The charts that matter: the stimulus tug of war continues

As the world's government throw money at their economies, John Stepek looks at how it's affecting the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

It’s less than two weeks to go until our 20th anniversary issue! We’re all very excited. Merryn’s just putting the finishing touches to a very special interview with one of our favourite investors to mark the occasion – that’s one you won’t want to miss.

If you don’t already subscribe, make sure you don’t miss out – sign up now and you’ll get your first six issues free.

And thank you for your contributions! We’ve already had lots of emails answering our big questions for 2040, but we’d like even more. Do you think we’ll have put a tourist on the moon by 2040? Will cash have been banned? Will Amazon still be one of the world’s most valuable companies? Check out the questions here and email your responses to 2040@moneyweek.com.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Negative interest rates are the financial term du jour. If you’re not entirely sure why or what they are, then please do check out our latest “Too Embarrassed To Ask” video which will answer all your questions (except perhaps sadly, “how do I actually get paid a worthwhile rate of interest on my savings these days”)?

Merryn’s latest podcast is really worth listening to this week, particularly if you’re looking for global investment opportunities. She talks to Shaniel Ranjee of Pictet Asset Management about a country that most of us probably have the wrong impression of, at least on the investment front – that is, China. I learned a lot from this podcast and I think you will too.

Here are the links for this week’s editions of Money Morning and other web stories you may have missed.

- Monday: How will we repay our vast debt pile? Do we even need to?

- Merryn’s blog: Negative interest rates and the end of free bank accounts

- Tuesday: What’s the world’s most hated market? I hate to say it, but you probably live there

- Merryn’s blog: Cash rich and bored? Be careful what you do with your money

- Wednesday: Buying bitcoin could be the best way to play the remote working boom

- Thursday: Why commodities could be the best investment for 2021

- Friday: Big spending government is here to stay – just ask Rishi Sunak

- The weekly quiz: What do you recall of what went on in the money world last week?

Now for the charts of the week.

The charts that matter

Again, markets were tossed around on the winds of political rumour. Investors keep getting excited about the idea that some sort of government spending package will be announced any minute. Then it’s not announced, and they get disappointed. But then they think: “Yeah, but whoever gets elected, they’ll spend more money” and markets go back up. And then investors think: “Yeah, but what if it’s a contested election?” and markets go back down.

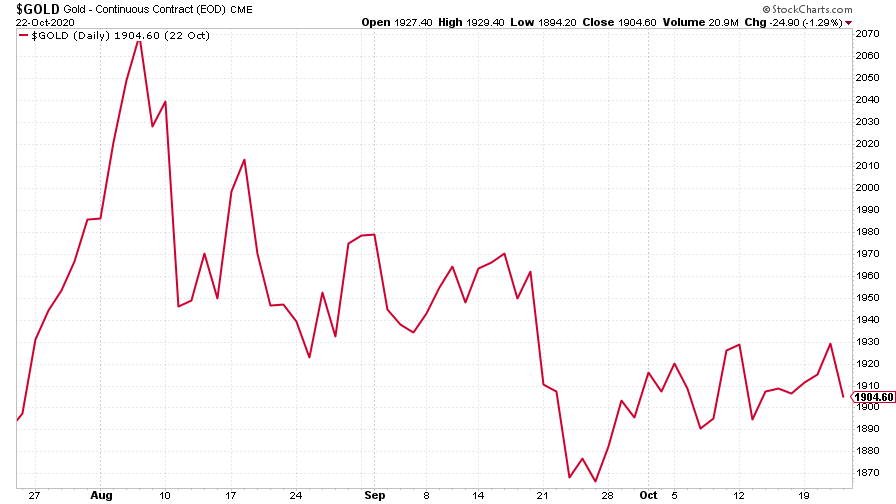

So it was with gold this week. It ended the week little changed overall, but off its highs for the week.

(Gold: three months)

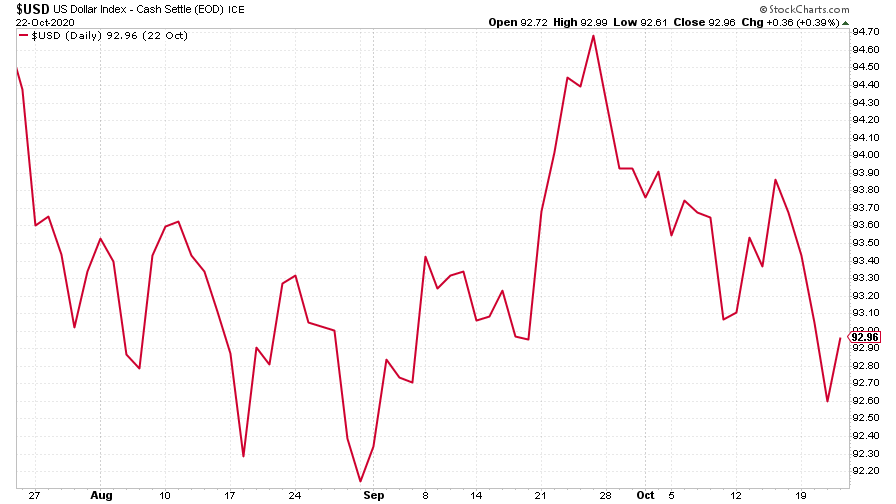

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) fell a little on last week.

(DXY: three months)

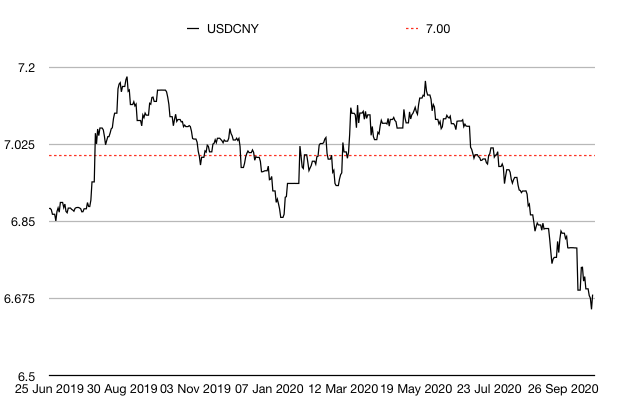

The Chinese yuan (or renminbi) continued to strengthen against the dollar (when the black line below rises, it means the yuan is getting weaker vs the dollar). The economic recovery in China appears strong and investors want a piece of that, regardless of political risk, it seems.

(Chinese yuan to the US dollar: since 25 Jun 2019)

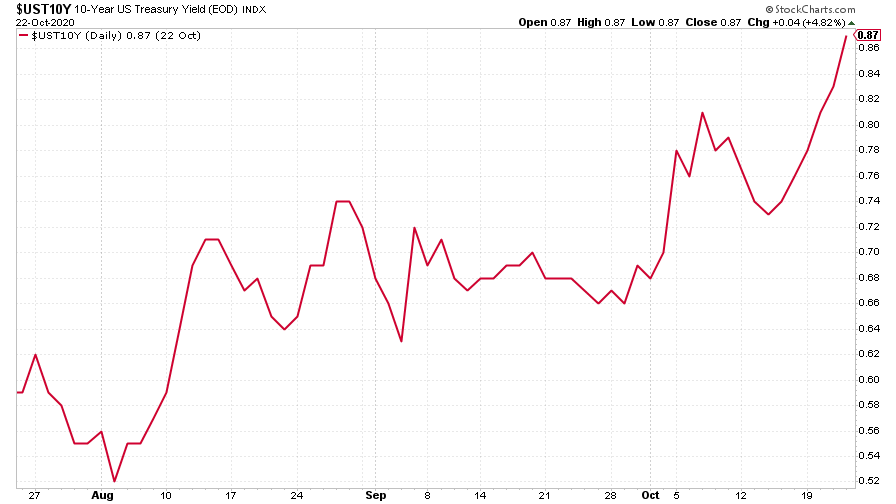

The yield on the ten-year US government bond started to look a little more interesting than it has in recent weeks. It’s now trading at its highest level since mid-June. It’s easy to forget now, but at the start of this year, the ten-year was trading on a yield of just under 2%. A return to those sorts of levels would create some interesting waves in markets.

(Ten-year US Treasury yield: three months)

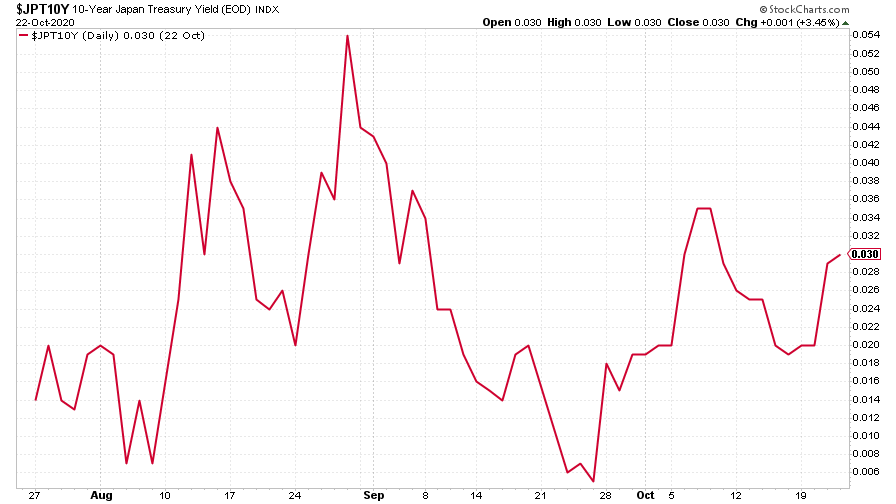

The yield on the Japanese ten-year meanwhile remains under strict control by the Bank of Japan (which may point to future policy for the Federal Reserve).

(Ten-year Japanese government bond yield: three months)

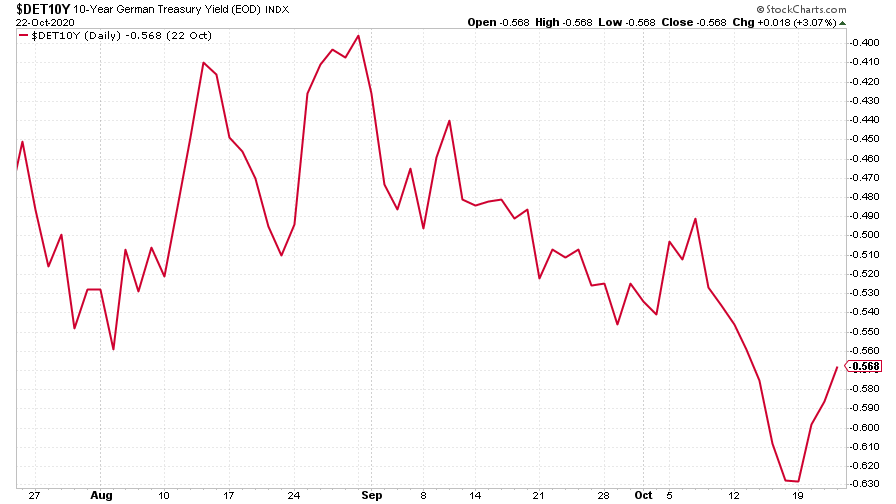

Meanwhile, the yield on the ten-year German bund rallied a bit from last week’s low.

(Ten-year Bund yield: three months)

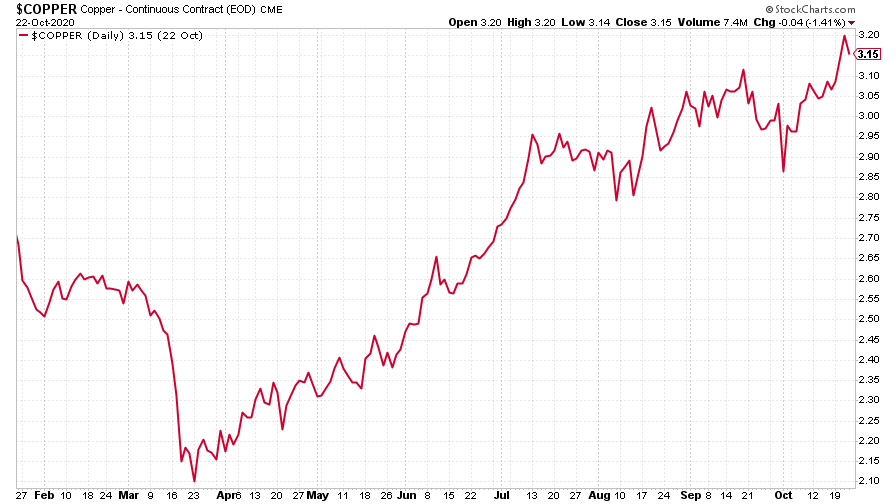

Copper continued to do well. It’s had an extraordinary recovery from the coronavirus lows. Goldman Sachs reckons that next year might see much of the rest of the commodity sector follow suit.

(Copper: nine months)

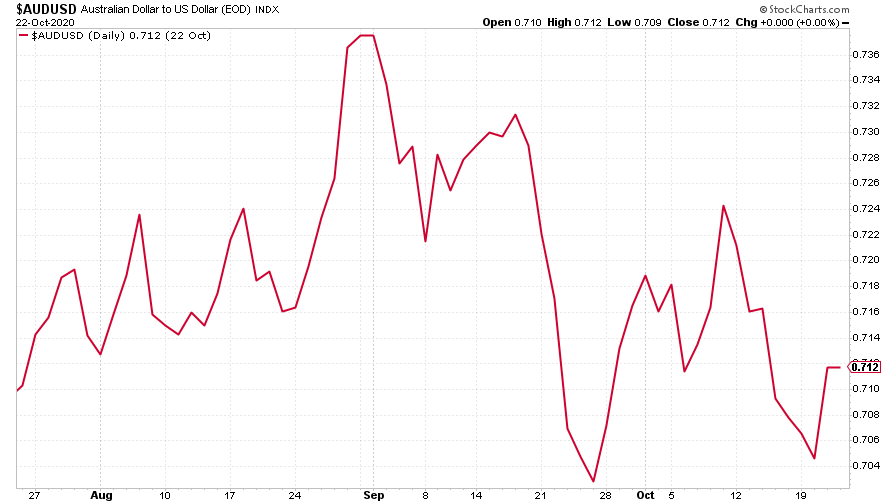

The Aussie dollar meanwhile didn’t move much on the week.

(Aussie dollar vs US dollar exchange rate: three months)

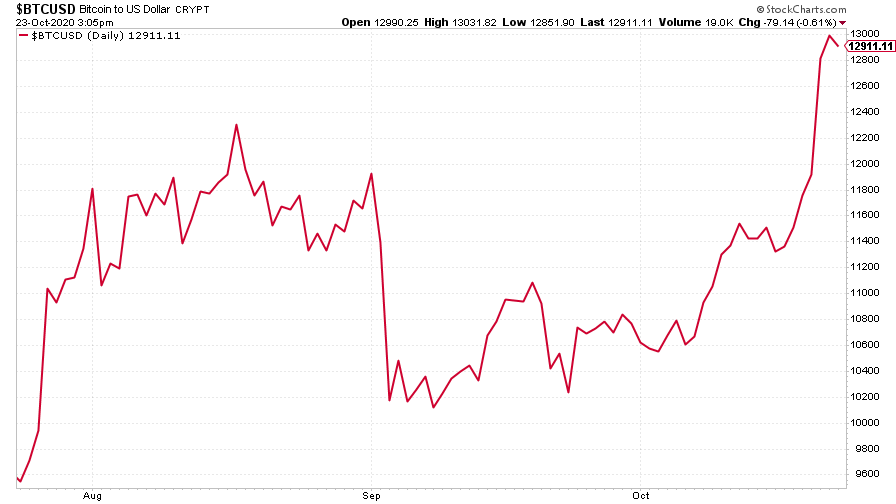

Cryptocurrency bitcoin finally had one of its more exciting weeks, as payments giant PayPal said that it would allow its users to trade in bitcoin (and other cryptocurrencies) and to buy and sell goods using the currency. That strikes me as an impressive vote of confidence. It’s one thing to own bitcoin on a specialist exchange – it’s quite another to own it via a massive payments provider. Arguably, the fact that people trust PayPal suggests that this could open up a lot more interest in bitcoin. Oh, and Dominic reckons it’s the best way to play the changes the coronavirus has wrought in the working world.

(Bitcoin: three months)

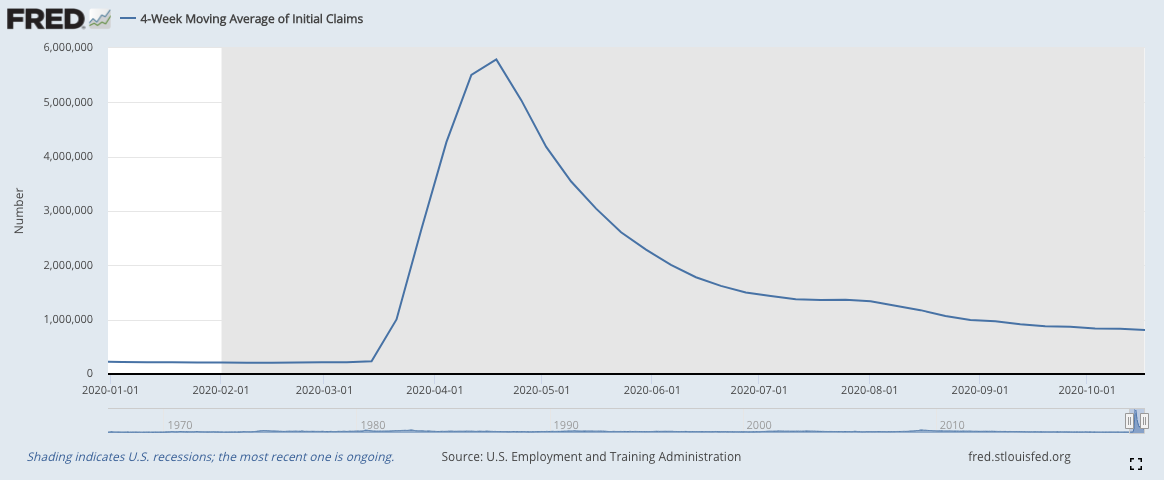

US weekly jobless claims fell sharply this week to 787,000, which was well below the 860,000 expected and down from the 842,000 seen last week (which was itself revised lower from 898,000). The four-week moving average ticked as a result slipped back to 811,000, from 832,750 previously, which was also revised lower.

(US jobless claims, four-week moving average: since Jan 2020)

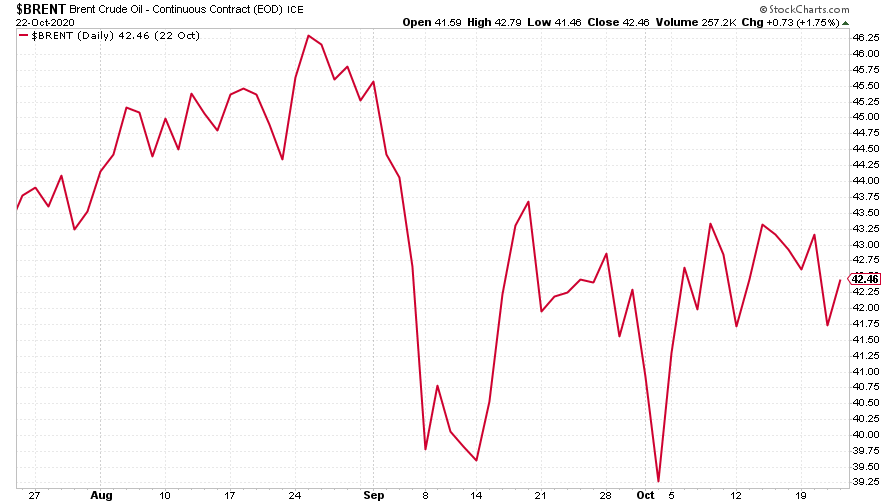

The oil price (as measured by Brent crude) was a little lower this week. Oil has been trading in a pretty tight range for several months now. My betting is that when it does make a break for it, it’ll break higher, which is why I’d be using spare investment cash to pick up at least a little bit of exposure to the sector.

(Brent crude oil: three months)

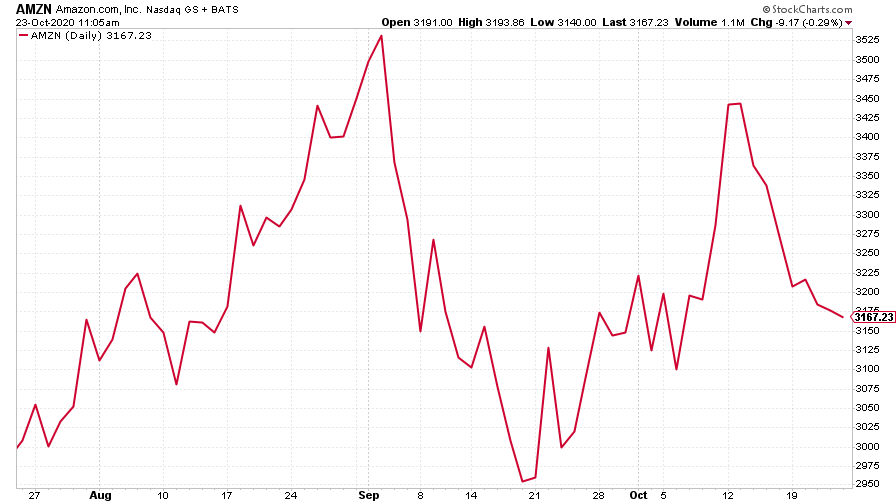

Amazon fell back a little this year as the wider market slipped back...

(Amazon: three months)

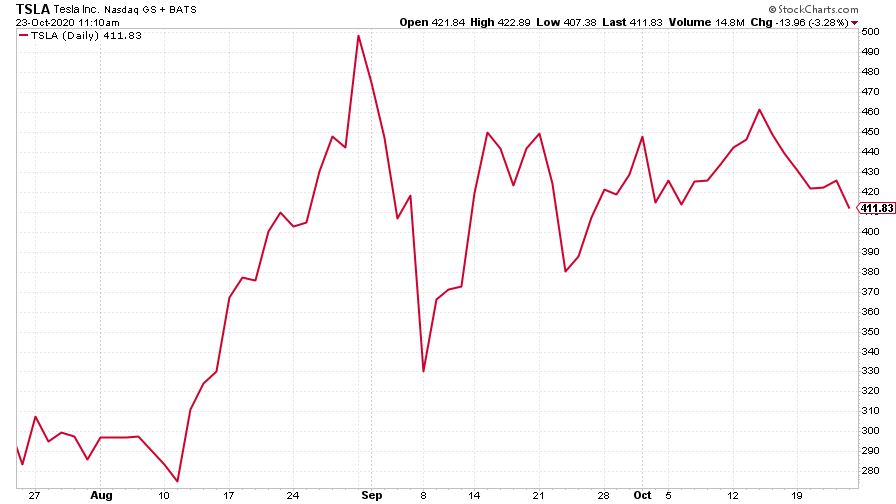

… and it was the same story for electric car manufacturer Tesla.

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.