Why this biotech company has years of growth ahead

Zimmer Biomet, a leader in the worldwide market for hip and knee joints, enjoys a competitive advantage and has years of growth ahead, says Dr Mike Tubbs.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

People are living longer across most of the world. The average life expectancy at birth in the 38 countries of the OECD, an association of developed economies, increased from 67 to 80 between 1960 2020. Japan had the highest life expectancy in 2020 – 85 – while the UK’s was 81.

Educated professional people tend to live longer than average, with a 25-year-old American graduate surviving a decade longer than a high-school dropout. As people age they experience joint problems that reduce mobility to the point where artificial joints are required, especially hips and knees. Ageing baby-boomers and the obesity crisis (around 40% of Americans are obese) are the key drivers of demand.

The leader in the worldwide market for hip and knee joints is Zimmer Biomet (NYSE: ZBH), with 33% of the market, followed by Stryker with 22%. The UK’s Smith & Nephew is in fourth place with 11%. Zimmer originally took the walking frame invented in Britain in the late 1940s, made some minor improvements and called the result a Zimmer frame. However, their product range today includes high-tech hip, knee, shoulder, elbow and ankle joints, along with various diagnostic tests. Zimmer also used to cater for dental and spinal problems, but these lower-margin products were spun off as a separate company, ZimVie, in March 2022.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A Covid-19-induced backlog

Zimmer and other artificial-joint suppliers were adversely affected by Covid-19 since many joint-replacement operations were delayed while hospitals were overloaded with Covid-19 cases. These delayed operations form a substantial backlog, which should add to revenue over the next few years. The effects of the pandemic are clear in Zimmer’s revenue, which fell from $8bn in 2019 to $7bn in 2020, but recovered to $7.84bn in 2021.

Knee and hip replacements are its top product category, with 2021 sales of $4.5bn. The next-biggest subsector is products and services relating to sports medicine, extremities and trauma (SET), with $1.73bn. The dental and spine category (now spun off as ZimVie) comprised $1bn; other products were worth $0.6bn. About 60% of sales were made in the Americas.

Zimmer enjoys an enduring competitive advantage over potential rivals owing to its intellectual property (notably patents) and high switching costs for surgeons. Surgeons must overcome a substantial barrier if they want to switch from one supplier to another because of the time needed to train and develop expertise in using the new company’s tools and procedures. During his study time the surgeon will not be earning and is likely to work more slowly when doing operations. The patient outcomes may well be less favourable during this period and this could affect the surgeon’s reputation.

Most surgeons also develop a close relationship with their supplier’s sales representative, since they will have taught the surgeon how to use the various special tools and will often have assisted in operations. Surgeons often choose to use the supplier that they encountered during their residency and then remain with that supplier – this helps Zimmer, the market leader.

Zimmer invested $497m, or 6% of sales, in research and development in 2021. This large investment adds to its competitive advantage by enabling the development of new and improved products at a faster rate than would be possible for a smaller supplier with lower sales.

Zimmer’s ROSA robotics platform, for instance, assists surgeons in planning and performing complex knee, hip and neurosurgical operations. It has introduced the world’s first and only “smart” knee implant (it tracks a patient’s walking speed and step count), as well as a camera-based artificial intelligence system that tracks and monitors the timing of all the processes involved in an operation.

Increasing investment in innovation

Zimmer, which has a market value of $23bn, made an operating profit of $780m (10% of sales) in 2021, with net earnings of $402m. Adjusted net earnings (excluding amortisation of intangibles, restructuring and other items) were $1.55bn. Diluted earnings per share (EPS) totalled $1.91, or $7.37 on an adjusted basis.

Results for the first half of 2022 show sales up by 2.4% year-on-year (6.4% when exchange-rate fluctuations are accounted for) and full-year guidance increased to diluted EPS for continuing operations (excluding the spun-off dental and spine division) of $6.70-$6.90. Net debt at the end of the second quarter was $5.6bn, or around twice adjusted Ebitda. Zimmer has been steadily paying down its debt over the last few years.

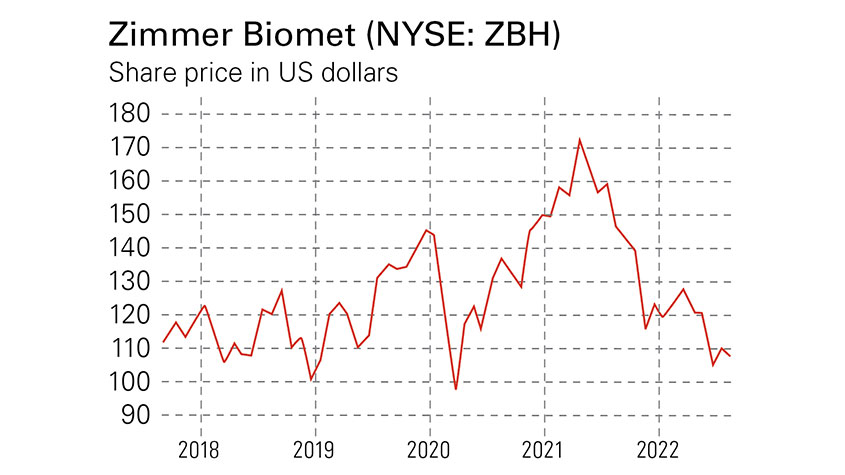

Analysts’ estimates for 2023 are for EPS of $7.14, which, at the recent price of $109, gives a 2023 price/earnings (p/e) ratio of 15.3 (14.1 for 2024). The annual dividend is $0.96, giving a yield of 0.86%. Bryan Hanson was appointed CEO in December 2017 and has been re-energising the company after the operational problems it suffered in 2016/2017. He has spun off ZimVie, driven a restructuring programme to improve operational efficiency and invested in innovation for long-term growth (particularly in digital and robotic products); competitiveness is improving.

The recent share price of $112 is 36% below $175, the fair-value estimate by investment research platform Morningstar, making Zimmer a value play on the expectation of sales increases from a rise in joint replacements now that the pandemic is receding. The demand for joint replacements is likely to rise in developed countries as baby-boomers age and obesity spreads. In developing countries, too, life expectancy is increasing and people want to remain mobile for longer.

SEE ALSO:

- Healthy profits: how to make money from investing in medical technology

- How to invest in biotechnology: the healthcare sector’s high-growth area

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Highly qualified (BSc PhD CPhys FInstP MIoD) expert in R&D management, business improvement and investment analysis, Dr Mike Tubbs worked for decades on the 'inside' of corporate giants such as Xerox, Battelle and Lucas. Working in the research and development departments, he learnt what became the key to his investing; knowledge which gave him a unique perspective on the stock markets.

Dr Tubbs went on to create the R&D Scorecard which was presented annually to the Department of Trade & Industry and the European Commission. It was a guide for European businesses on how to improve prospects using correctly applied research and development.

He has been a contributor to MoneyWeek for many years, with a particular focus on R&D-driven growth companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton