The charts that matter: it’s all about the stimulus

John Stepek looks at how homes of a pre-election stimulus deal in the US have affected the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

In this week’s issue of MoneyWeek magazine we take a closer look at the state of US politics right now, in particular the vexed question of what happens if there isn’t a clear winner in the forthcoming election – and what might that mean for markets? If you’re not already a subscriber, you can get a free gold report, plus your first six issues free, if you sign up today.

What does the breathtaking generosity of British politicians’ defined benefit pension schemes have to do with coronavirus and lockdown policies? Perhaps a lot more than you might think. It’s just one of the topics Merryn and I tackle in the latest podcast.

Our latest “Too Embarrassed To Ask” video offers a beginner’s guide to one of the most important aspects of building a long-term financial plan – asset allocation.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Here are the links for this week’s editions of Money Morning and other web stories you may have missed. Make sure you read Merryn’s latest update on MoneyWeek’s model investment trust portfolio.

- Monday: Why would anyone ever buy a 100-year bond?

- Merryn’s blog: UK stocks will bounce back – make sure your portfolio is adequately positioned

- Tuesday: House prices are rising across the globe, not just in the UK

- MW Investment Trust portfolio update: MoneyWeek’s investment trust portfolio – should we keep the Law Debenture trust?

- Wednesday: Platinum has lost its shine – but the green energy revolution could change all that

- Thursday: Oil stocks: share prices in this hated sector are back at their Covid-19 lows – time to buy?

- Friday: What’s the difference between investing and gambling?

Now for the charts of the week.

The charts that matter

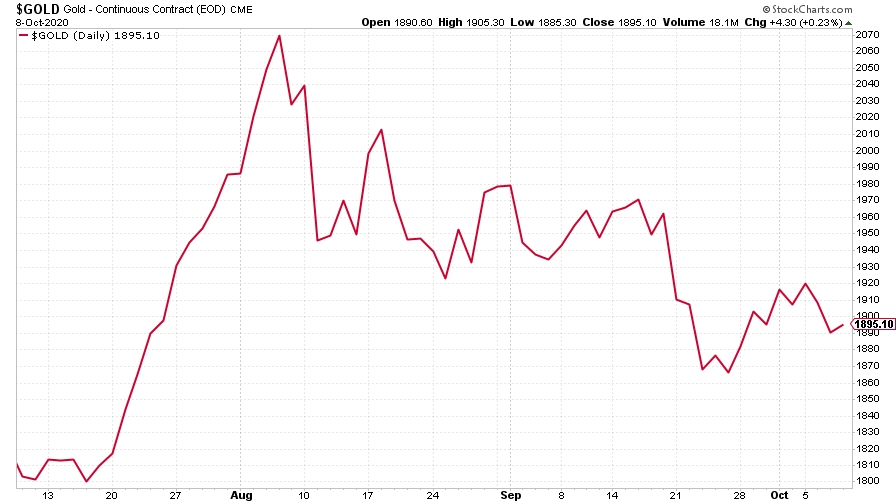

This week, it was all about the stimulus hopes. The chart below doesn’t show it but gold had a solid rally towards the close on Friday on hopes that US politicians are inching closer to a pre-election stimulus deal, despite uncertainty over whether anything at all will happen. That said, it seems unlikely that the paralysis will continue – so it’s more about whether more government spending comes now, or after the next president has been agreed.

(Gold: three months)

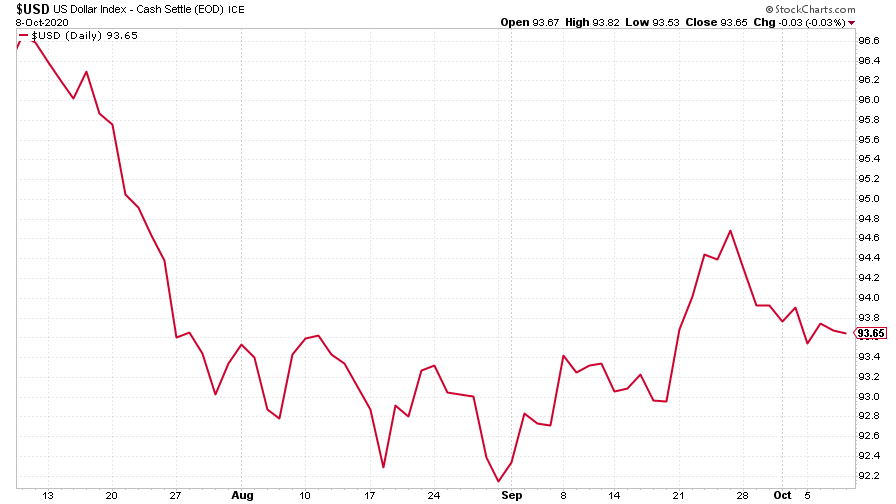

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) was little changed on the week.

(DXY: three months)

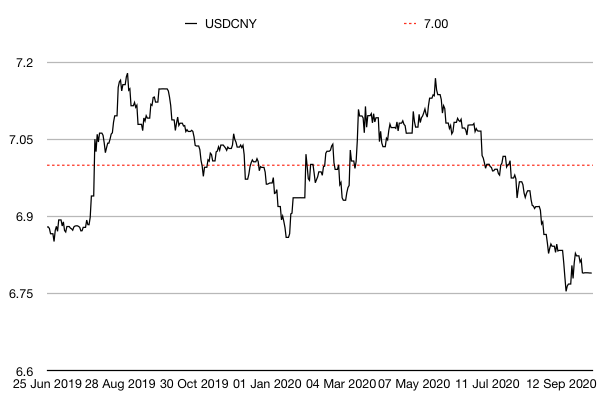

The Chinese yuan (or renminbi) was flat against the dollar again this week (when the black line below rises, it means the yuan is getting weaker vs the dollar).

(Chinese yuan to the US dollar: since 25 Jun 2019)

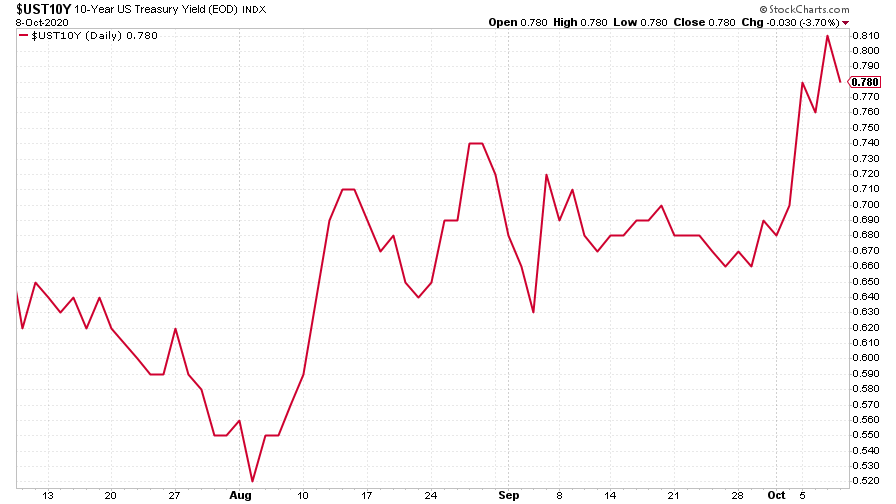

Of more interest, the yield on the ten-year US government bond perked up to its highest level since earlier this year.

(Ten-year US Treasury yield: three months)

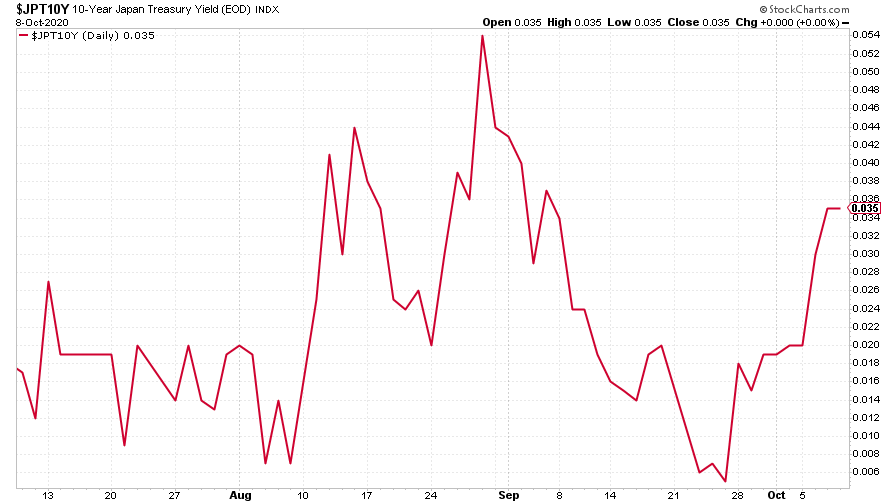

The yield on the Japanese ten-year ticked higher too (within its exceptionally tight range).

(Ten-year Japanese government bond yield: three months)

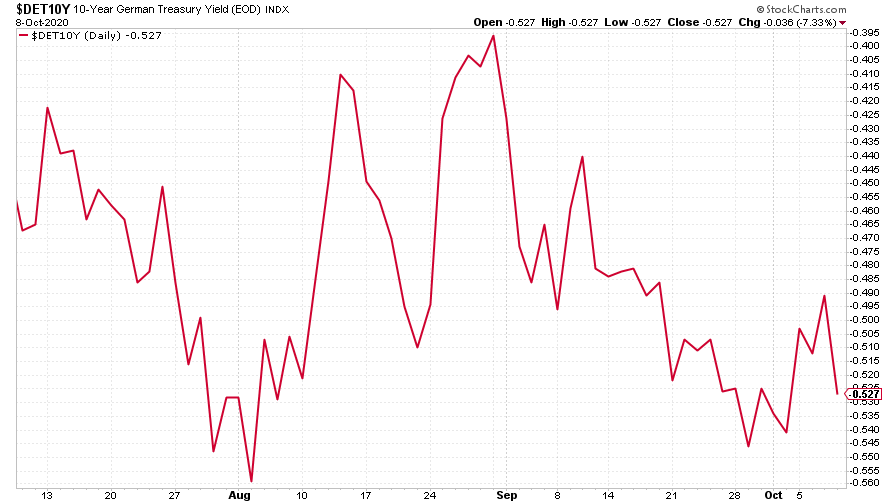

The yield on the ten-year German bund was little changed.

(Ten-year Bund yield: three months)

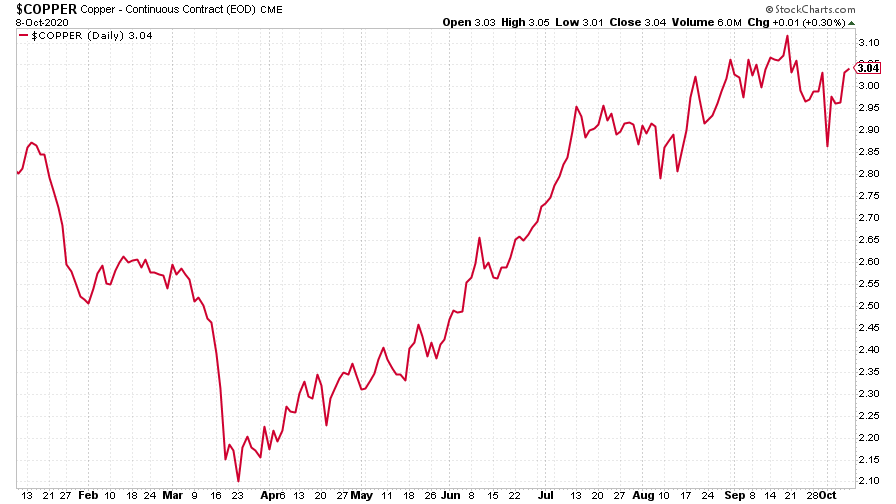

Copper rallied somewhat this week as investors grew more optimistic on China.

(Copper: nine months)

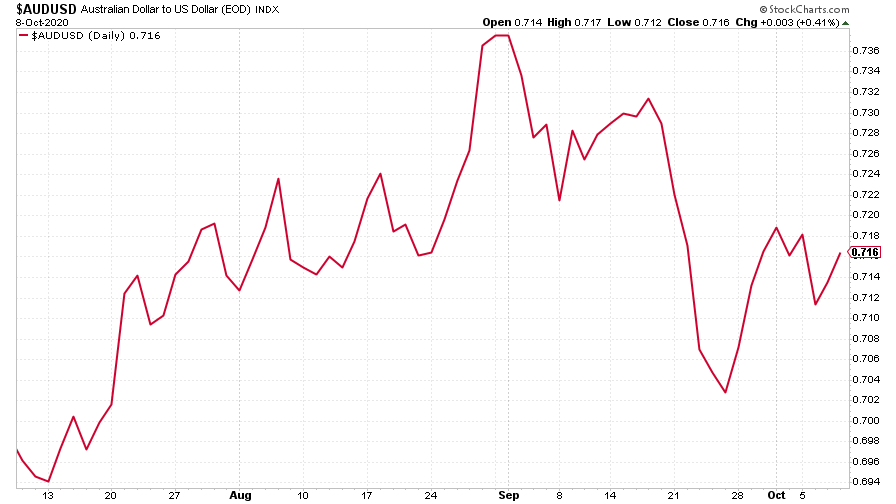

The Aussie dollar was little changed.

(Aussie dollar vs US dollar exchange rate: three months)

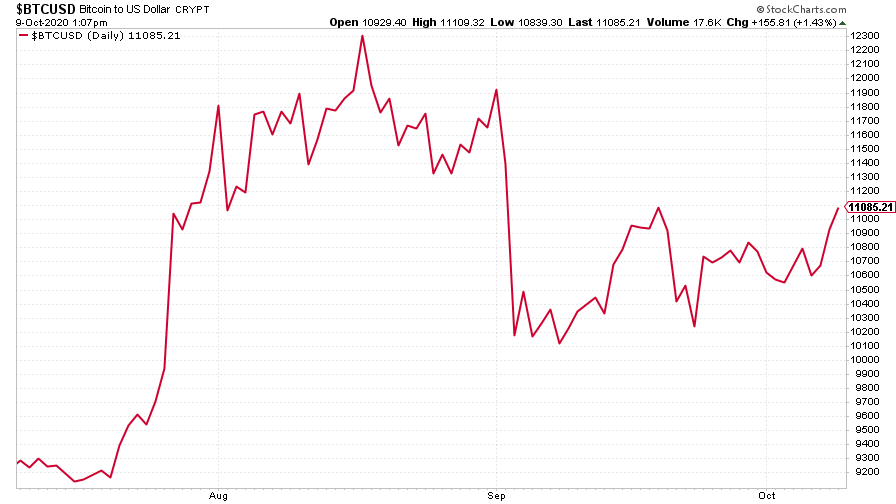

Cryptocurrency bitcoin had a solid rebound this week, no doubt helped by the news that one of Twitter founder Jack Dorsey’s companies – payments platform Square – had bought a large sum ($50m-worth) of bitcoins.

(Bitcoin: three months)

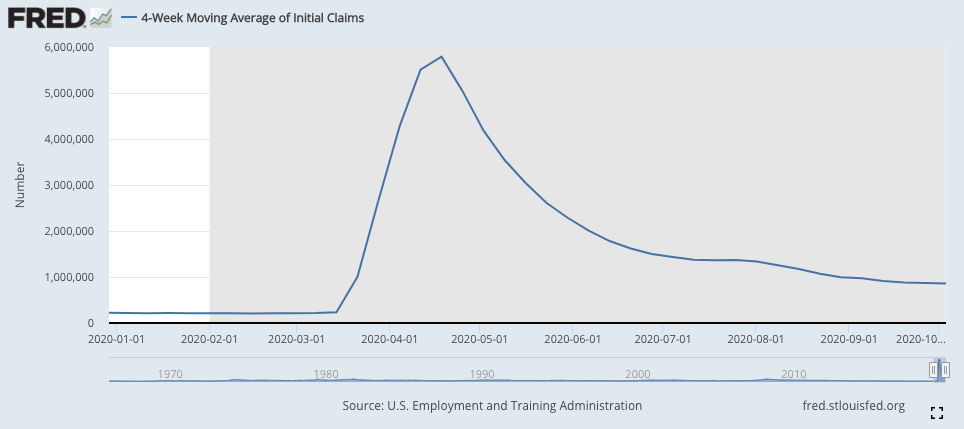

US weekly jobless claims were down on last week, but a little higher than economists had expected. There were 840,000 new claims, down from 849,000 last week (that was revised higher from 837,000). The four-week moving average fell to 857,250 from a revised 870,250 previously.

(US jobless claims, four-week moving average: since Jan 2020)

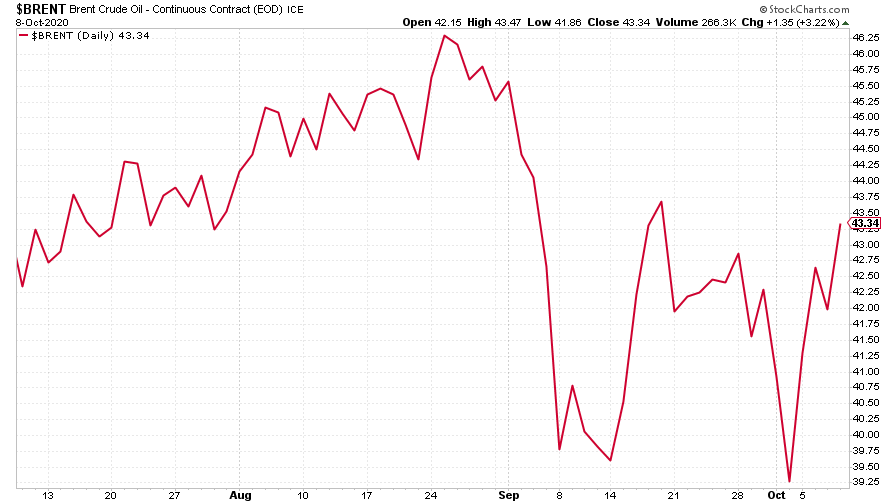

The oil price (as measured by Brent crude) rallied this week. Oil cartel Opec declared that the “worst is over” for the market. We’ll see (though I wouldn’t be surprised if it is).

(Brent crude oil: three months)

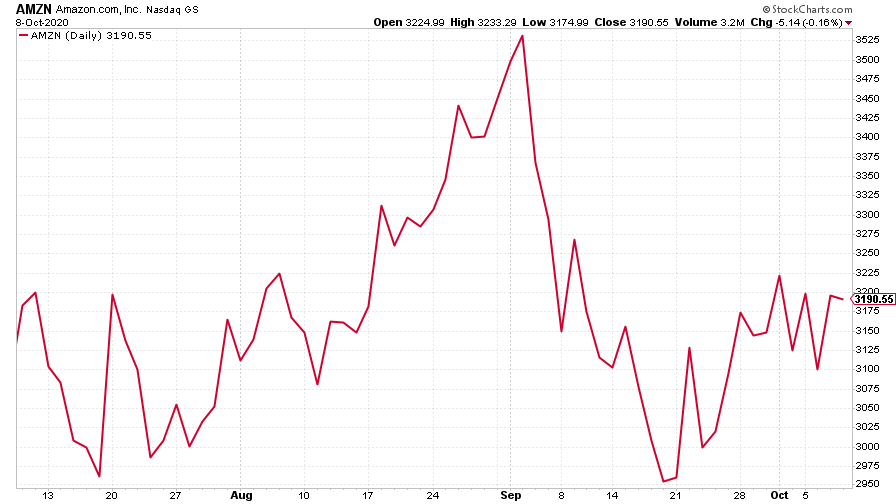

Amazon was a little higher this week...

(Amazon: three months)

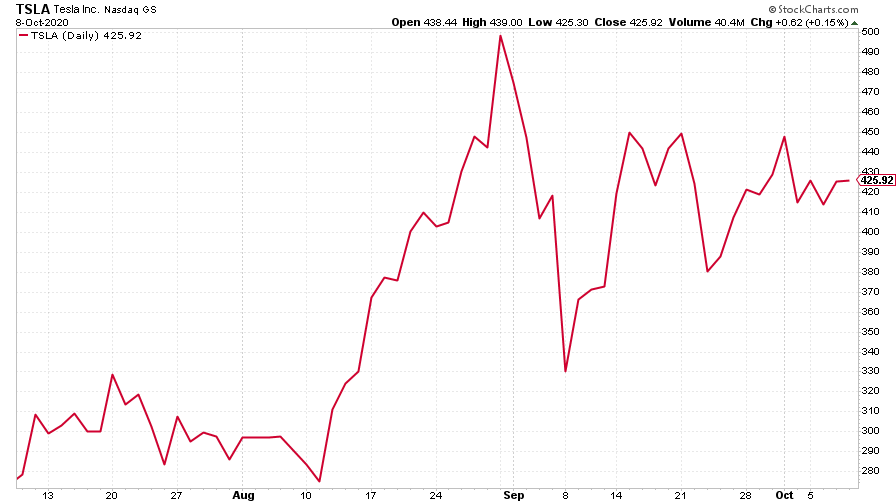

While Tesla ended the week a little lower.

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?