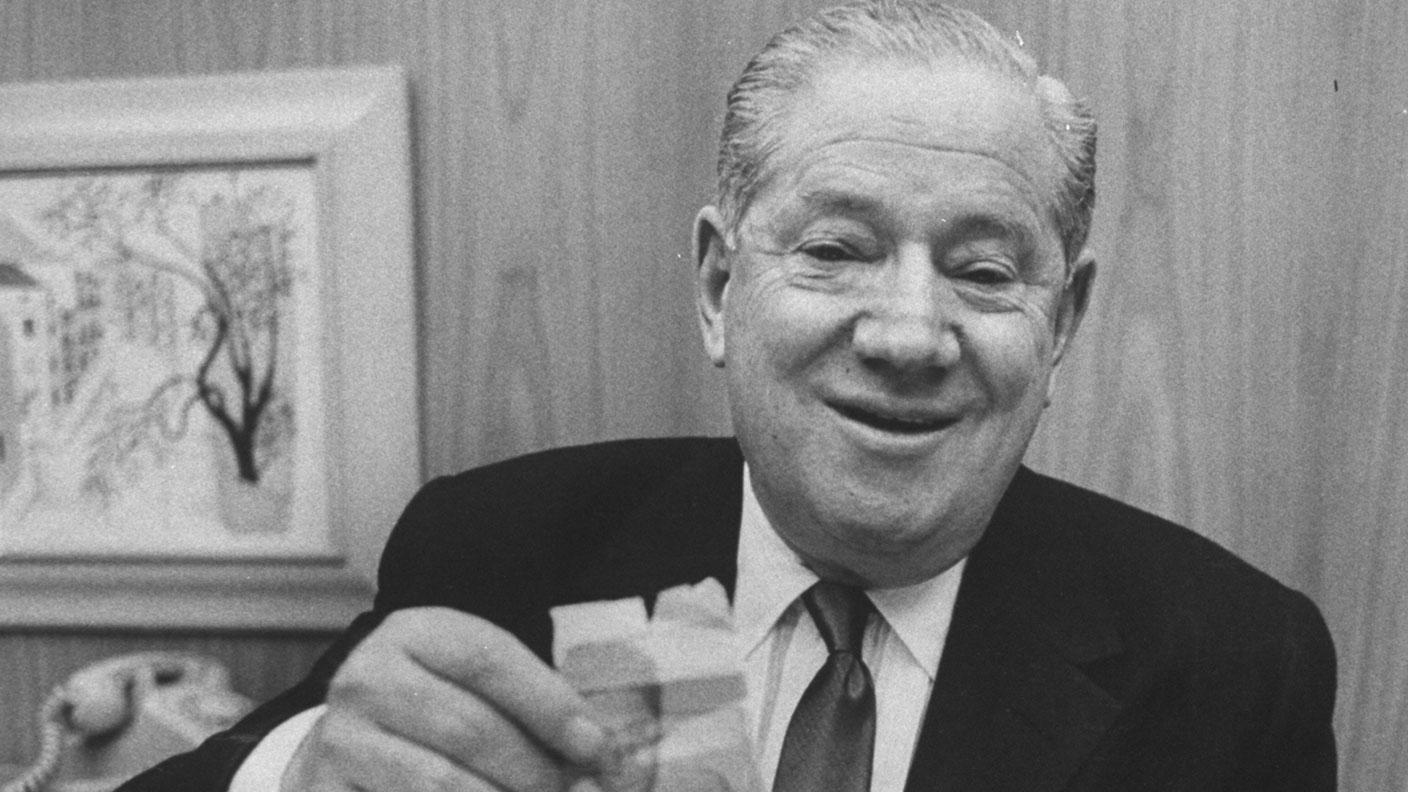

Great frauds in history... John Factor’s penny-stock scams

John Factor sold worthless penny stocks through a boiler room operation, ramping the price via his financial newsletters. But he was never held to account.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

John Factor (born Iakov Faktorowicz) claimed to have been born in Hull in 1892 (although his family stated that he was born in Lodz in Poland four years earlier). In 1904, he emigrated to the United States with his family, and grew up in St Louis and then New York. Initially Factor worked as a barber before becoming involved with organised crime, meeting the mobster Arnold Rothstein. Although indicted multiple times for stock and land fraud for various schemes in the United States, he was never charged. By 1923 was living in a 14-room flat.

How did the scam work?

In 1924 Factor moved back to England and began selling worthless penny stocks, through a boiler room operation known as Westminster Finance Company. One of these stocks, the British Associated Oil Company, offered guaranteed dividends of 7% and 12% for an initial investment of as little as £2. After paying a few of the dividends in order to attract more investors, Factor fled to France with an estimated £500,000 (£28.7m in today’s money), correctly predicting that his victims would be too embarrassed to press charges.

What happened next?

Factor returned to England in 1926. Using Alexander Clarence Bowles, a down-on-his-luck former army captain as a front, Factor set up a racket that included financial newsletters, as well as a brokerage called Tyler Wilson. He used one newsletter, the Financial Recorder, to sell shares in a worthless unlisted company, Hecla Consolidated Goldmines. He later embarked on another fraud through a second paper, Finance, in which he tipped a listed stock and spent money to push up its share price. He then used the goodwill to sell two more worthless stocks, Vulcan Copper Mines and Rhodesia Border Mining. Factor pocketed an estimated £1.6m (£95.5m today) before he fled to the United States in 1930.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Lessons for investors

Factor was convicted of fraud in his absence, but managed to delay extradition long enough (including by arranging his own kidnapping) that the authorities were forced to let him go. He later served time for unrelated crimes, was involved with Mob-related activities for several decades and was given a presidential pardon by John F Kennedy in 1962 after donating to his campaign. However, Factor’s half brother, Max, did far better, selling his eponymous cosmetics firm in 1973 for $500m ($3bn today), showing that long-term investment can beat short-term speculation.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Review: Pierre & Vacances – affordable luxury in iconic Flaine

Review: Pierre & Vacances – affordable luxury in iconic FlaineSnow-sure and steeped in rich architectural heritage, Flaine is a unique ski resort which offers something for all of the family.

-

Could you get cheaper loans under ‘significant’ FCA credit proposals?

Could you get cheaper loans under ‘significant’ FCA credit proposals?The Financial Conduct Authority has launched a consultation which could lead to better access to credit for consumers and increase competition across the market, according to experts.

-

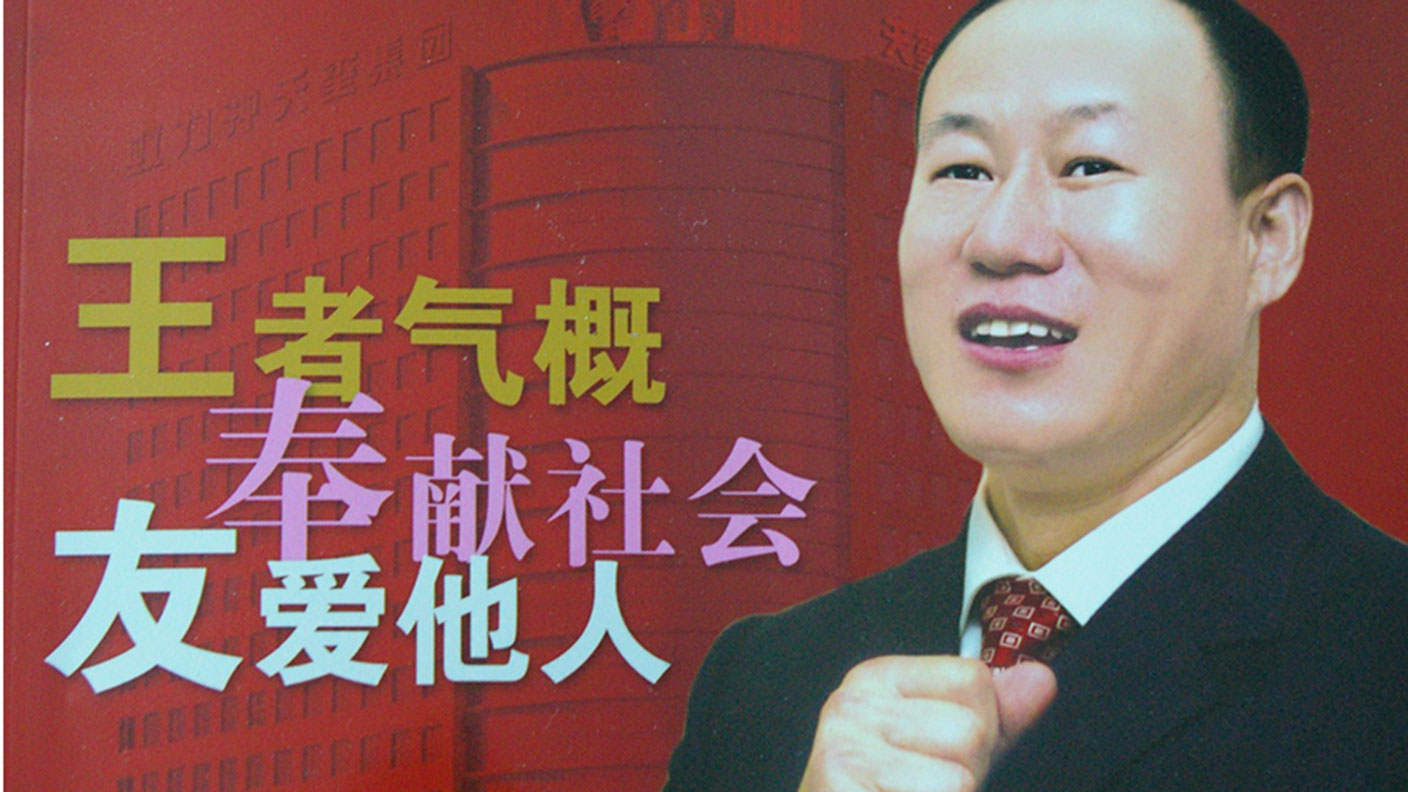

Great frauds in history: Wang Fengyou’s ant-breeding scam

Great frauds in history: Wang Fengyou’s ant-breeding scamProfiles “Model entrepreneur” Wang Fengyou's ant-farming Ponzi scheme pulled in $1.2bn, with investors losing all.

-

Great frauds in history: Jeff Carpoff’s green Ponzi scheme

Great frauds in history: Jeff Carpoff’s green Ponzi schemeProfiles Jeff Carpoff's plan to make money from renting out solar-powered generators quickly turned into a Ponzi scheme.

-

Great frauds in history: Helmut Kiener, Germany’s mini-Madoff

Great frauds in history: Helmut Kiener, Germany’s mini-MadoffProfiles The performance of Helmut Kiener’s fund of funds, which invested money from institutions and private investors into hedge funds, seemed too good to be true. It was.

-

Great frauds in history: Manfred Schmider, the Sheikh of Karlsruhe

Great frauds in history: Manfred Schmider, the Sheikh of KarlsruheProfiles Manfred Schmider massaged the sales figures at FlowTex, his utility technology company, and used investors’ money to buy villas around the world, a fleet of luxury cars, and even a helicopter.

-

Great frauds in history: how Elizabeth Bigley, AKA “Madame DeVere”, spirited away cash

Great frauds in history: how Elizabeth Bigley, AKA “Madame DeVere”, spirited away cashProfiles Serial fraudster Elizabeth Bigley AKA, the “psychic” Madame Lydia DeVere, conned people into believing she was the long lost daughter of fabulously wealthy industrialist Andrew Carnegie.

-

Great Frauds in History: Robert Schuyler’s illicit share issue

Profiles Robert Schuyler was known as “America’s first railroad king” issued millions of dollars' worth of fraudulent shares in his company, and kept the money, fleeing to France when his scam was exposed.

-

Great Frauds in History: Michael Meehan’s market manipulation

Great Frauds in History: Michael Meehan’s market manipulationProfiles Stockbroker Michael Meehan manipulated the markets, driving stock prices up and making a mint.

-

Great frauds in history: Meyer Blinder's Blind ’em & Rob ’em

Great frauds in history: Meyer Blinder's Blind ’em & Rob ’emProfiles Meyer Blinder’s brokerage firm cold-called unsuspecting punters and pumped shares in fraudulent shell companies while stiffing them with huge commissions.