The charts that matter: has the dollar’s rally paused, or is it over?

The US dollar ended the week higher, although off its highest point. Is that it? John Stepek looks at how it's affected the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In this week’s issue of MoneyWeek, we look at how emerging markets have fared during Covid-19 and look at the most attractive options to invest in right now. If you’re not already a subscriber, get your copy here.

And if you’re wondering what I mean by emerging market, well, you’re in luck – in our new “Too Embarrassed To Ask” video we just happen to explain exactly what an “emerging market” is. Take five minutes to let me know what you think, at editor@moneyweek.com – or tell us what you’d like us to cover next.

In the latest MoneyWeek podcast, Merryn talks to fund manager Mark Slater of the Slater Growth fund about the Covid-19 crash, investing during a panic, and why investors are wrong to be gloomy on the UK. Listen now to learn about two of his favourite UK-listed stocks.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Meanwhile, I joined The Week team on their podcast, The Week Unwrapped, this week. We discussed the recent clashes on the border between India and China, the Fed’s new inflation policy, and the slightly worrying trend towards workplaces inviting in spiritual gurus to boost their staff’s sense of meaning in a post-Covid world. If that idea makes you want to vomit too, then you will probably enjoy this podcast.

Here are the links for this week’s editions of Money Morning and other web stories you may have missed.

- Monday: Has the tech bubble burst? The week ahead could be critical

- Merryn’s blog: Dealing with the debt – big tax rises are not the answer right now

- Tuesday: This “jam tomorrow” bull market may be nearing its end

- Wednesday: Both bitcoin and tech stocks have tumbled – how much worse will it get?

- Thursday: What happens to UK house prices once the urban exodus ends?

- Friday: Will the market crash again? Watch the US dollar for clues

And if you run a small business, and you’re looking for an overview of the government’s Kickstart scheme, which offers employers funding for work placements, have a read at my colleague David Prosser’s latest column.

Now for the charts of the week.

The charts that matter

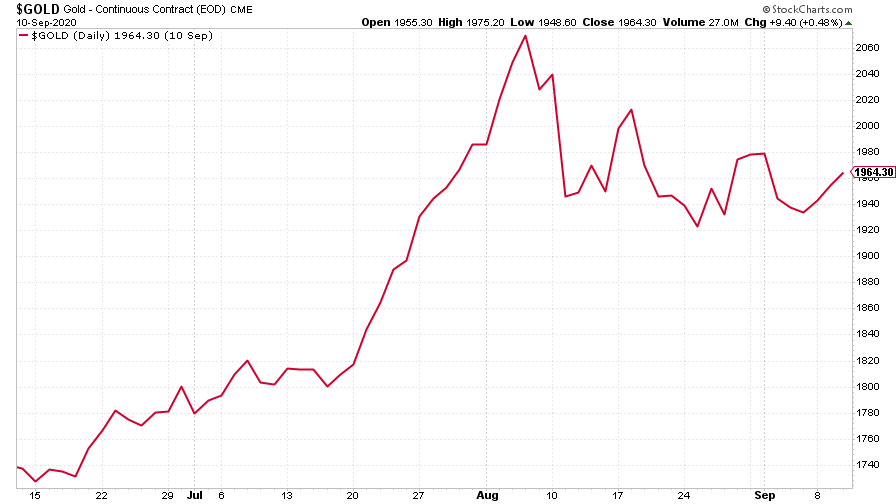

Gold strengthened towards the end of the week, helped by the dollar’s recent jump higher being interrupted.

(Gold: three months)

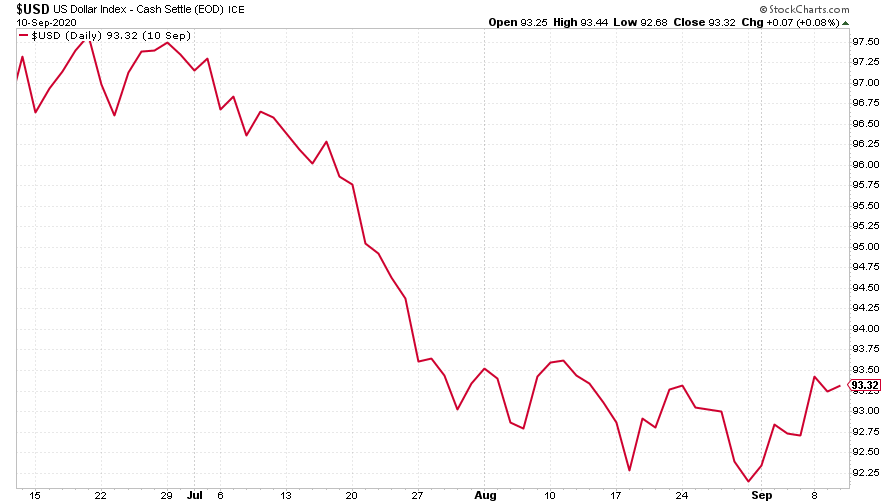

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) ended the week higher, although off its highest point. The apparently relaxed attitude of European monetary authorities to the strength of the euro helped reduce the pressure pushing the dollar higher.

(DXY: three months)

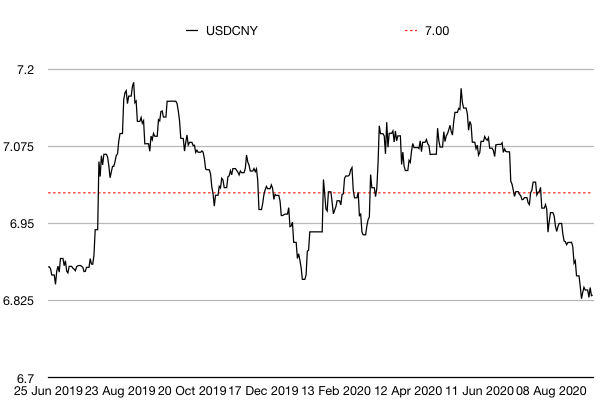

The Chinese yuan (or renminbi) exchange rate with the dollar was little changed this week (when the black line below falls, it means the yuan is getting stronger), and remains well below the ¥7/$1 level that used to be viewed as the “line in the sand” beyond which the Chinese government would be reluctant to let it weaken. (I’d suggest the line is now more like ¥7.20, given that it’s breached ¥7 quite often now).

(Chinese yuan to the US dollar: since 25 Jun 2019)

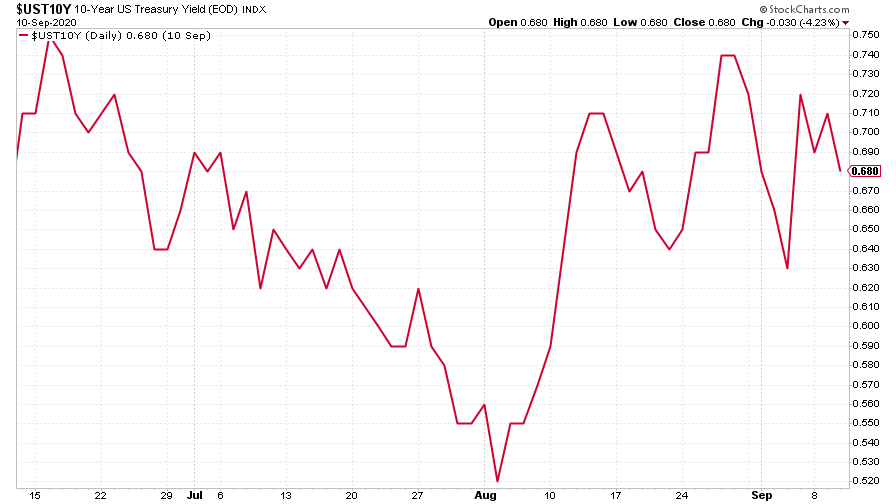

The yield on the ten-year US government bond rose a little on the week as investors grew less wary towards the weekend.

(Ten-year US Treasury yield: three months)

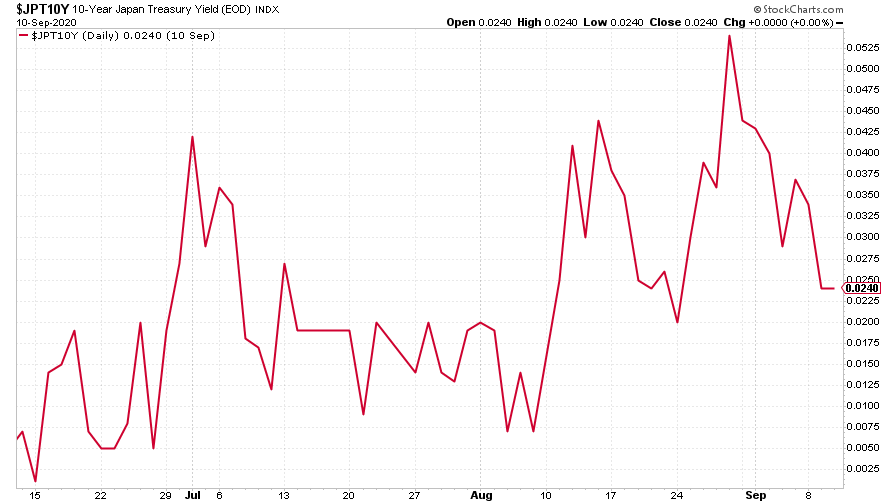

The yield on the Japanese ten-year was little changed.

(Ten-year Japanese government bond yield: three months)

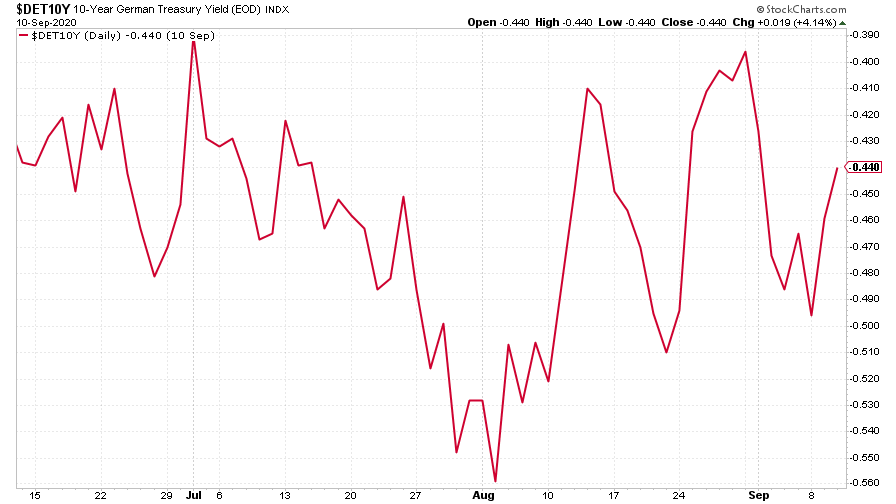

The yield on the ten-year German Bund perked up a little (though it remained deeply negative).

(Ten-year Bund yield: three months)

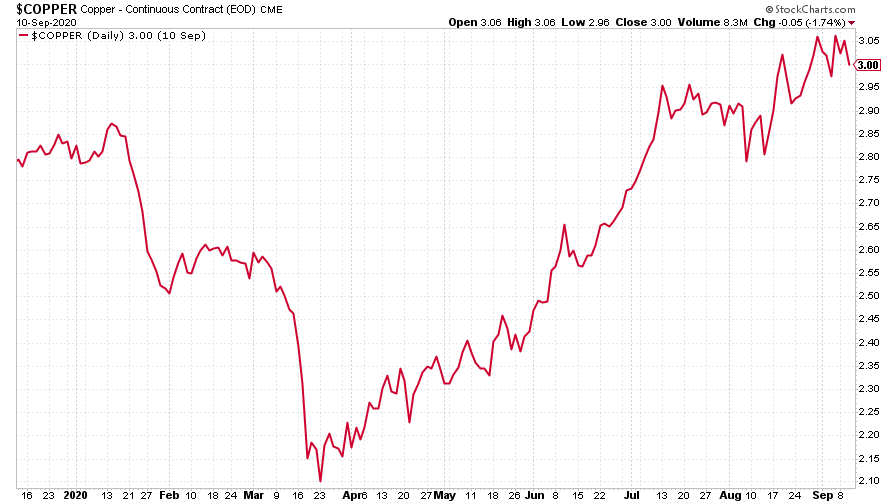

Copper ended the week a little higher, partly due to reports of China’s incredible appetite for the metal. China’s copper imports rose by 65% year-on-year last month.

(Copper: nine months)

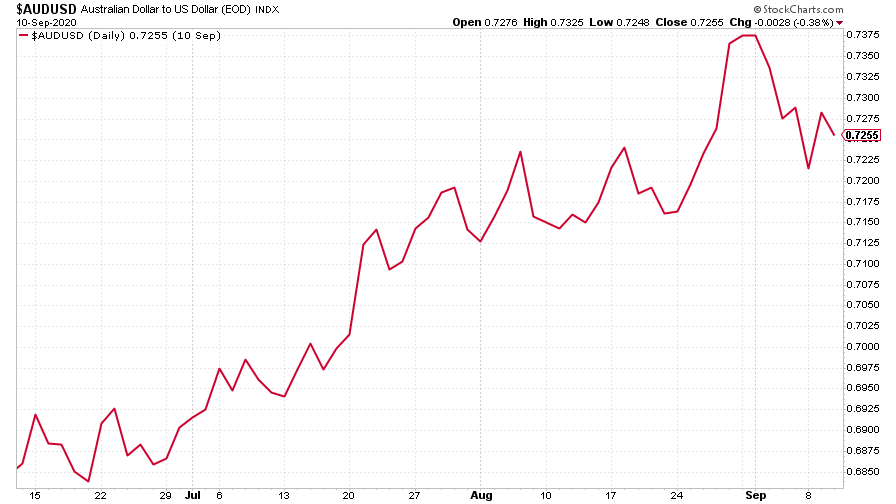

The Aussie dollar was basically flat on the week as it reflected moves in the US dollar.

(Aussie dollar vs US dollar exchange rate: three months)

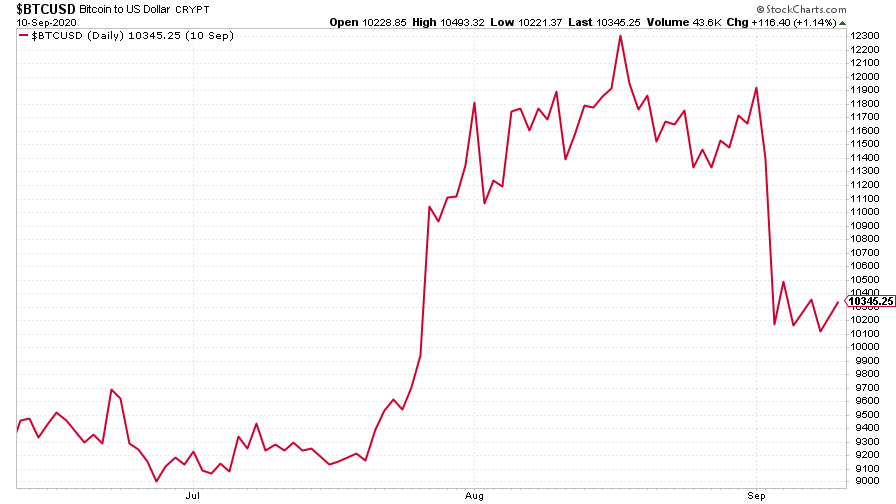

Cryptocurrency bitcoin continued to trade “sort-of” in line with precious metals – getting a bit of relief when the US dollar’s strength ebbed away at the end of the week.

(Bitcoin: three months)

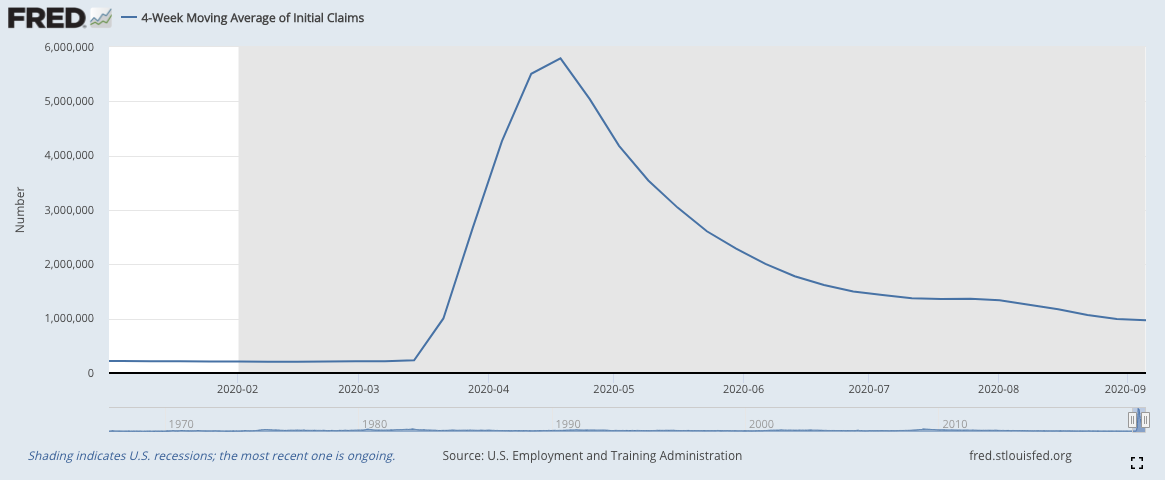

US weekly jobless claims were flat on last week. There were 884,000 new claims last week, which was worse than expected, and the same as last week (the original reading was 881,000 but it was revised a little higher). The four-week moving average fell a little to 970,750 from 992,500 (also revised a little higher) previously.

(US jobless claims, four-week moving average: since Jan 2020)

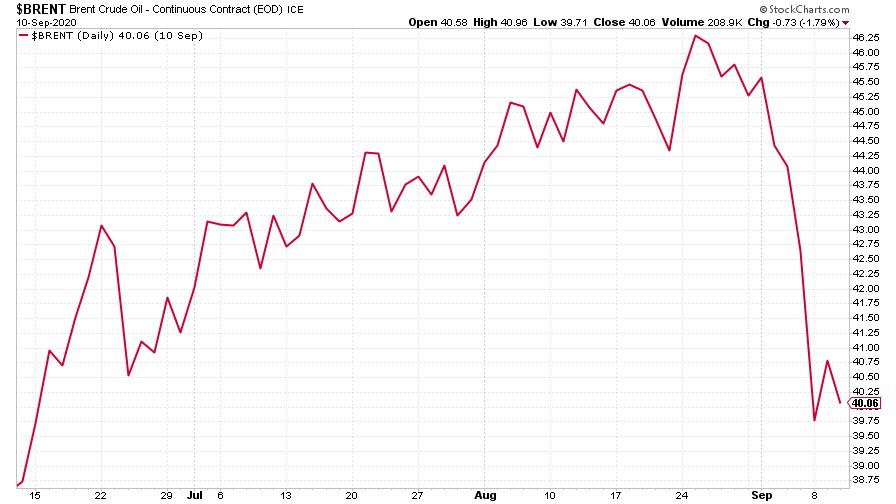

The oil price (as measured by Brent crude) slid hard this week as fears over the impact of further lockdowns on demand began to pick up. Clearly oil is heavily impacted by mobility – if we’re flying and driving less, it’s not going to do well – but I suspect there’s also a small element of electric vehicle fear going on this week too.

GM’s decision to take a high-profile stake in would-be electric truck start-up Nikola this week helped to boost platinum prices, for example, so I wouldn’t be surprised if it also dented sentiment towards oil.

By the way, if you’re intrigued by the deal, please do note that Nikola is even more speculative than Tesla (on which it is clearly modelled) and was this week also accused by short sellers at Hindenburg Research of being an elaborate fraud (which it denies). It’s not a stock I’d be taking a punt on. This looks more like a public statement of intent by GM than a transformative deal. Still, it’s a bold PR move.

(Brent crude oil: three months)

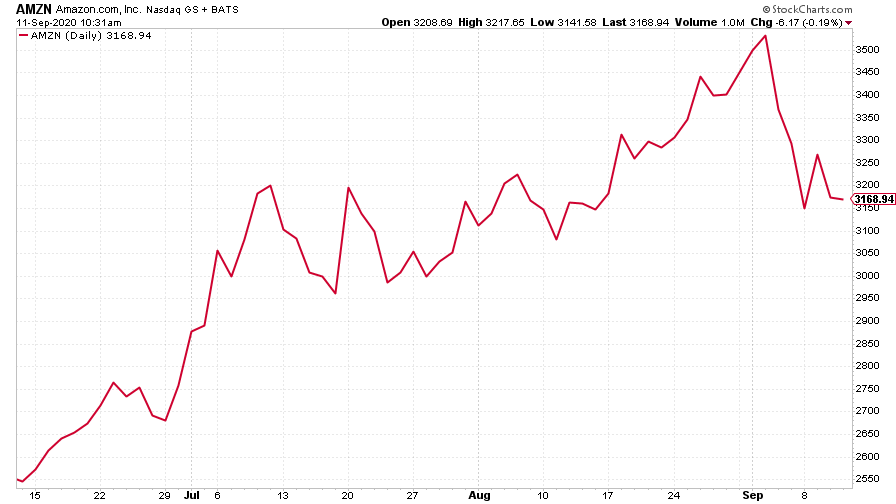

Amazon continued lower this week as the Nasdaq fell into “correction” territory (down 10%). That said, by the end of the week, it looked as though the tech index was clawing back ground. Let’s see what happens next.

(Amazon: three months)

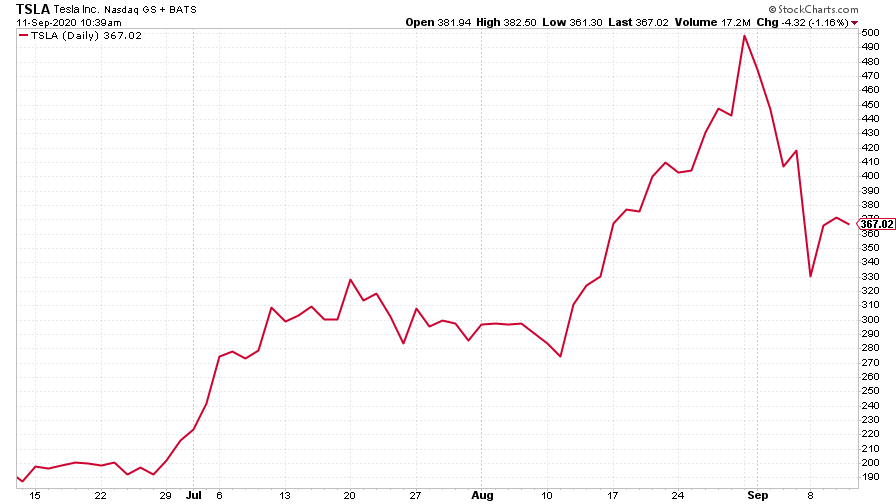

Tesla continued to correct lower this week. A drop from near $500 (post stock split) at the most recent high means that Tesla has lost about a quarter of its value in a fortnight. What’s the most striking thing about that statistic? Well, for me it’s the fact that even after that kind of drop, the electric car group is still up an astonishing 35% in the past month. To me there’s no question of whether this market is bubbly or not – of course it is! – but that doesn’t make it any easier to spot the pin that will burst it.

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?