The charts that matter: the dollar bounces, bitcoin soars, Tesla roars

As bitcoin and Tesla go stratospheric and the US dollar rebounds, John Stepek looks at the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In our first issue of MoneyWeek magazine for the New Year, we turn to a subject that has been strangely absent from the headlines given what a big story it was for so long – Brexit, and the deal struck between Britain and the EU just before Christmas. Is it any good? Does it draw a line under the Brexit discussion? Where do we go from here? It’s all in the latest issue – get your first six mags free when you subscribe.

In this week’s podcast, Merryn and I marvelled at bitcoin, railed at Tesla, and wondered at just how much more manic things can get before a crash – surely – arrives to deliver a reality check to markets (in the US at least). We also decided that a one-off debt write-off would probably be the best way out of our economic mess, even although it comes fraught with difficulty. Have a listen here.

I also appeared on The Week podcast this week. I decided to scare everyone by talking about Bank of England money printing and hyperinflation. We also discussed Jack Ma’s mysterious disappearance – have a listen here.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

On the podcasts by the way – if you have the time, inclination and the option to do so, please leave us a review (preferably a five-star one) on whatever podcast platform you use. It shows us you want us to keep doing them and it shows the platform that people want to hear them.

Our latest “Too Embarrassed To Ask” video explains what investment trusts are. They’re our favourite type of fund so they’re worth understanding if you don’t already. You can watch the video here.

Here are the links for this week’s editions of Money Morning and other web stories you may have missed.

- Monday: What does the Brexit deal mean for your money?

- Tuesday: Here’s why you should pay attention to the Chinese yuan

- News story: When lockdown ends, be prepared for an inflationary surprise

- Wednesday: Frisby’s forecasts – what does 2021 have in store for investors?

- Thursday: Here’s why markets have shrugged off the US political turmoil

- Friday: How rising oil prices could prick the US stockmarket bubble

Now for the charts of the week.

The charts that matter

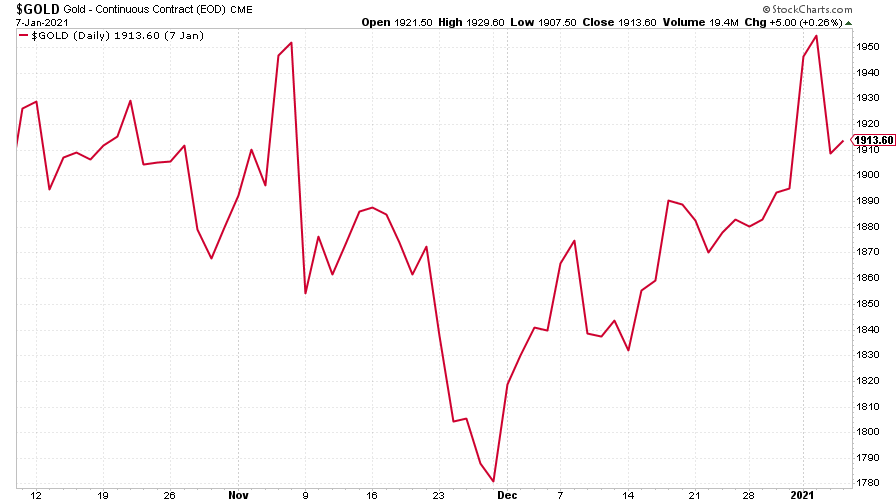

Gold had a bit of a spike over the week as the results of the election in Georgia revealed that the Democrats will have control of the US government. That means there should probably be more government spending than there otherwise would have been. However, on Friday (which isn’t shown on the chart below), the bottom fell out somewhat as the US dollar had a rebound. Whether that rebound can last – we’ll see.

(Gold: three months)

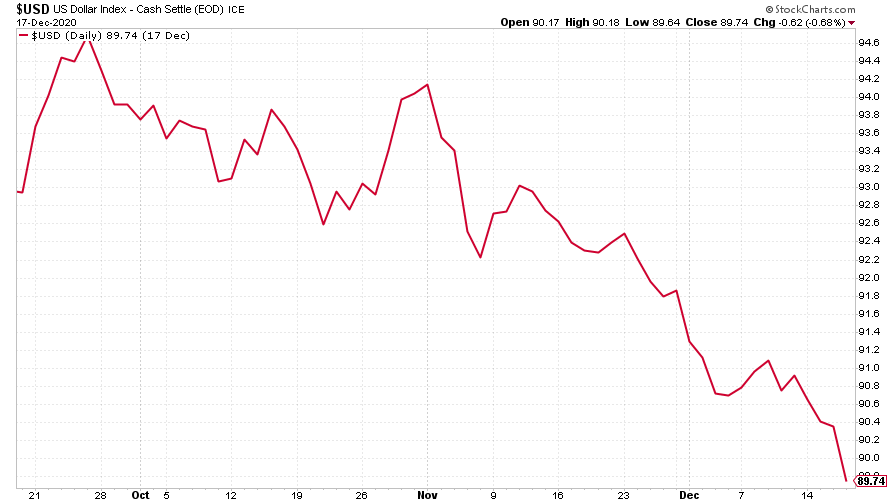

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) remained weak but is starting to rebound. Given how certain everyone is that the dollar will fall this year, this is exactly the sort of “surprise” to keep an eye on. There are lots of good reasons for the dollar to fall – but there are some reasons why it might not.

The Chinese authorities won’t necessarily want to see the yuan strengthen much more against the dollar. Same goes for the European Central Bank and the euro. And then you have the fact that US Treasury yields have bounced strongly, which all else being equal, should attract capital into the US. And with the election chaos near an end (despite the scenes in the US this week) then maybe a weak dollar is less of a sure thing than everyone expects.

Let’s keep a close eye on it. I’m not convinced the rally will last but it could definitely upset the apple cart if it does.

(DXY: three months)

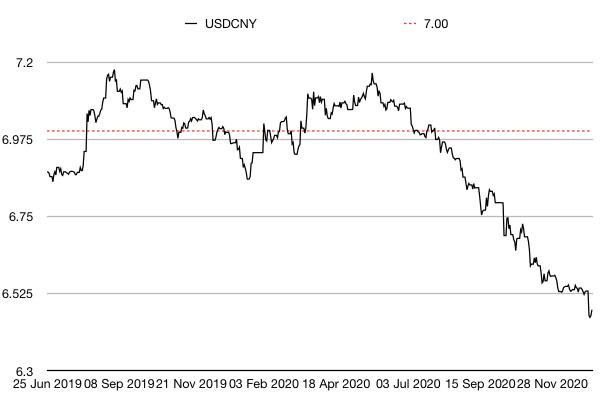

The Chinese yuan (or renminbi) carried on rising against the US currency (when the black line below rises, it means the yuan is getting weaker vs the dollar). Will that continue this year? I discussed the topic in a Money Morning earlier this week.

(Chinese yuan to the US dollar: since 25 Jun 2019)

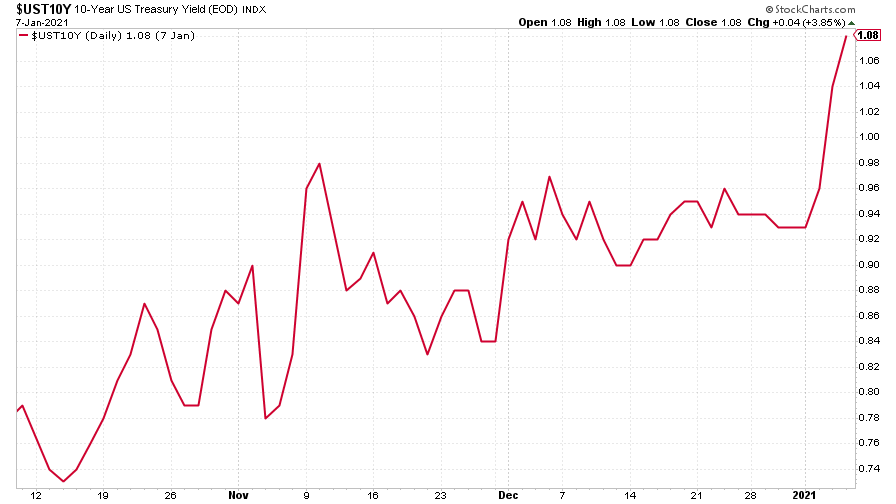

The yield on the ten-year US government bond has surged higher (in relative terms) since the start of the year. This is a sign that investors are starting to believe in the “reflation” trade. However, you’re also going to get to a point before too long where the Federal Reserve gets twitchy about this increase in interest rates. What’ll happen when that particular push comes to shove? The Fed might have to print more money – or find an excuse to do so – in order to suppress rates.

(Ten-year US Treasury yield: three months)

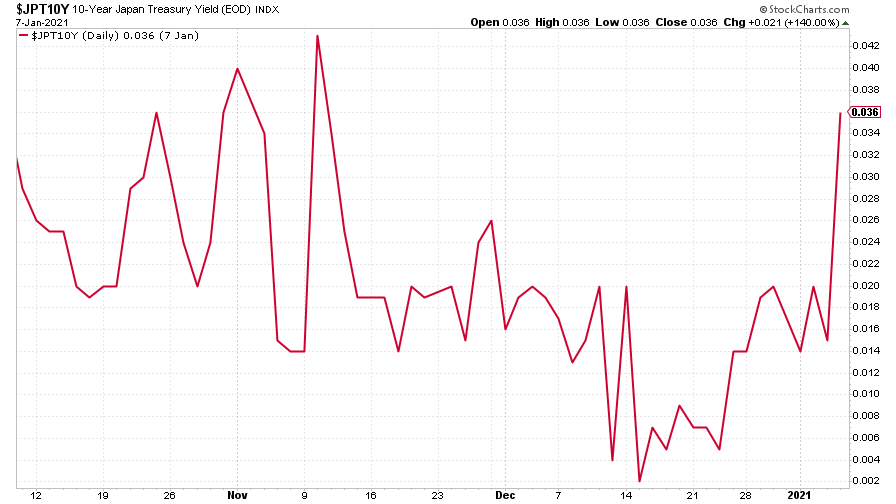

What’s also interesting is that the yield on the Japanese ten-year actually bumped higher in line with the US ten-year. Nothing to write home about yet, but remember that the Japanese central bank pretty much maintains this as a ‘dead’ market with the yield pinned to 0%. It’ll be interesting to see what happens if the market starts to test the bank’s resolve on that front.

(Ten-year Japanese government bond yield: three months)

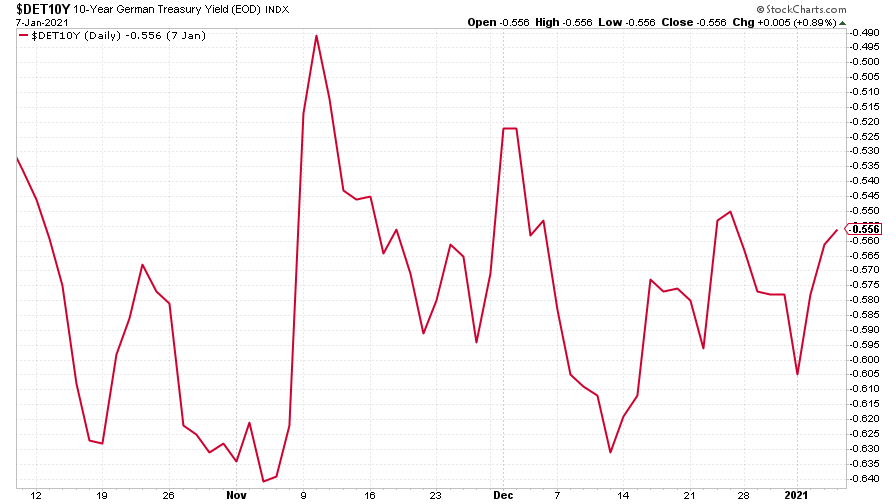

Notably, the yield on the ten-year German Bund didn’t shift as much. Optimism over reflation is far more muted in the eurozone, and that’s purely down to competition between central banks. The European Central Bank simply doesn’t have the leeway of others around the world, and that gives the eurozone a “hard” currency tendency – at least for the time being.

(Ten-year Bund yield: three months)

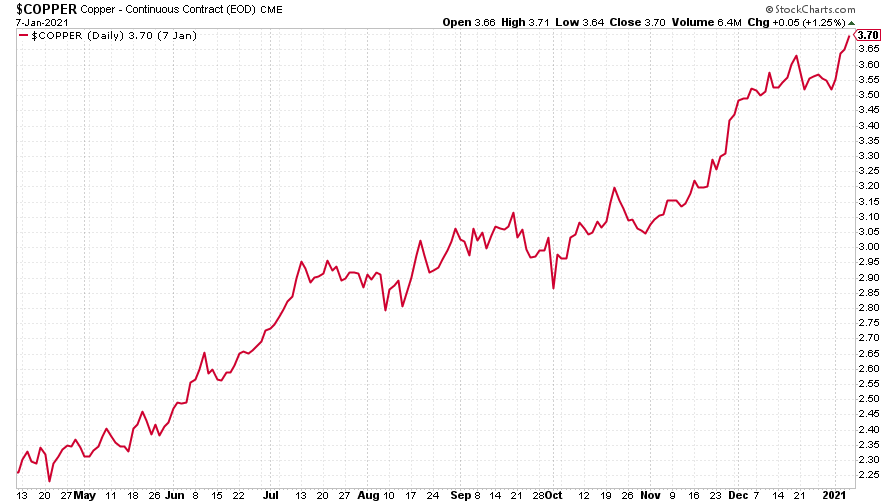

Copper is still the asset class to be in. It appears to be the ultimate reflation trade.

(Copper: nine months)

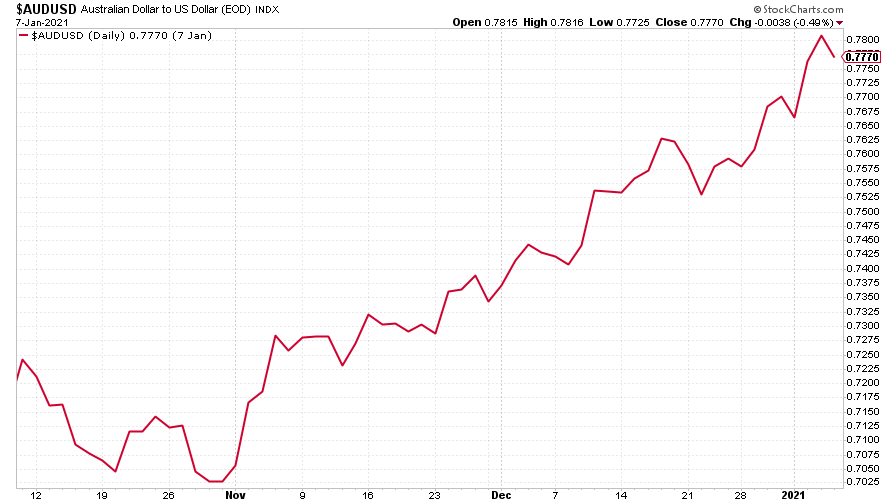

The Aussie dollar is still rising, though it took a breather towards the end of the week as the US dollar rebounded.

(Aussie dollar vs US dollar exchange rate: three months)

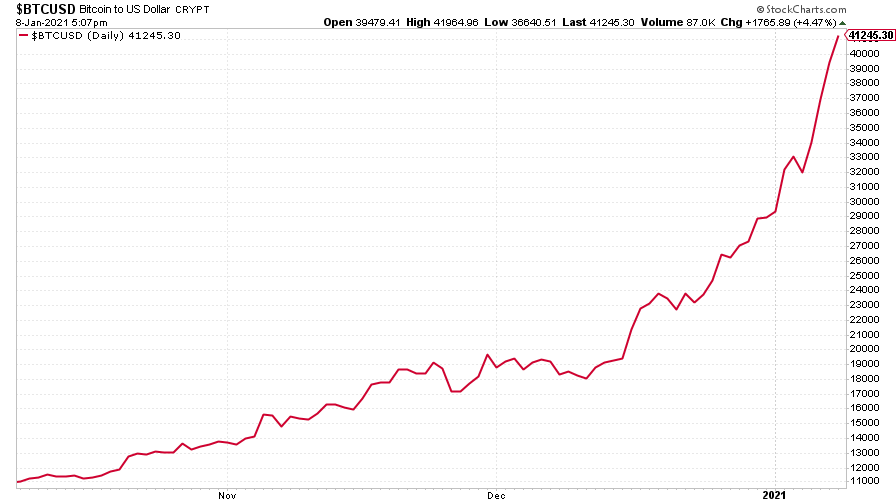

Remember back when we’d report on cryptocurrency bitcoin as recently as summer of last year, and marvel at how calm and almost entirely ignored by the market it had become? Those days are long gone. Bitcoin has almost doubled since the last Saturday Money Morning of last year (ie, less than a month). To hear Merryn and I struggle to comprehend it like the old-fashioned gold bugs we are, listen to the most recent podcast.

(Bitcoin: three months)

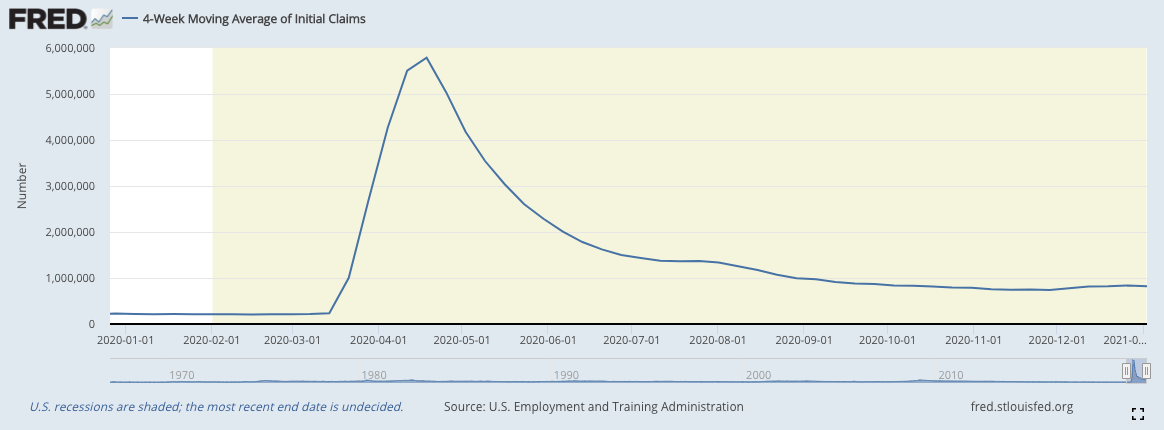

US weekly jobless claims came in at 787,000, compared to 790,000 last week. That was better than expected – analysts had been looking at 833,000. The four-week moving average rose to 818,750 from 800,000 the week before.

Meanwhile the market largely ignored the latest non-farm payrolls data, even although it was much weaker than expected (140,000 jobs were lost in December, mainly due to lockdowns hitting the restaurant sector). This is likely to continue until the pandemic is much closer to an end.

(US jobless claims, four-week moving average: since Jan 2020)

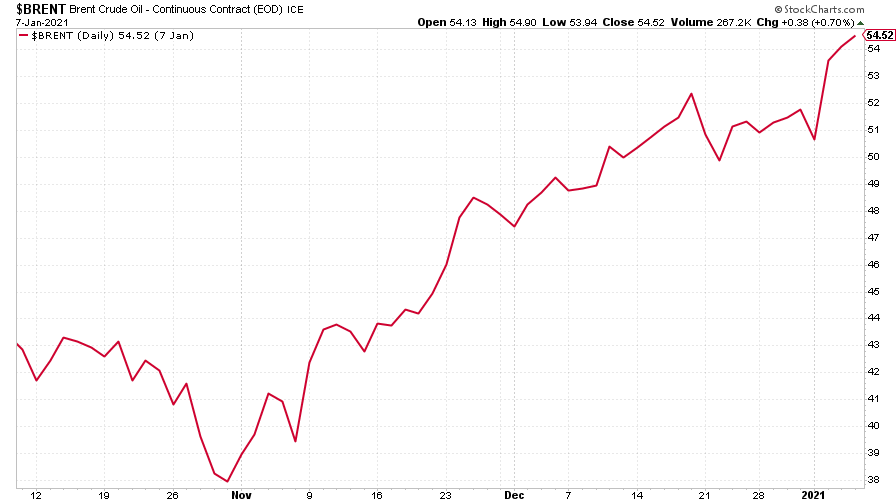

The oil price (as measured by Brent crude) rose sharply this week as Saudi Arabia made a surprise cut to production.

(Brent crude oil: three months)

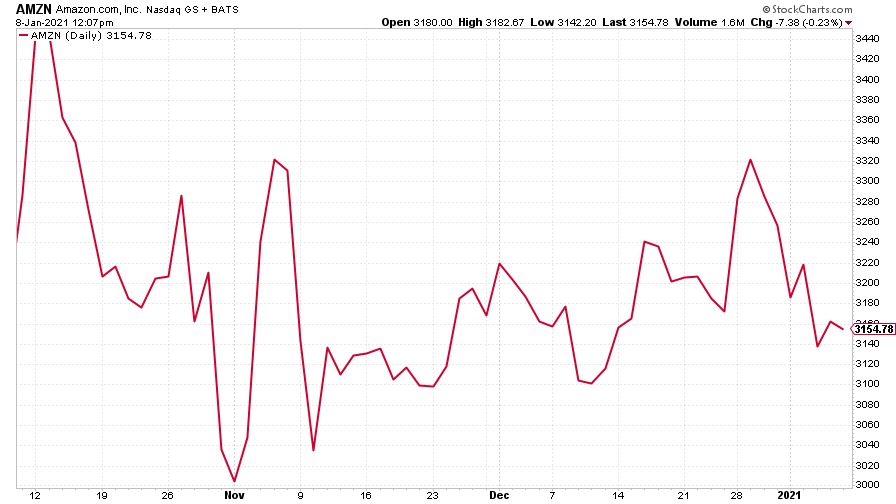

Amazon drifted again. It’s not of much interest to investors when there are stocks like Tesla. If this stasis lasts much longer, there’s a danger of Amazon becoming a value stock...

(Amazon: three months)

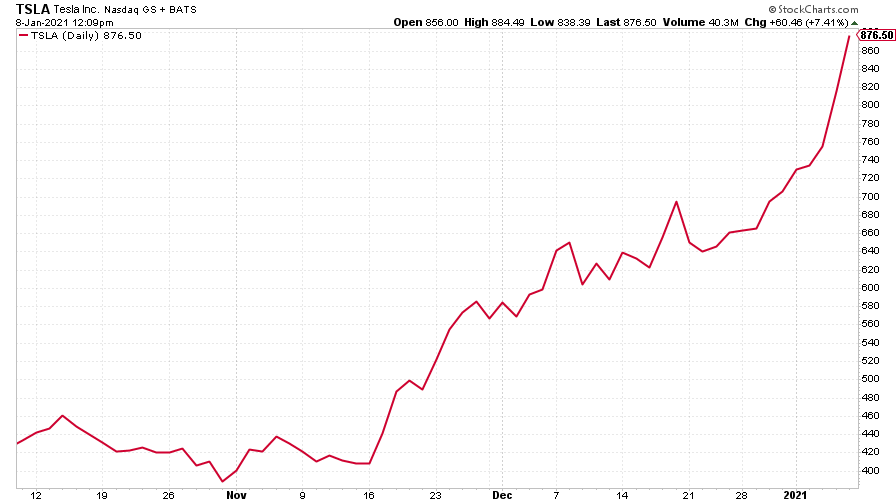

As always, there is very little I can say about Tesla except “wow” (and everything I said to Merryn on the podcast of course). Anyone who thought promotion to the S&P 500 would mark the top has been desperately disappointed, let’s just put it that way.

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.