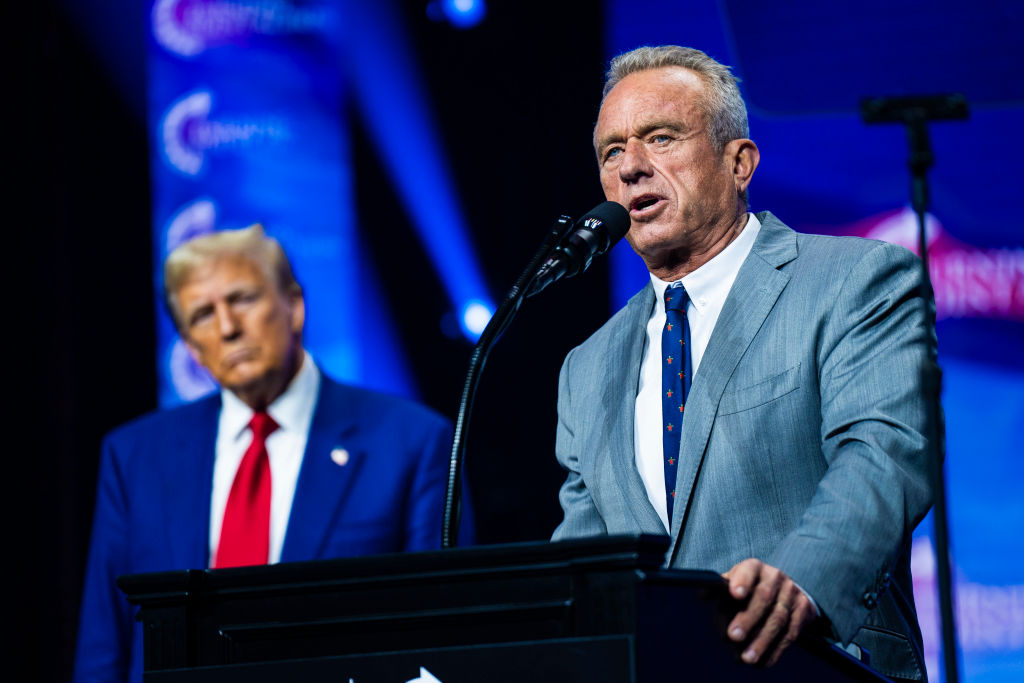

Vaccine stocks slump after RFK Jr picked as Trump's health secretary

Drugmakers' shares slumped after RFK Jr, a vaccine sceptic, was appointed as the next US Health Secretary. How will this affect drug companies?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Shares in big vaccine producers have slumped since Donald Trump asked Robert F. Kennedy (RFK) Jr. to lead the Department of Health and Human Services, says The New York Times. Kennedy, known for his “divisive” views on public health, including “scepticism” about vaccines (as well as pesticides and water fluoridation) is to lead “a huge department… whose regulations affect America’s food and medicine choices”.

How could RFK Jr impact the US healthcare industry?

Ironically, picking such a well-known vaccine sceptic may be a form of “political retribution” by Trump, who claims that the vaccine makers “sat on positive Covid jab test results until after he had lost the [2020] election”, says the Daily Telegraph. He furthermore accused the US Food and Drug Administration (FDA), which is also likely to be in Kennedy’s crosshairs, of not wanting to give him a “vaccine win prior to the election”.

Installing RFK Jr in an official administration role “may be difficult”, as his anti-vax views have been so extreme that they led to bans on YouTube and Instagram, says Robert Cyran on Breakingviews. That “might preclude confirmation even in a Republican-led Senate”.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

However, even if he only ends up serving as a senior advisor, it would still give him “plenty of scope to target the pharmaceutical and related industries”. While RFK has said in interviews that “he wouldn’t take away anyone’s vaccines”, he reportedly wants to remove product liability protection from vaccines, a step that might have a “similarly harmful effect”.

Whatever role Kennedy eventually plays, even his presence within the administration could “erode public trust” in vaccines, “put up roadblocks to the approval of new vaccines and prevent the CDC from recommending any vaccines that make it through the approval process”, says Morningstar’s Karen Andersen. This, in turn, could mean that certain US states could “waver” in support of broad mandates for childhood vaccines. Still, any reduction in projected US vaccine sales would not be “long-lasting”, and so this should not provide “a significant hit” to drug companies’ valuations.

The industry hopes that RFK’s influence may be cancelled out by other “smart people” advising Trump, say Ian Johnston and Oliver Barnes in the Financial Times. They could restrain RFK, while there may be increased benefits from the stockpiling of certain vaccines for defence purposes.

Vivek Ramaswamy, appointed alongside Elon Musk to oversee a state efficiency drive, has also been a big fan of reducing red tape in the drug approval process, accusing the FDA of erecting “unnecessary barriers to innovation”.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

Dario Amodei: The AI boss in a showdown with Trump

Dario Amodei: The AI boss in a showdown with TrumpAnthropic’s CEO Dario Amodei was on an extraordinary upward trajectory when he found himself on the wrong side of the American president. He is about to be severely tested.

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward

-

In defence of GDP, the much-maligned measure of growth

In defence of GDP, the much-maligned measure of growthGDP doesn’t measure what we should care about, say critics. Is that true?

-

A niche way to diversify your exposure to the AI boom

A niche way to diversify your exposure to the AI boomThe AI boom is still dominating markets, but specialist strategies can help diversify your risks

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.