How to find an angel investor for your business

Make sure your start-up business has the right type of backer before signing a deal, says David Prosser.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

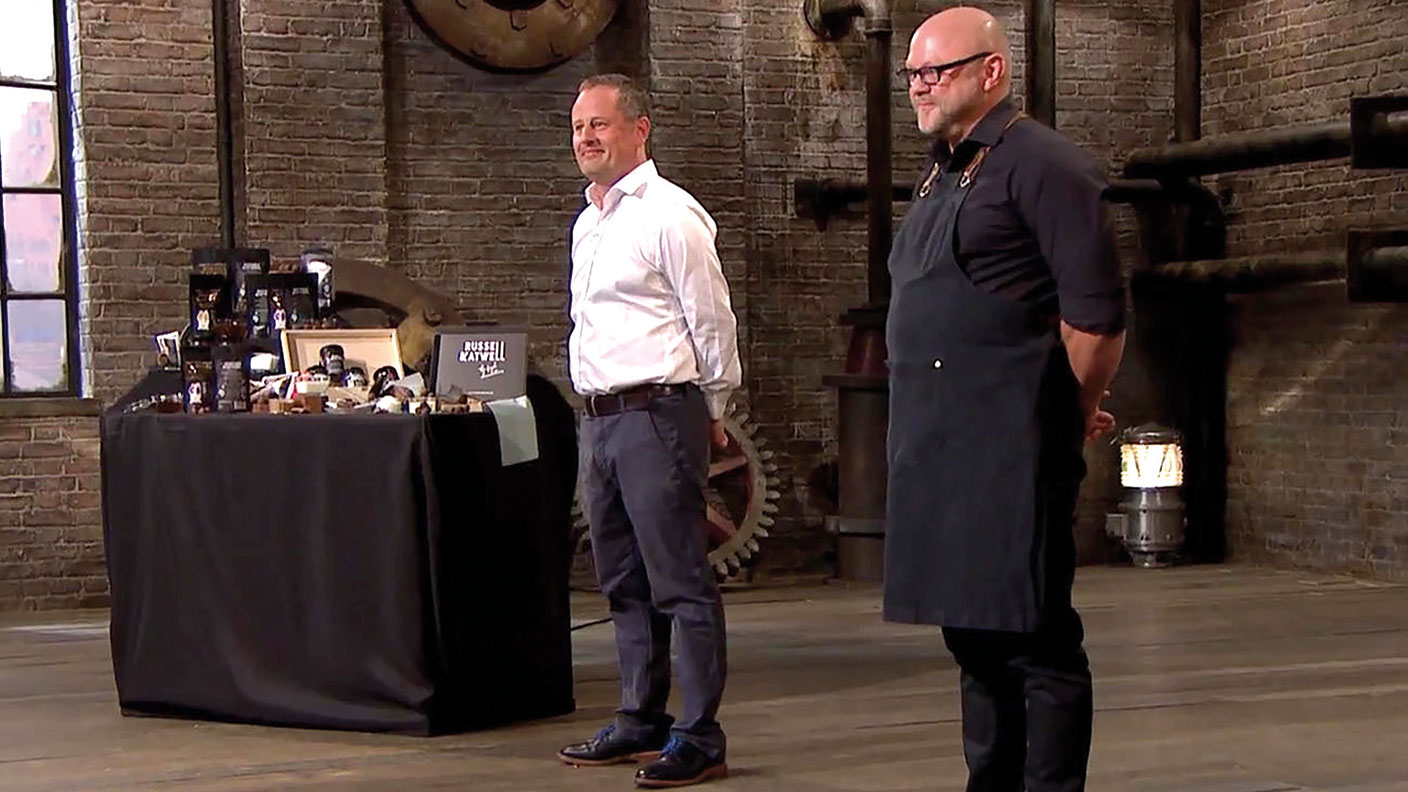

Business angels are spreading their wings. The Angel Investment Network says last year saw a record number of people registering as angels – investors who are prepared to back start-up businesses with funding and their expertise – and the number of connections between angels and entrepreneurs rose 16%. That is good news for business owners looking for support for their fledgling enterprises.

Business angels come from a variety of backgrounds and may operate individually or as part of a syndicate, investing their own money in start-up ventures. They are typically prepared to back companies at an earlier stage than investors such as venture capital and private equity firms. And they often offer valuable insight, as well as cash, helping inexperienced entrepreneurs to navigate the path to growth.

Seeking support

If you’re looking for angels, there are several good places to start the search. The UK Business Angels Association effectively operates as the UK’s trade association, with 650 members who invested £2.3bn last year. The UK is also home to several prominent networks of business angels, who share opportunities and pool information: the most active of these in 2021 included Envestors, Minerva Business Angel Network and Cambridge Angels, says start-up platform Beauhurst. And entrepreneurs should not feel bound by geographical borders; the Angel Investment Network and Angel Capital Association, both US-based, have many members who invest on a global basis.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

With so many potential sources of angel capital, it makes sense to be discerning. Business angels will naturally want to conduct extensive due diligence before parting with their money, but this should be a two-way process. Entrepreneurs should be interviewing potential investors just as they are being interviewed themselves.

Founders will want to know that angels have the financial capacity to make the investment, but other qualities may also be paramount. Does a prospective investor have expertise in the area in which you operate? How much experience do they have of the investment process? Will they be able to provide ongoing advice to your business, acting as a mentor to the management team?

Hands-on or silent partner?

One particularly crucial question is how hands-on a business angel wants to be. In some cases, angels are looking to operate as more or less silent partners, leaving the entrepreneur to run the business on a day-to-day basis. Others are looking for much more involvement; they won’t want to take on an operational role, but they will expect to be consulted regularly and to be involved with key strategic decisions.

There isn’t a right approach, but entrepreneurs need to be clear about what they want. If you’re looking for active and regular support, a silent partner may not provide it; if funding alone is the priority, having a more involved business angel may cause tensions.

Given these nuances, it is important that entrepreneurs and potential angel investors take some time to build a relationship before sealing the deal – anywhere between three and six months is pretty typical. The conversation doesn’t have to be exclusive; there is nothing to stop founders exploring investment from several angels before making a final decision.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David Prosser is a regular MoneyWeek columnist, writing on small business and entrepreneurship, as well as pensions and other forms of tax-efficient savings and investments. David has been a financial journalist for almost 30 years, specialising initially in personal finance, and then in broader business coverage. He has worked for national newspaper groups including The Financial Times, The Guardian and Observer, Express Newspapers and, most recently, The Independent, where he served for more than three years as business editor.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

New Federal Reserve chair Kevin Warsh has his work cut out

New Federal Reserve chair Kevin Warsh has his work cut outOpinion Kevin Warsh must make it clear that he, not Trump, is in charge at the Fed. If he doesn't, the US dollar and Treasury bills sell-off will start all over again

-

How Canada's Mark Carney is taking on Donald Trump

How Canada's Mark Carney is taking on Donald TrumpCanada has been in Donald Trump’s crosshairs ever since he took power and, under PM Mark Carney, is seeking strategies to cope and thrive. How’s he doing?

-

Rachel Reeves is rediscovering the Laffer curve

Rachel Reeves is rediscovering the Laffer curveOpinion If you keep raising taxes, at some point, you start to bring in less revenue. Rachel Reeves has shown the way, says Matthew Lynn

-

The enshittification of the internet and what it means for us

The enshittification of the internet and what it means for usWhy do transformative digital technologies start out as useful tools but then gradually get worse and worse? There is a reason for it – but is there a way out?