Gold’s surprisingly stealthy bull market

Gold's multi-year gains gathered less attention than you’d expect, but that now seems to be changing, says Cris Sholto Heaton

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I am not as much of a gold bug. I sympathise with many of the criticisms. It is not a productive asset. It does not generate an income. It incurs storage costs, so you can even say that it has a negative yield. We are not returning to a gold standard, so the idea that it represents sound money is wishful thinking. These arguments are all very logical.

Yet gold also has a long history as a trusted store of wealth and there are logical reasons for that as well. It’s rare and expensive to mine. It looks the part – this is a social judgement, but one that has lasted for thousands of years. It does not tarnish, rust or corrode. It is dense. It has few industrial uses, so its value is set by investment or jewellery demand (ie, wealth-related purposes). Other materials have some of these desirable traits, but gold combines them all.

So regardless of any persuasive case against gold, it is still seen as valuable by a large number of people and that’s ultimately what matters. You don’t need to be a gold bug to recognise that it behaves differently to other assets and there are solid reasons why that’s likely to continue for the foreseeable future, which means that it can have a very useful role in an investment portfolio.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Gold hits a new record high

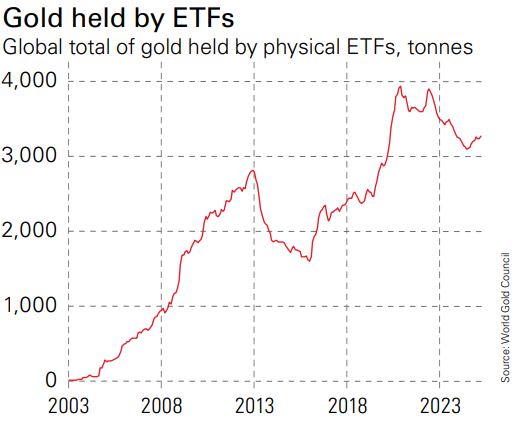

Gold has certainly done very well for investors of late. The price has reached a record high in real (inflation-adjusted) terms, passing the record set in 1980. Yet this has been a surprisingly stealthy bull market: it would be an exaggeration to say that it’s gone unremarked, but there has been far less discussion about gold than during the big mid-to-late 2000s bull run. Even more surprising is that the amount of gold held by exchange traded funds (ETFs) – the most convenient way for most investors to hold gold – is lower than it was in 2020-2022, when the gold price perked up again after a few flat years.

This lack of curiosity is starting to change. Earlier this month, both Bloomberg and the Financial Times had lengthy articles about gold’s new highs. In truth, neither were very complimentary, implying that buyers are somewhere between mad and miserly. Gold bugs sometimes see this kind of commentary as a deliberate attempt to talk their favourite metal down, which is a stretch (the only asset that the investment industry is really desperate to discredit is cash because it earns nothing on cash savings, hence the incredibly misguided lobbying campaign to kill off the cash individual savings account (Isa) that the City is now waging). However, it reminds us that there is something about gold that makes many investors a little bit uncomfortable.

Perhaps it’s the nagging sense that gold is going up not because of a mania or a bubble (yet), but because the world is in a state of flux. In particular, a critical driver of demand has probably been the accumulation of gold reserves by central banks in emerging markets (eg, China), as they try to diversify away from the dollar. This still feels like a long-term trend. Any additional buying as gold comes out of the shadows – watch those ETF flows – would be a helpful extra boost.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?