Boom times for the collectable watch market

Vintage and collectable watches are setting records at auction. Chris Carter reports.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

For all the troubles in financial markets, vintage watches continued to tick along nicely in June.

A rare Rolex wristwatch given to Royal Navy divers in the 1970s sold well above its high £120,000 pre-sale estimate with Bonhams in London to fetch £195,600, including buyer’s premium. The government-issued Rolex 5513/5517 Military Submariner, known as a MilSub, is a more rugged version of its civilian equivalent. Around 1,200 of the watches are thought to have been handed out during the decade, and many were damaged through years of use.

The example that sold is missing its bezel after the seller, the watch’s second owner, recalled it dropping off during a dive in the 1990s. But watches, being personal items, are somewhat special among collectables in that a bit of wear and tear usually adds to a watch’s appeal. Every watch has a story to tell – along with the time.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A giant leap for a wristwatch

Another wristwatch, a gold Omega Speedmaster No. 19 (pictured), that had been presented to astronaut Michael Collins in around 1969, also “soared light-years beyond pre-auction”, according to Texas-based Heritage Auctions. Collins was one of the three crew members on the inaugural moon landing that year, along with Neil Armstrong and Buzz Aldrin. Each of the astronauts, along with president Richard Nixon and his deputy Spiro Agnew, received one of the 28 timepieces made. It sold for $765,000, while the 210 lots in the sale brought in almost $3.4m combined.

Over in New York, auction house Phillips, in association with Bacs & Russo, “can’t stop setting watch auction records”, notes Carol Besler in the Robb Report. It brought in $30.3m in total at its latest watch sale, the second highest-ever amount for a US watch auction. It also concluded a highly successful “white glove” spring season (meaning every lot found a buyer) for Phillips’ watch department, which made $127.2m overall.

In the latest sale, five watches sold for over $1m, including the first platinum George Daniels Anniversary watch, with serial number 00. It sold for $2.4m – again, well above its $1m estimate, to set a record for a British wristwatch. Some of the proceeds went to good causes.

The collectable watch market is hitting new heights

Staying in New York, rival auction house Christie’s broke its own watch sales record, with its two-day event bringing in $21.8m in total. Almost 60% of lots sold above their high pre-sale estimates. The highlight of the sale series was “The Kairos Collection” of 128 “extraordinary” modern Patek Philippe timepieces, which together sold for a combined $21.9m in Geneva, Hong Kong and New York.

The stand-out item in the New York sale was a Patek Philippe Ref. 5531R-012, an “exceptional” 18-carat rose gold Grande Complication. It fetched a little over $2.2m.

Watches go digital with NFTs

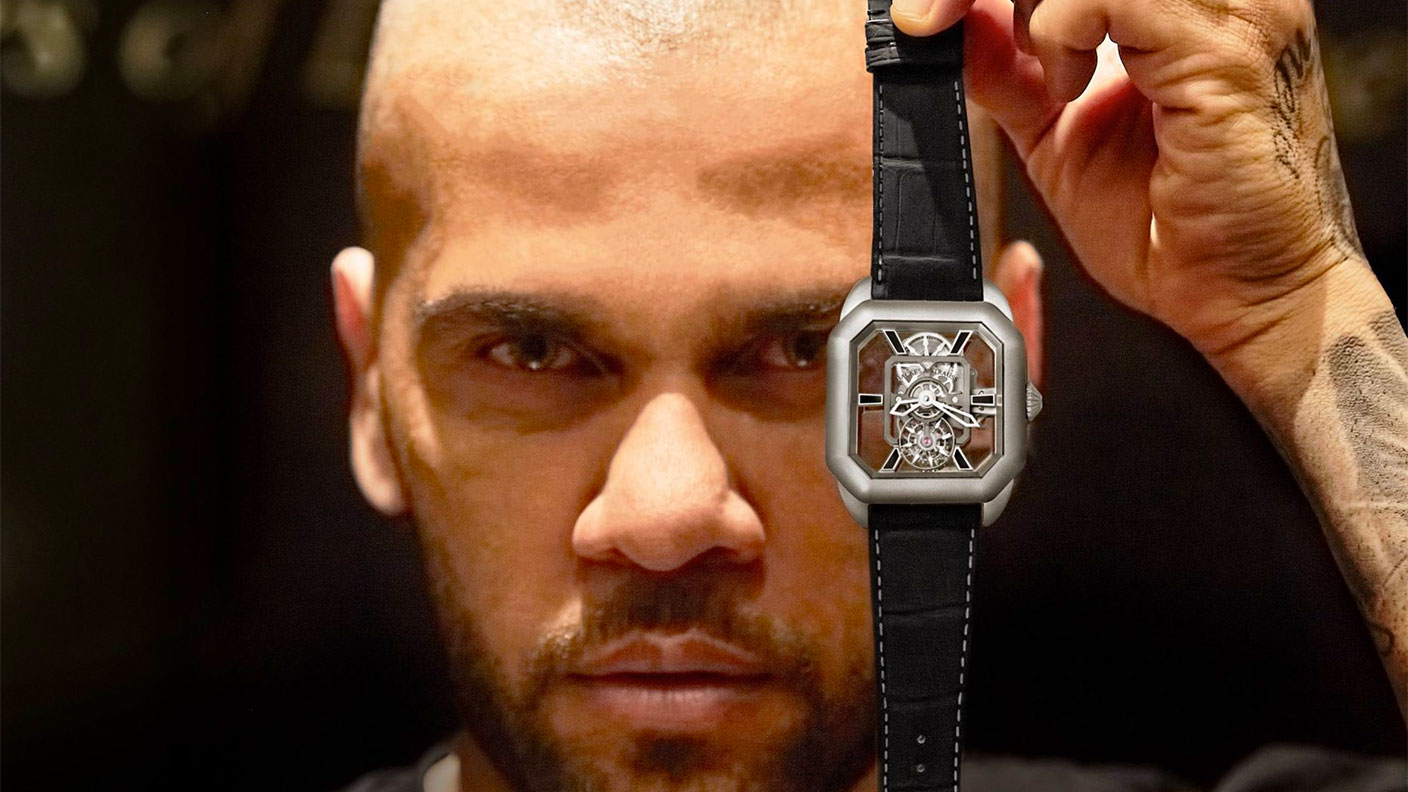

Watchmakers in search of new markets are embracing unique digital artworks, known as non-fungible tokens (NFT). In May, luxury British brand Backes & Strauss announced its collaboration with Brazil and FC Barcelona footballer Dani Alves (pictured) and specialist consultancy ColossalBit to produce a series of NFTs related to the 43 physical timepieces of the “Alves Trophy Collection”, celebrating the 43 trophies won by Alves in his two-decade-long career, says Jessica Bumpus in The New York Times.

In a similar vein, in April, Nima Behnoud, a former creative director of retailers Jacob & Co and Tourneau, launched a collection of 1,810 digital watch NFTs. Called Nimany Club, the collection is organised into various levels, along the lines of a video game, with the rarest priced at 0.1 ether (the cryptocurrency used on the digital ledger Ethereum), worth around $181, says Bumpus. These could be traded for Nimany-brand watches via a lottery draw.

Meanwhile, Swiss watchmaker Tag Heuer will give wearers of its Connected Calibre E4 smartwatch the ability to view their NFT artworks on the go, notes Laure Guilbault for Vogue Business. Users just need to connect their “smart wallet” (which holds their NFTs) to their smartwatch via an update from Apple’s App Store and Google’s Play Store.

“We think that the wrist is a great place to display your NFT – to have it close to you but also as a way of authentication between members of the community, like a badge of honour,” Tag Heuer’s CEO Frédéric Arnault tells Vogue Business. The LVMH-owned brand began accepting cryptocurrency payments in the US from May.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Where to look for Christmas gifts for collectors

Where to look for Christmas gifts for collectors“Buy now” marketplaces are rich hunting grounds when it comes to buying Christmas gifts for collectors, says Chris Carter

-

How dinosaur fossils became collectables for the mega-rich

How dinosaur fossils became collectables for the mega-richDinosaur fossils are prized like blue-chip artworks and are even accelerating past the prices of many Old Masters paintings, says Chris Carter

-

Sotheby’s fishes for art collectors – will it succeed?

Sotheby’s fishes for art collectors – will it succeed?Sotheby’s is seeking to restore confidence in the market after landing Leonard Lauder's art collection, including Gustav Klimt's Portrait of Elisabeth Lederer

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.