcare trusts to invest in

- Why this biotech company has years of growth ahead

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Stephen Connolly is the managing director of consultancy Plain Money. He has worked in investment banking and asset management for over 30 years and writes on business and finance topics.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton