Gold mining stocks outperform gold – can it last?

Gold miners are shining brighter than the yellow metal for the first time in this cycle. Enjoy the ride while it lasts, says Cris Sholto Heaton

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

There have been two big developments in gold recently. The first is that the metal itself is reaching new highs: this week, it passed $3,500 per ounce for the first time. The other is that gold mining stocks are outperforming gold, which is something we have not really seen in this cycle.

Gold miners are a geared play on gold. When gold goes up, they rise higher; when it goes down, they fall further. This is because they have operational leverage: relatively high fixed costs mean that they make weak profits when gold prices are depressed, but higher prices can translate into a strong increase in margins.

Of course, this depends on input costs not going up too much, but recent trends have been positive. Gold miners have been seeing huge improvements in free cash flow for a while, yet the shares only began to move this year.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Investors are sceptical about the gold mining boom

You can view this in a few different ways. One is that buyers of gold have different motivations to buyers of stocks. Gold is going up because some investors are nervous and see it as a useful hedge against the kind of risks that could cause a stock market slump. Gold stocks are still stocks, and if they are worried about the market as a whole, they would logically rather have gold than any kind of stocks. Conversely, buyers of stocks are excited about the bull market in areas such as artificial intelligence. They are not interested in the bull market in gold – and hence not interested in gold stocks – because they see racier opportunities elsewhere.

Another possibility is that investors are doubtful about the quality of gold miners in particular, based on memories of the last cycle.

Yes, they are making plenty of money now, but will they be disciplined enough to hand that back to shareholders? Or will they squander it on higher-cost or riskier projects to expand production, or indulge in empire-building mergers and acquisitions?

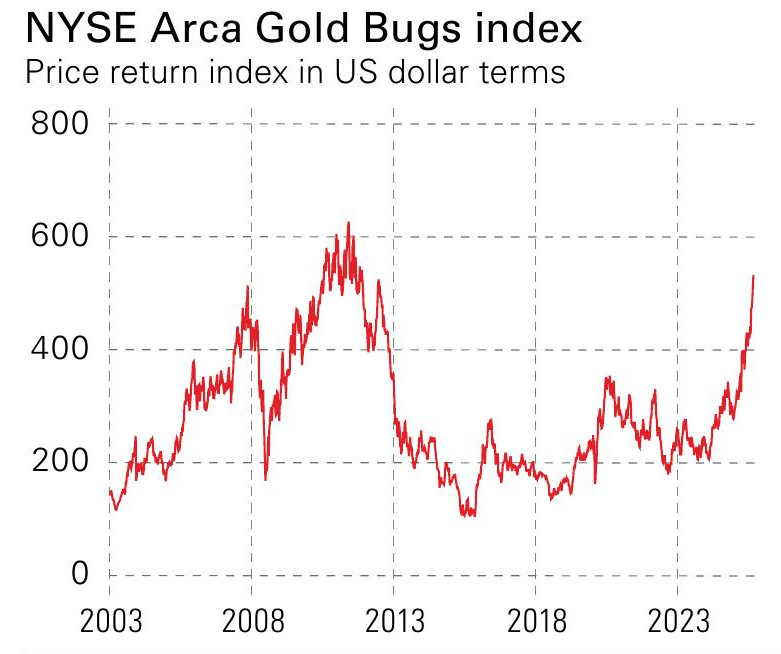

Certainly, the sector has a remarkably poor long-term record. The MSCI ACWI Select Gold Miners index has a gross total return – ie, with dividends – of 3.3% per year in US dollar terms since 2003. That’s a compound return of just over 100%. One nuance here is that after gold had been in a long bear market during the 1980s, many gold miners took to hedging their output in the 1990s and early 2000s, which worked against them once prices began rising. Still, the record of the NYSE Arca Gold Bugs index, which tracks stocks that did little hedging, is not that impressive either.

However, hedging is now minimal so producers are fully exposed to rising prices. Gold miners will be very profitable with gold anywhere close to here. They also tend to have low correlation to the wider market, which may be useful if the AI boom turns to bust. A tracker such as iShares Gold Producers (LSE: SPGP) or the even more operationally leveraged Van Eck Junior Gold Miners (LSE: GJGB) is a simple way to follow the trend. Just don’t treat it as a long-term core holding. History suggests that it isn’t.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Can US small caps survive the software selloff?

Can US small caps survive the software selloff?US stocks have made their worst start to a year since 1995 relative to a global benchmark. But experts think some sectors of the market are still worth buying.

-

Review: Eliamos Villas Hotel & Spa – revel in the quiet madness of Kefalonia

Review: Eliamos Villas Hotel & Spa – revel in the quiet madness of KefaloniaTravel Eliamos Villas Hotel & Spa on the Greek island of Kefalonia is a restful sanctuary for the mind, body and soul

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton