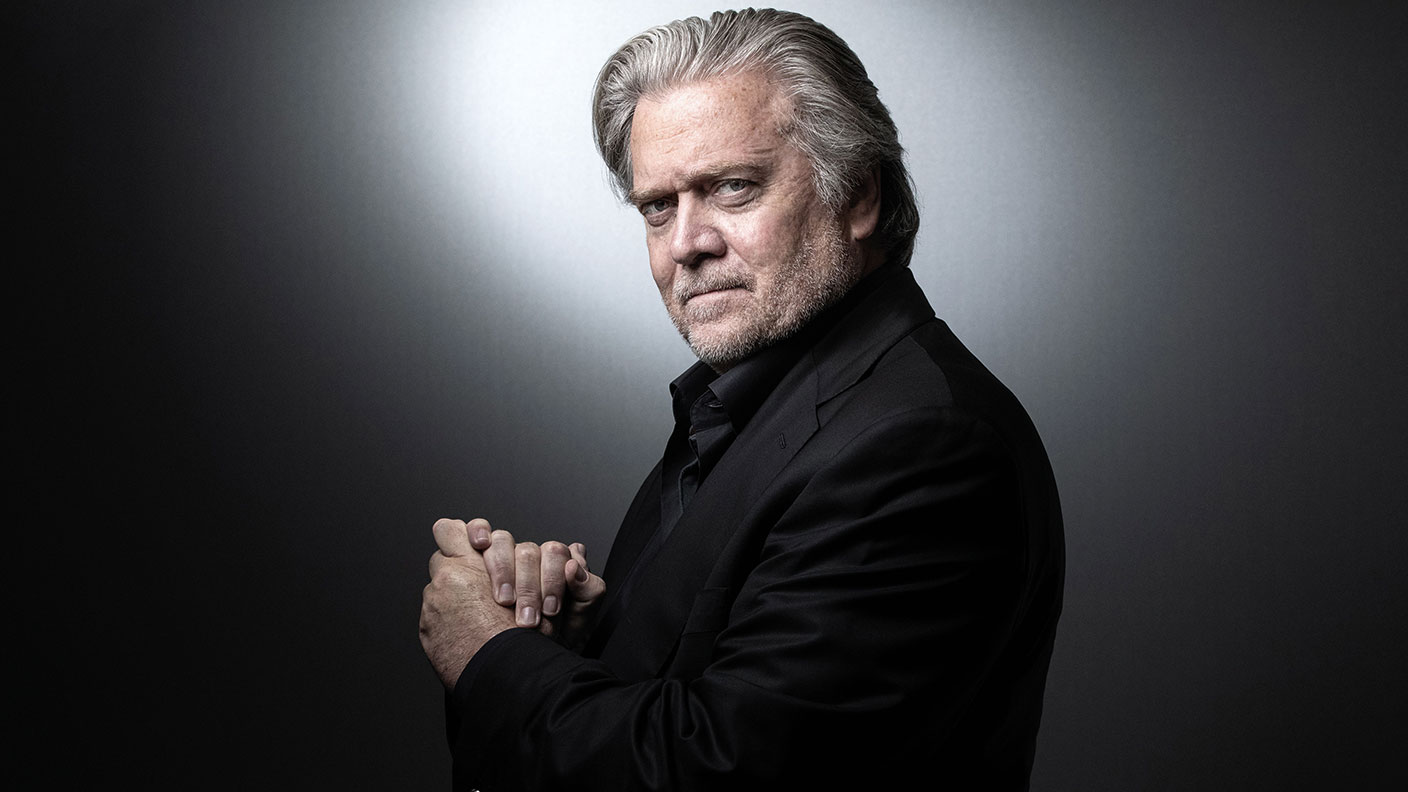

The downfall of Steve Bannon, Donald Trump’s philosopher king

Steve Bannon, the American president’s combustible former chief strategist, has gone down in flames, accused of milking a political fund for personal gain. It’s not the end we’d have expected, says Jane Lewis.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

News that Donald Trump’s former chief strategist, Steve Bannon, has been arrested and charged with fraud is bound to have ruffled a few feathers. Bannon may be yesterday’s man in US politics, but he still sits at the centre of a global “spider’s web of rightwing activists and politicians”, says Tortoise Media. Along with three others, Bannon is accused of milking the $25m “We Build the Wall” fund, says The New Yorker – allegedly “siphoning” off more than $1m from donations made by hundreds of thousands of Americans, and “hiding payments through a shell company”. Bannon denies the charges.

A taste for the high life

For years, Bannon – a former naval officer, Goldman Sachs banker and documentary-maker – has been promoting himself as a “thought leader… deeply interested in history, philosophy and economic supply chains”. Yet if these charges are true, the “would-be philosopher king” would stand revealed as “just another grifter looking to exploit Trump’s supporters” for his own gain.

Bannon, 66, used to boast that he had no worries on that score. “I’ve made enough money,” he told The Times two years ago. “I’ve got not just f*** you money, I’ve got f*** everybody money… I could live any lifestyle I wanted.” And for a “self-proclaimed man of the people”, he clearly likes the good things in life – living “in a state of perpetual motion” prior to his arrest, “flying private” when possible and staying in luxury hotels around the world. When arraigned last week, Bannon looked “as though he had just come off a long Grateful Dead tour”. He’d actually been “summering” off the coast of Connecticut on a $28m yacht belonging to exiled Chinese billionaire Guo Wengui.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Bannon’s life has been “a succession of Gatsbyish reinventions”, says Bloomberg. Born in Richmond, Virginia, into a working-class family, he joined the US Navy after graduation and dates his political awakening to the 1979 Iranian hostage crisis, where, from a vantage point in the north Arabian Sea, he saw “how badly Jimmy Carter f***ed things up”.

Transferring to the Pentagon, Bannon took a masters in national security at Georgetown, before being lured by “the siren of Reagan-era Wall Street”. He specialised in media and entertainment mergers and acquisitions at Goldman Sachs, before moving to Los Angeles to become a Hollywood wheeler-dealer.

Bannon’s move into libertarian politics gained him a sinister reputation he enjoyed playing up: “Darkness is good”, he liked to say. It also coincided with an emerging talent for tapping the really big money, says Forbes. Both Breitbart, an alt-right opinion site he founded, and later the Trump campaign were bankrolled by the billionaire Mercer hedge-fund dynasty. He was, however, always a divisive figure in Trump’s court and, when the president “cast his former Svengali aside” in 2018, the Mercers followed suit, says The Times. Since then, Bannon has “travelled the world” on “a quest for relevance and funding”.

There was always a chance that “a character as combustible as Bannon” would “end up in jeopardy”, says The Times. But it was easier to imagine him “going out in a blaze of glory” making “grand declarations about revolution”. In this instance, Trump is probably right: Bannon’s downfall is a “sad event”.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jane writes profiles for MoneyWeek and is city editor of The Week. A former British Society of Magazine Editors (BSME) editor of the year, she cut her teeth in journalism editing The Daily Telegraph’s Letters page and writing gossip for the London Evening Standard – while contributing to a kaleidoscopic range of business magazines including Personnel Today, Edge, Microscope, Computing, PC Business World, and Business & Finance.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

VICE bankruptcy: how did it happen?

VICE bankruptcy: how did it happen?Was the VICE bankruptcy inevitable? We look into how the once multibillion-dollar came crashing down.

-

What is Warren Buffett’s net worth?

What is Warren Buffett’s net worth?Warren Buffett, sometimes referred to as the “Oracle of Omaha”, is considered one of the most successful investors of all time. How did he make his billions?

-

Kwasi Kwarteng: the leading light of the Tory right

Kwasi Kwarteng: the leading light of the Tory rightProfiles Kwasi Kwarteng, who studied 17th-century currency policy for his doctoral thesis, has always had a keen interest in economic crises. Now he is in one of his own making

-

Yvon Chouinard: The billionaire “dirtbag” who's giving it all away

Yvon Chouinard: The billionaire “dirtbag” who's giving it all awayProfiles Outdoor-equipment retailer Yvon Chouinard is the latest in a line of rich benefactors to shun personal aggrandisement in favour of worthy causes.

-

Johann Rupert: the Warren Buffett of luxury goods

Johann Rupert: the Warren Buffett of luxury goodsProfiles Johann Rupert, the presiding boss of Swiss luxury group Richemont, has seen off a challenge to his authority by a hedge fund. But his trials are not over yet.

-

Profile: the fall of Alvin Chau, Macau’s junket king

Profile: the fall of Alvin Chau, Macau’s junket kingProfiles Alvin Chau made a fortune catering for Chinese gamblers as the authorities turned a blind eye. Now he’s on trial for illegal cross-border gambling, fraud and money laundering.

-

Ryan Cohen: the “meme king” who sparked a frenzy

Ryan Cohen: the “meme king” who sparked a frenzyProfiles Ryan Cohen was credited with saving a clapped-out videogames retailer with little more than a knack for whipping up a social-media storm. But his latest intervention has backfired.

-

The rise of Gautam Adani, Asia’s richest man

The rise of Gautam Adani, Asia’s richest manProfiles India’s Gautam Adani started working life as an exporter and hit the big time when he moved into infrastructure. Political connections have been useful – but are a double-edged sword.