Commodity prices are taking a breather

Commodity prices have fallen back after spiking early in the year. Iron ore is down 36% from its March peak, while copper has lost 20% since 1 January. And there could be further falls to come.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Fears of recession “continue to grip commodity markets,” say Goldman Sachs’s analysts in a note. Yet “physical fundamentals signal some of the tightest markets in decades”.

Commodity prices surged earlier this year after Russia’s invasion of Ukraine, but many raw materials have since tumbled back to earth. The price of iron ore is down 36% from its March peak, while aluminium and copper have lost 19% and 20% respectively since 1 January. Wheat futures have returned to pre-invasion levels.

Despite this, the S&P GSCI index, which tracks the prices of 24 major raw materials, has still gained 12% since the start of the year because energy prices remain buoyant. The S&P GSCI Energy sub-index, which tracks global oil and gas prices, is up 23% since 1 January.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Supply squeeze could drive commodity prices down further

The prices of oil, metals and agricultural products could yet have further to fall, says Jeffrey Frankel for Project Syndicate. First, global growth – and thus demand for commodities – is being squeezed by China’s slowdown, US rate rises and Europe’s energy crunch. Second, real interest rates are on the rise. There is a “long-established” relationship between higher real rates and lower commodity prices, one reason being that higher rates cause “institutional investors to shift out of... commodities” and into alternatives, such as government bonds.

This summer’s commodity plunge has “reminded us that commodity investing is not for the faint-hearted”, says Tom Stevenson in The Daily Telegraph. Yet for all the current fears about recession, the “underlying driver” of commodity markets is physical supply and demand. Years of “underinvestment in the production of sufficient energy and other resources” mean that supplies of many raw materials are running short.

High energy costs are also squeezing the supply of some metals, says Étienne Goetz in Les Echos. European producers of zinc and aluminium have been forced to cut back production in response to record electricity prices. It takes nearly 15 megawatt hours (MWh) to produce a ton of aluminium, prompting some to joke that the metal is “nothing but solid electricity”.

China's reopening should bolster demand

Commodity prices may be close to a bottom, says Yuhao Fang for Capital Economics. A gradual reopening of China’s economy later this year, combined with a measure of fiscal stimulus, should bolster demand in the world’s most important commodity market. What’s more, “the supply shortages that pushed up prices earlier in the year have not gone away”.

Inventories are at “distressed levels and significantly below five-year averages” for most major commodities, agree James Luke, Malcolm Melville and Dravasp Jhabvala of Schroders. They note that “15% to 25% corrections” of the type experienced in recent months have occurred in previous commodity bull markets. In the long term, the green transition and other climate-change policies could mean we are heading for a “structural” bull market for metals, energy and agriculture, so it might be time to “buy the dip”.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alex is an investment writer who has been contributing to MoneyWeek since 2015. He has been the magazine’s markets editor since 2019.

Alex has a passion for demystifying the often arcane world of finance for a general readership. While financial media tends to focus compulsively on the latest trend, the best opportunities can lie forgotten elsewhere.

He is especially interested in European equities – where his fluent French helps him to cover the continent’s largest bourse – and emerging markets, where his experience living in Beijing, and conversational Chinese, prove useful.

Hailing from Leeds, he studied Philosophy, Politics and Economics at the University of Oxford. He also holds a Master of Public Health from the University of Manchester.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

What happened to Thames Water?

What happened to Thames Water?Thames Water, the UK’s biggest water company could go under due to mismanagement and debt. We look into how the company got itself into this position, and what investors should expect.

-

How investors can profit from high food prices

How investors can profit from high food pricesA growing global population makes soft commodities a structural growth market. Amid rising food prices, here’s how to protect your profits

-

One day left for households to claim the £200 Alternative Fuels Payment to help with heating bills

One day left for households to claim the £200 Alternative Fuels Payment to help with heating billsAdvice Households could be due a £200 payment if they heat their homes using alternative fuel sources and aren’t connected to the mains gas grid - but time is running out to claim the money. We explain what you need to know.

-

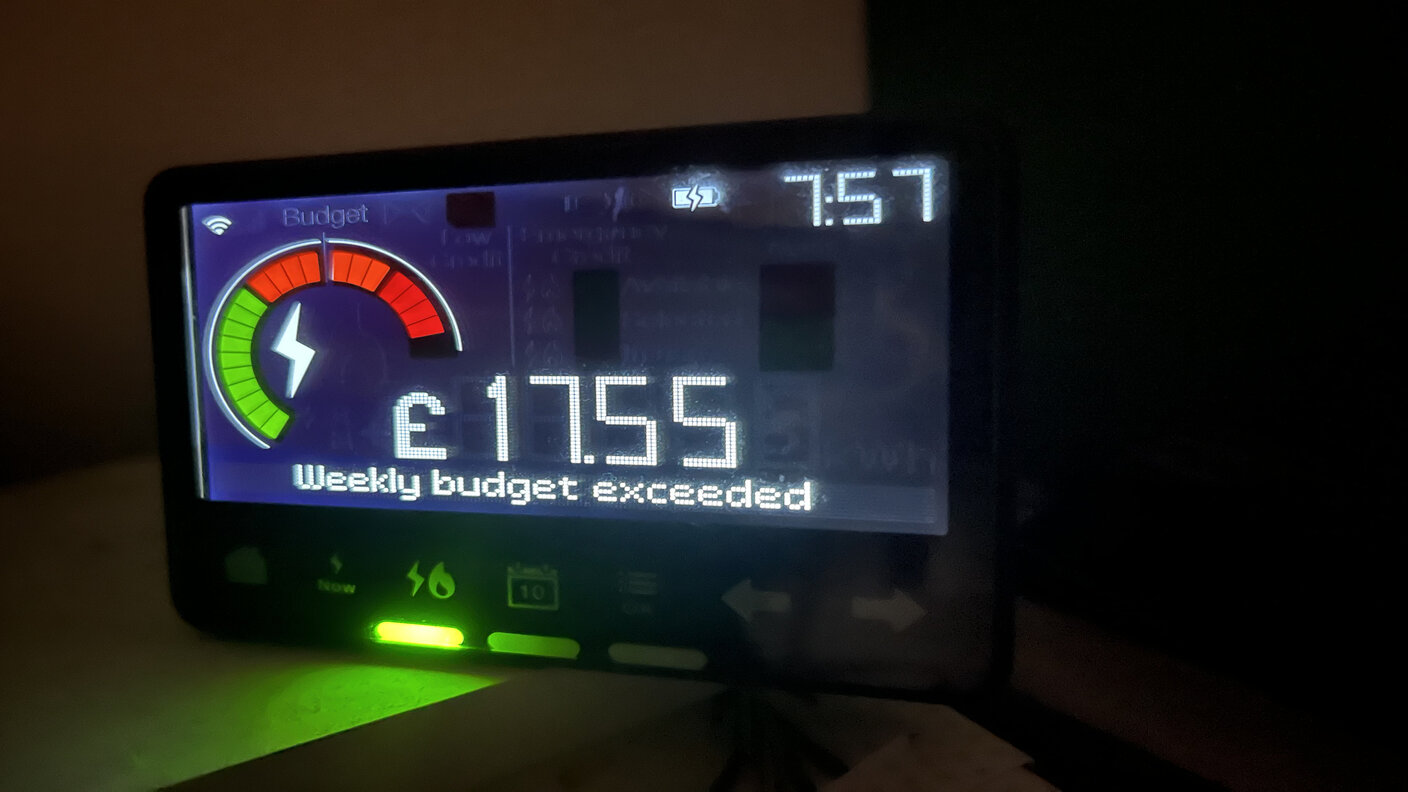

Energy bill to drop 17% this weekend as new price cap kicks in

Energy bill to drop 17% this weekend as new price cap kicks inNews Typical households on default energy tariffs will see their energy bills drop by £426 a year following today's energy price cap drop.

-

Don’t count resources out

Don’t count resources outAnalysis Commodities have performed poorly over the past year, but they tend to move in long and volatile cycles.

-

Energy bill refunds: Ovo and Good Energy to pay out £4m to customers who were overcharged

Energy bill refunds: Ovo and Good Energy to pay out £4m to customers who were overchargedNews Ofgem, the energy regulator, found the two suppliers had overcharged nearly 18,000 customers. Are you due a refund?

-

E.on Next, Good Energy and Octopus Energy pay £8m amid failures over late final bills

E.on Next, Good Energy and Octopus Energy pay £8m amid failures over late final billsNews Three energy firms have paid £8 million over compensation failures after lengthy delays in producing final bills to more than 100,000 customers when they switched suppliers

-

Heat pump rules are changing: how to reduce the cost of installation

Heat pump rules are changing: how to reduce the cost of installationTips The rules around installing a heat pump will change on 29 May, making it easier for some homeowners. We look at how much a heat pump costs, how the £7,500 government grant works, and other discounts available