Copper is set for a long bull market – here’s how to invest in it

Commodity prices have started to cool – with the exception of one industrial metal that is in short supply but is an essential ingredient in almost everything. Dominic Frisby picks the best ways to invest in copper.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Commodities are selling off a little as peace talks between Russia and Ukraine progress. The speculative mania seems to be unwinding.

Grains are down, oil is down – though daily swings of $10 a barrel now seem to be the norm – precious metals (palladium especially) are down.

War or not, most commodities will rise again – there was an ongoing shortage before Vladimir Putin went all Napoleon, but excess must be purged.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

However, of note is that one industrial metal is hardly down at all, which suggests that that particular bull market has a lot further to go.

And that is why today we consider copper.

Copper is needed for everything, and supplies are low

Russia is the world’s seventh-largest producer of copper. It produces about 4% of annual supply (about one million tonnes a year), and sells most of that copper to China (with some into Europe).

Iron, steel and manganese make up Ukraine’s main metallic production – it is not a big player on the copper stage.

The overall consensus was that the war and sanctions on Russia would not have as big an effect on the copper price as on other commodities – and that has so far proved the case. The main protagonists in the copper story lie far away – in China, Africa and the Americas.

I don’t know how many times I’ve written this sentence, or at least a variation of it, but here I find myself writing it again: China is the world’s largest consumer of copper. That’s despite it also being the world’s third-largest producer. It is a net importer, accounting for 54% of world copper demand.

Europe is the next biggest user, at around 15% of demand, followed by the Americas, the US especially, which account for another 11% of demand. Total annual demand is somewhere between 25 and 28 million tonnes (depending on whose research you follow).

Copper costs around $10,000 per tonne, so this is a $250bn-plus market. Correct me if I’ve got my maths wrong (I’m sure you won’t hesitate).

The country with the biggest reserves and by far and away the biggest producer is Chile. Fears of resource nationalisation there with its new-ish left-leaning government have so far proved unfounded. It produces almost six million tonnes, or 28% of annual global supply.

Next is its neighbour Peru (2,200 tonnes, 12% of global supply); China (1,700 tonnes, 8%); the Democratic Republic of Congo (1,300 tonnes, 7%); and the US (1,200 tonnes, 5%).

Copper is used just about everywhere: homebuilding, construction, manufacturing, power generation, electronics and transportation. Which is why demand is often seen as a barometer of economic health. Overall demand is split roughly 65% electrical, 25% industrial and 10% transportation.

China’s inventories are at their lowest levels in four years (since before the pandemic), as are London Metal Exchange (LME) inventories, as is global visible inventory generally, suggesting strong support for current prices.

What does the copper chart tell us?

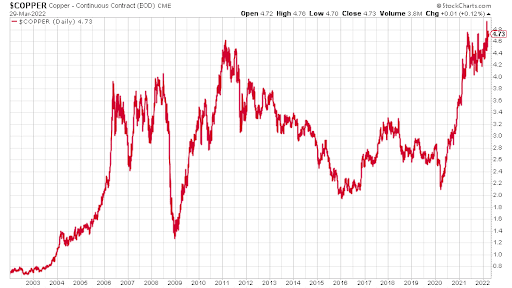

So to the copper price. It had a huge run up in the bull market of the 2000s. It collapsed in 2008, rallied again to a peak in 2011 (around $4.60/lb), and then went through nine years of bear market, during which it lost more than 50%.

It successfully retested its lows around $2/lb in 2016 and 2020. It then went ballistic in the post coronavirus-rebound, reaching new highs in 2021, since when it has been consolidating around the new highs.

Here is 20 years of copper:

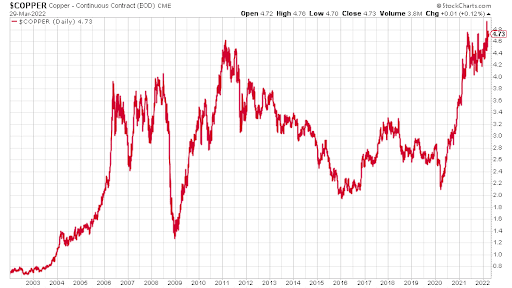

And zooming in, here is three years of copper, so you can see the consolidation of the last year, steadily creeping higher.

The Dominic Frisby house call remains: “own copper”. It wants to go higher.

Never mind China, if we are to have our Green Revolution, we are going to require a lot more of it.

So how to invest?

There is no shortage of methods, depending on your risk appetite – from futures to exchange-traded funds (ETFs) to spread bets to stocks and shares.

You can even go down the scrapyard and buy the metal itself. That is what one of my brothers-in-law used to do. But he is odd.

If you want to simply play the copper price, without taking in individual company or mining risk, there is the Copper ETF (LSE: COPA).

Then there are the miners. If you don’t want individual company risk, there is even an option for you there: the Global X copper miners ETF, the most liquid version of which is listed in New York (NYSE: COPX) but there are also “subsidiaries” in London, denominated in dollars (LSE: COPX) and sterling (LSE: COPG). The latter is probably the best way to avoid broker forex charges, though you’ll end up paying them by the back door.

London has no shortage of options when it comes to mining companies. There are the giants: BHP Group (LSE: BLT), plus Glencore (LSE: GLEN), Anglo American (LSE: AAL), Rio Tinto (LSE: RIO), and Antofagasta (LSE: ANTO).

US-listed Freeport-McMoran (NYSE: FCX), the world’s second-largest producer (after Chilean state-owned Codelco), should also probably get a plug, as it’s a purer play than most of the mining giants, Antofagasta aside.

There are plenty of small-caps and mid-caps to spice up your dinner, or give you indigestion, depending on how much you consume. I’ll leave those to you to unearth – Canada and Australia probably have the most listed, although there are also plenty on Aim, London’s junior market.

Just remember what Mark Twain said: “a mine is a hole in the ground with a liar standing next to it”. Or words to that effect.

Dominic’s film, Adam Smith: Father of the Fringe, about the unlikely influence of the father of economics on the greatest arts festival in the world is now available to watch on YouTube.

SEE ALSO:

Why investors should consider adding Glencore to their portfolios

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.